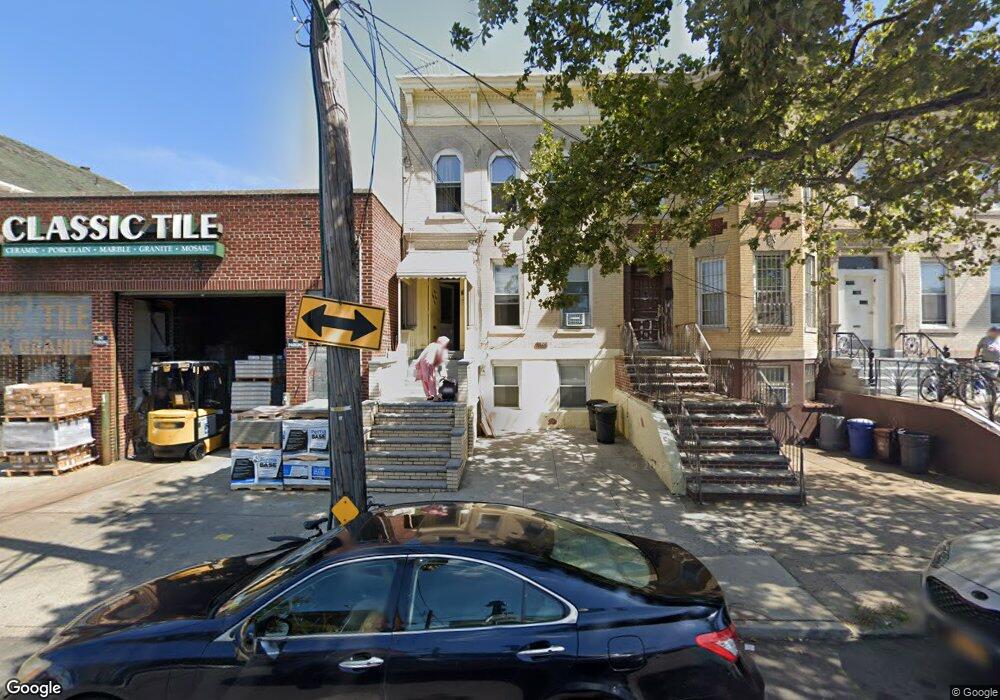

1665 86th St Brooklyn, NY 11214

Bensonhurst NeighborhoodEstimated Value: $1,369,000 - $1,876,000

Studio

--

Bath

3,135

Sq Ft

$504/Sq Ft

Est. Value

About This Home

This home is located at 1665 86th St, Brooklyn, NY 11214 and is currently estimated at $1,578,667, approximately $503 per square foot. 1665 86th St is a home located in Kings County with nearby schools including P.S. 204 Vince Lombardi, IS 201 Madeleine Brennan Intermediate School, and New Utrecht High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 7, 1998

Sold by

Haney Rose Marie

Bought by

Irfan Tamjeed

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$203,000

Interest Rate

6.8%

Purchase Details

Closed on

Mar 12, 1997

Sold by

Sinagra Karen L

Bought by

Haney Rose Marie

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$156,000

Interest Rate

8.09%

Purchase Details

Closed on

Jul 25, 1995

Sold by

Rettino Peter

Bought by

Sinagra Karen L

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Irfan Tamjeed | $290,000 | Nations Title Insurance | |

| Haney Rose Marie | $260,000 | Commonwealth Land Title Ins | |

| Sinagra Karen L | -- | Chicago Title Insurance Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Irfan Tamjeed | $203,000 | |

| Previous Owner | Haney Rose Marie | $156,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $7,663 | $77,160 | $13,800 | $63,360 |

| 2024 | $7,663 | $90,780 | $13,800 | $76,980 |

| 2023 | $7,312 | $98,400 | $13,800 | $84,600 |

| 2022 | $5,128 | $97,500 | $13,800 | $83,700 |

| 2021 | $6,852 | $86,040 | $13,800 | $72,240 |

| 2019 | $6,602 | $81,240 | $13,800 | $67,440 |

| 2018 | $6,056 | $31,170 | $6,571 | $24,599 |

| 2017 | $5,762 | $29,738 | $7,549 | $22,189 |

| 2016 | $5,349 | $28,305 | $6,774 | $21,531 |

| 2015 | $3,164 | $28,290 | $8,398 | $19,892 |

| 2014 | $3,164 | $27,469 | $9,783 | $17,686 |

Source: Public Records

Map

Nearby Homes

- 8413 17th Ave

- 1710 84th St Unit 301

- 1710 84th St Unit 314

- 1710 84th St Unit 213

- 8160 Bay 16th St

- 1721 Benson Ave

- 1755 Benson Ave Unit 3C

- 1755 Benson Ave Unit 2C

- 8420 18th Ave

- 8501 18th Ave

- 1687 83rd St

- 1673 83rd St

- 1632 83rd St

- 1662 82nd St

- 1635 83rd St

- 1830 84th St

- 8210 18th Ave

- 46 Rutherford Place

- 8720 18th St

- 8716 18th Ave

Your Personal Tour Guide

Ask me questions while you tour the home.