166 Viking Ct Unit 166 Sidney, OH 45365

Estimated Value: $168,000 - $202,000

2

Beds

2

Baths

1,350

Sq Ft

$138/Sq Ft

Est. Value

About This Home

This home is located at 166 Viking Ct Unit 166, Sidney, OH 45365 and is currently estimated at $186,741, approximately $138 per square foot. 166 Viking Ct Unit 166 is a home located in Shelby County with nearby schools including Sidney High School, Holy Angels Catholic School, and Christian Academy Schools.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 16, 2022

Sold by

Walter John R and Walter Marcella L

Bought by

Christman Karen L

Current Estimated Value

Purchase Details

Closed on

Jul 28, 2016

Sold by

Sadgebury Beverly J

Bought by

Walter John R and Walter Marcella L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$75,650

Interest Rate

3.54%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jul 25, 2008

Sold by

Shatto Kathleen

Bought by

Sadgebury Beverly J

Purchase Details

Closed on

Aug 28, 2007

Sold by

Bowers Bill

Bought by

Shatto Kathleen

Purchase Details

Closed on

Aug 8, 2007

Sold by

Estate Of Marian C Groves

Bought by

Bowers Bill and Shatto Kathleen

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Christman Karen L | -- | None Listed On Document | |

| Walter John R | $89,000 | Attorney | |

| Sadgebury Beverly J | -- | None Available | |

| Shatto Kathleen | $34,000 | Attorney | |

| Bowers Bill | -- | Attorney |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Walter John R | $75,650 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,697 | $49,270 | $3,660 | $45,610 |

| 2023 | $1,720 | $49,270 | $3,660 | $45,610 |

| 2022 | $1,244 | $39,940 | $2,650 | $37,290 |

| 2021 | $1,257 | $39,940 | $2,650 | $37,290 |

| 2020 | $1,257 | $39,940 | $2,650 | $37,290 |

| 2019 | $1,024 | $34,220 | $2,650 | $31,570 |

| 2018 | $1,009 | $34,220 | $2,650 | $31,570 |

| 2017 | $1,001 | $34,220 | $2,650 | $31,570 |

| 2016 | $1,334 | $32,940 | $2,650 | $30,290 |

| 2015 | $1,338 | $32,940 | $2,650 | $30,290 |

| 2014 | $1,337 | $32,940 | $2,650 | $30,290 |

| 2013 | $1,324 | $30,130 | $2,650 | $27,480 |

Source: Public Records

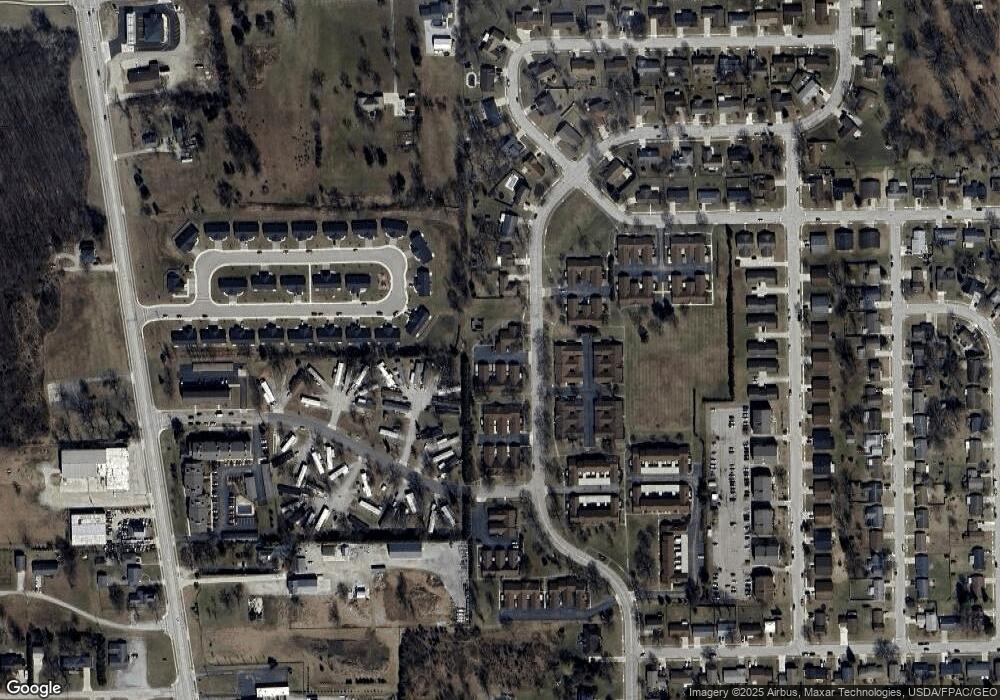

Map

Nearby Homes

- 173 Tranquility Ct

- 125 Leisure Ct

- 0 Sunshine Dr

- 2437 Armstrong Dr

- 2403 Armstrong Dr

- 136 Village Green Dr

- 2625 Spearhead Ct

- 526 W Hoewisher Rd

- 0 Windsor Park

- 637 Greenbriar Ct

- 2805 Wapakoneta Ave Unit 49

- 2805 Wapakoneta Ave Unit 14

- 2816 Broadway Ave

- 648 Addy Ave

- 676 Addy Ave

- 662 Addy Ave

- 634 Addy Ave

- 115 E Pinehurst St

- 3095 Thompson Schiff Rd

- 307 E Ruth St

- 163 Viking Ct

- 162 Viking Ct

- 164 Viking Ct

- 167 Viking Ct

- 161 Viking Ct

- 2415 N Main Ave

- 160 Pioneer Ct

- 180 Tranquility Ct

- 181 Tranquility Ct

- 158 Pioneer Ct

- 159 Pioneer Ct

- 157 Pioneer Ct

- 182 Tranquility Ct

- 183 Tranquility Ct

- 184 Voyager Ct

- 2421 N Main Ave

- 2433 Grace Place

- 179 Tranquility Ct Unit 179

- 189 Voyager Ct

- 178 Tranquility Ct

Your Personal Tour Guide

Ask me questions while you tour the home.