1657 Hallworth Ct Unit 1657 Columbus, OH 43232

Livingston-McNaughten NeighborhoodEstimated Value: $95,000 - $150,000

2

Beds

2

Baths

1,122

Sq Ft

$118/Sq Ft

Est. Value

About This Home

This home is located at 1657 Hallworth Ct Unit 1657, Columbus, OH 43232 and is currently estimated at $132,626, approximately $118 per square foot. 1657 Hallworth Ct Unit 1657 is a home located in Franklin County with nearby schools including Oakmont Elementary School, Yorktown Middle School, and Independence High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 4, 2009

Sold by

Wells Fargo Financial Ohio 1 Inc

Bought by

Mccruter Warren

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$34,366

Outstanding Balance

$21,818

Interest Rate

4.86%

Mortgage Type

FHA

Estimated Equity

$110,808

Purchase Details

Closed on

Jan 28, 2009

Sold by

Clarke Fitzgerald W and Case #08Cve02 2951

Bought by

Wells Fargo Financial Ohio 1 Inc

Purchase Details

Closed on

Nov 3, 2004

Sold by

Estate Of Wayne K Clarke

Bought by

Clarke Jina

Purchase Details

Closed on

Oct 26, 2004

Sold by

Clarke Jina

Bought by

Clarke Elsa R and Clarke Fitzgerald W

Purchase Details

Closed on

May 5, 1995

Sold by

Fitzgerald W Clarke

Bought by

Wayne K Clarke

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$25,000

Interest Rate

8.43%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jun 1, 1983

Purchase Details

Closed on

Oct 1, 1981

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Mccruter Warren | $26,600 | Rels Title | |

| Wells Fargo Financial Ohio 1 Inc | $40,000 | None Available | |

| Clarke Jina | -- | -- | |

| Clarke Elsa R | $46,000 | -- | |

| Wayne K Clarke | $25,000 | -- | |

| -- | $37,500 | -- | |

| -- | $38,900 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Mccruter Warren | $34,366 | |

| Previous Owner | Wayne K Clarke | $25,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,321 | $29,440 | $4,200 | $25,240 |

| 2023 | $1,304 | $29,435 | $4,200 | $25,235 |

| 2022 | $999 | $19,260 | $2,280 | $16,980 |

| 2021 | $1,001 | $19,260 | $2,280 | $16,980 |

| 2020 | $1,002 | $19,260 | $2,280 | $16,980 |

| 2019 | $898 | $14,810 | $1,750 | $13,060 |

| 2018 | $788 | $14,810 | $1,750 | $13,060 |

| 2017 | $824 | $14,810 | $1,750 | $13,060 |

| 2016 | $749 | $11,310 | $1,790 | $9,520 |

| 2015 | $680 | $11,310 | $1,790 | $9,520 |

| 2014 | $682 | $11,310 | $1,790 | $9,520 |

| 2013 | $481 | $16,170 | $2,555 | $13,615 |

Source: Public Records

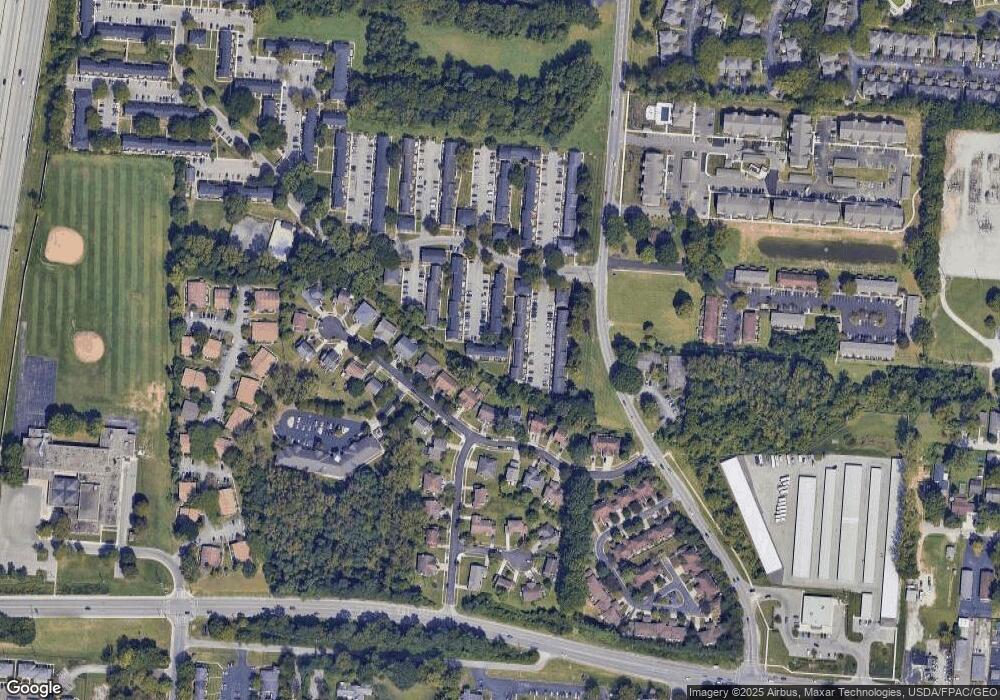

Map

Nearby Homes

- 1591 Stephanie Ct Unit 15912

- 1718 Sunapple Way

- 5846 Riverton Rd

- 5596 Autumn Chase Dr

- 1314 Yorkland Rd Unit C

- 1930 Walnut Hill Park Dr

- 0 Radekin Rd Unit 225029852

- 6156 Roselawn Ave

- 1942 Bairsford Dr Unit 944

- 0 Brice Rd

- 1835 Woodette Rd

- 1759 Lonsdale Rd

- 5366 Yorkshire Village Ln Unit B-22

- 5337 Ivyhurst Dr

- 1616 Coppertree Rd Unit 1615

- 6348 E Livingston Ave

- 6424-6426 Birchview Dr N

- 1818 Lucks Rd

- 2293 Ayers Dr

- 1945 Riverdale Rd

- 1659 Hallworth Ct

- 1655 Hallworth Ct

- 1655 Hallworth Ct Unit 17

- 1647 Hallworth Ct Unit 1647

- 1648 Hallworth Ct

- 1651 Hallworth Ct

- 1654 Hallworth Ct Unit 1654

- 1654 Hallworth Ct Unit Bldg 16

- 1646 Hallworth Ct

- 1652 Hallworth Ct Unit 16521

- 1656 Hallworth Ct Unit 1656

- 1650 Hallworth Ct Unit 1650

- 1645 Hallworth Ct

- 1658 Hallworth Ct Unit 1658

- 1651 Hallworth Ct

- 1649 Hallworth Ct Unit 1649

- 1660 Hallworth Ct

- 1642 Hallworth Ct

- 1643 Hallworth Ct

- 1662 Hallworth Ct Unit 1662