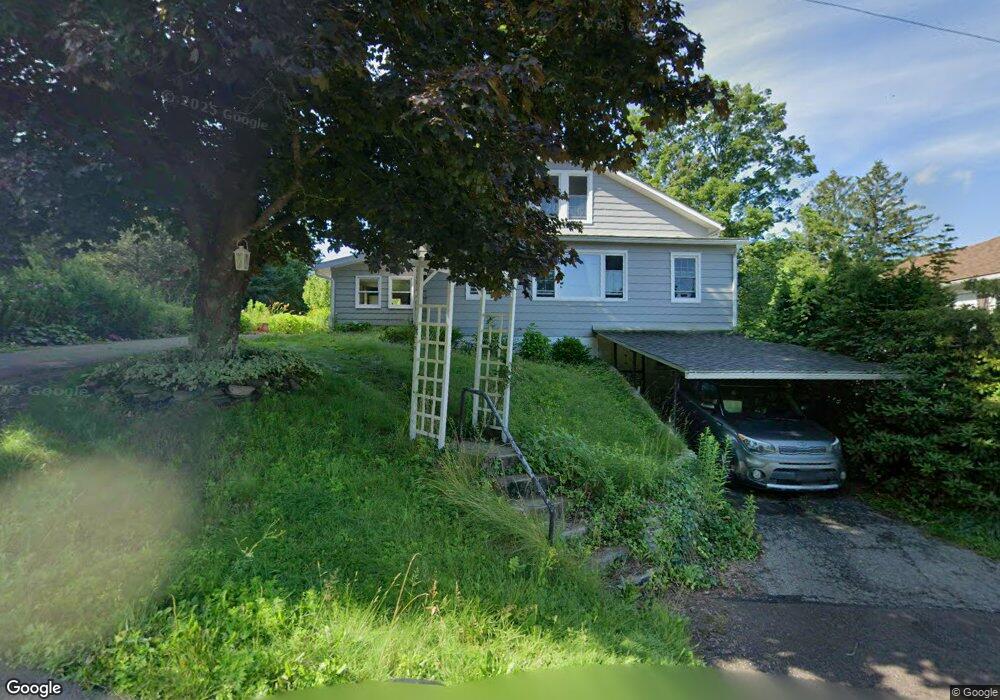

166 E Cherry St Unit T401 Dushore, PA 18614

Estimated Value: $104,000 - $154,000

4

Beds

1

Bath

1,424

Sq Ft

$90/Sq Ft

Est. Value

About This Home

This home is located at 166 E Cherry St Unit T401, Dushore, PA 18614 and is currently estimated at $128,298, approximately $90 per square foot. 166 E Cherry St Unit T401 is a home located in Sullivan County with nearby schools including Sullivan County Elementary School and Sullivan County High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 22, 2022

Sold by

Nolan Jerrod J and Nolan Mary E

Bought by

Ammerman Ean James

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$136,363

Outstanding Balance

$132,135

Interest Rate

6.95%

Mortgage Type

New Conventional

Estimated Equity

-$3,837

Purchase Details

Closed on

Sep 12, 2022

Sold by

Nolan Jerrod J and Nolan Mary E

Bought by

Richlin Tyrel and Richlin Ashleigh

Purchase Details

Closed on

Dec 21, 2015

Sold by

Nolan Jerrod J and Shaffer Robin K

Bought by

Nolan Jerrod J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$88,275

Interest Rate

3.97%

Mortgage Type

FHA

Purchase Details

Closed on

Jul 30, 2008

Sold by

White Laura

Bought by

Nolan Jerrod J and Nolan Robin K

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$93,177

Interest Rate

6.4%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Ammerman Ean James | $135,000 | Lg Settlement Services | |

| Richlin Mark A | $250 | -- | |

| Richlin Tyrel | $2,250 | -- | |

| Nolan Jerrod J | -- | None Available | |

| Nolan Jerrod J | $94,000 | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Ammerman Ean James | $136,363 | |

| Previous Owner | Nolan Jerrod J | $88,275 | |

| Previous Owner | Nolan Jerrod J | $93,177 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,251 | $53,200 | $9,300 | $43,900 |

| 2024 | $1,210 | $53,200 | $9,300 | $43,900 |

| 2023 | $1,154 | $53,200 | $9,300 | $43,900 |

| 2022 | $373 | $53,600 | $9,700 | $43,900 |

| 2021 | $373 | $53,600 | $9,700 | $43,900 |

| 2020 | $1,125 | $53,600 | $9,700 | $43,900 |

| 2019 | $1,104 | $53,600 | $9,700 | $43,900 |

| 2017 | $1,071 | $53,600 | $9,700 | $43,900 |

| 2015 | $497 | $53,400 | $9,700 | $43,700 |

| 2014 | $497 | $53,400 | $9,700 | $43,700 |

| 2012 | $497 | $53,400 | $9,700 | $43,700 |

Source: Public Records

Map

Nearby Homes

- 181 E Cherry St

- PARCEL 001 Route 220 Hwy

- 244 S Turnpike St

- 242 S Turnpike St Unit LR895

- 167 Payne Run Ln

- 1070 Hayes Rd

- 0 Cummiskey Rd

- 1050 Old Bernice Rd

- 595 Old Bernice Rd

- 0 Old Bernice Rd Unit 31721825

- 730 Elys Rd

- 3272 Pelton Hill Rd

- 4526 Pennsylvania 487

- 272 Crawford Rd

- 5751 Pennsylvania 487

- 2200 Overton Rd

- 338 Front St

- 535 Cavanaugh Rd

- 409 Front St

- 439 Front St

- 164 E Cherry St

- 164 E Cherry St

- 162 E Cherry St

- 161 E Cherry St

- 158 E Cherry St

- 221 Bernice Rd

- 172 E Cherry St

- 223 Bernice Rd Unit RT487

- 157 E Cherry St

- 112 Thomson Ave

- 201 Bernice Rd

- 113 Thomson Ave

- 181 E East Cherry St

- 159 E Cherry St

- 212 Bernice Rd

- 116 Thomson Ave

- 125 Beech St

- 131 Beech St

- 121 Beech St

- 184 E Cherry St