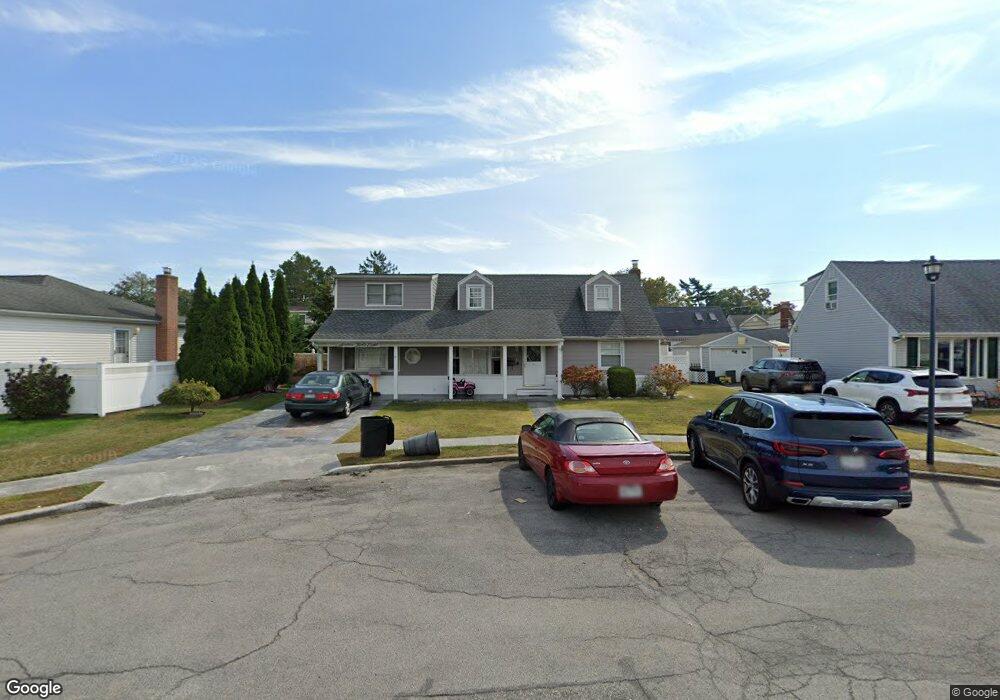

1648 Paula Ln Unit 1 East Meadow, NY 11554

Estimated Value: $806,000 - $847,699

4

Beds

2

Baths

2,166

Sq Ft

$382/Sq Ft

Est. Value

About This Home

This home is located at 1648 Paula Ln Unit 1, East Meadow, NY 11554 and is currently estimated at $826,850, approximately $381 per square foot. 1648 Paula Ln Unit 1 is a home located in Nassau County with nearby schools including Barnum Woods School, Woodland Middle School, and Sacred Heart School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 17, 2021

Sold by

Mamati Hayri and Mamati Nancy

Bought by

Augustin Joseph V

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$548,000

Outstanding Balance

$502,565

Interest Rate

3.05%

Mortgage Type

New Conventional

Estimated Equity

$324,285

Purchase Details

Closed on

Aug 8, 2011

Sold by

Refvik Dale and Shepard Family Trust

Bought by

Mamati Hayri and Mamati Nancy

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$308,000

Interest Rate

4.62%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Sep 18, 2003

Sold by

Shepard Eleanor

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Augustin Joseph V | $685,000 | First American Title | |

| Mamati Hayri | $385,000 | -- | |

| -- | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Augustin Joseph V | $548,000 | |

| Previous Owner | Mamati Hayri | $308,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $14,175 | $585 | $270 | $315 |

| 2024 | $4,283 | $585 | $270 | $315 |

| 2023 | $12,673 | $585 | $270 | $315 |

| 2022 | $12,673 | $585 | $270 | $315 |

| 2021 | $13,734 | $569 | $249 | $320 |

| 2020 | $8,449 | $602 | $598 | $4 |

| 2019 | $3,183 | $645 | $601 | $44 |

| 2018 | $3,281 | $688 | $0 | $0 |

| 2017 | $5,677 | $731 | $590 | $141 |

| 2016 | $9,026 | $794 | $521 | $273 |

| 2015 | $3,442 | $794 | $521 | $273 |

| 2014 | $3,442 | $794 | $521 | $273 |

| 2013 | $3,890 | $945 | $641 | $304 |

Source: Public Records

Map

Nearby Homes

- 614 Bond Ct

- 1434 Mark Dr

- 978 Little Whaleneck Rd

- 985 Merrick Ave

- 935 Winthrop Dr

- 1016 Tyrus Ct

- 755 Durham Rd

- 1855 Zana Ct

- 861 Maple Ln

- 1459 Prospect Ave

- 734 Wenwood Dr

- 773 Wenwood Dr

- 1450 Tadmor St

- 761 Barkley Ave

- 985 North Dr

- 1963 Central Dr N

- 427 Benito St

- 1390 Wilson Rd

- 1277 Jerusalem Ave

- 437 Cedar Ln