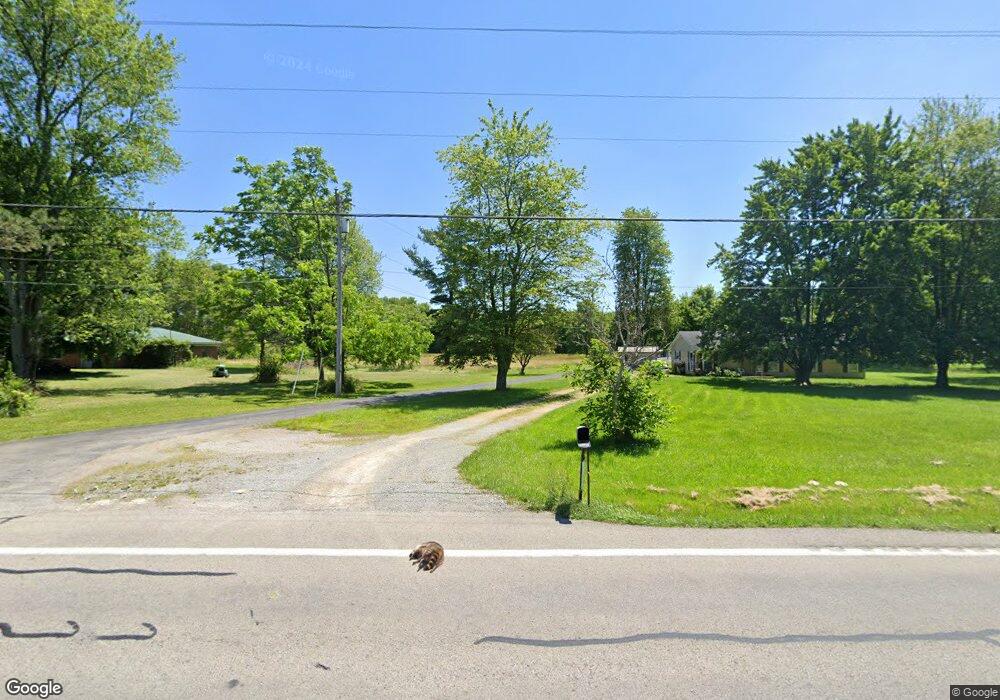

16704 Us Highway 68 Mount Orab, OH 45154

Estimated Value: $118,000 - $245,000

4

Beds

2

Baths

1,248

Sq Ft

$149/Sq Ft

Est. Value

About This Home

This home is located at 16704 Us Highway 68, Mount Orab, OH 45154 and is currently estimated at $185,889, approximately $148 per square foot. 16704 Us Highway 68 is a home located in Brown County with nearby schools including Western Brown High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 9, 2015

Sold by

Lewis Orie and Hall Edward

Bought by

Polhemus Jesse

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$65,960

Outstanding Balance

$50,980

Interest Rate

3.85%

Mortgage Type

New Conventional

Estimated Equity

$134,909

Purchase Details

Closed on

May 8, 2014

Sold by

Hensley Charles C

Bought by

Lewis Orie and Hall Edward

Purchase Details

Closed on

Nov 12, 2002

Sold by

Gilkinson Benjamin T

Bought by

Yankie Lisa G

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$18,500

Interest Rate

8.5%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jul 15, 2002

Sold by

Bankers Trst Co

Bought by

Gilkison Benjamin and Gilkison Vickie

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$38,080

Interest Rate

6.82%

Mortgage Type

New Conventional

Purchase Details

Closed on

Dec 20, 2001

Sold by

Kussman Edward A

Bought by

Bankers Trust Co California

Purchase Details

Closed on

Aug 30, 1994

Sold by

Schumann Jeffrey A

Bought by

Brown Wiley T

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Polhemus Jesse | $90,667 | None Available | |

| Lewis Orie | $30,000 | None Available | |

| Yankie Lisa G | $82,000 | -- | |

| Gilkison Benjamin | $47,600 | -- | |

| Bankers Trust Co California | $50,000 | -- | |

| Brown Wiley T | $58,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Polhemus Jesse | $65,960 | |

| Previous Owner | Yankie Lisa G | $18,500 | |

| Previous Owner | Gilkison Benjamin | $38,080 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,110 | $38,650 | $8,700 | $29,950 |

| 2023 | $1,110 | $29,480 | $6,040 | $23,440 |

| 2022 | $905 | $29,480 | $6,040 | $23,440 |

| 2021 | $892 | $29,480 | $6,040 | $23,440 |

| 2020 | $801 | $25,630 | $5,250 | $20,380 |

| 2019 | $860 | $25,630 | $5,250 | $20,380 |

| 2018 | $853 | $25,630 | $5,250 | $20,380 |

| 2017 | $828 | $24,760 | $5,780 | $18,980 |

| 2016 | $828 | $24,760 | $5,780 | $18,980 |

| 2015 | $824 | $24,760 | $5,780 | $18,980 |

| 2014 | $832 | $24,230 | $5,250 | $18,980 |

| 2013 | $807 | $24,230 | $5,250 | $18,980 |

Source: Public Records

Map

Nearby Homes

- 3447 Snider-Malott Rd

- 0 Snider-Malott Rd

- 3498 Upper 5 Mile West Rd

- 15721 Brooks Malott Rd

- 16285 Malady Rd

- 1 Bodman Rd

- 0 Bardwell W Unit 1854344

- 15422 U S 68

- 3056 Hannah Dr

- 15516 Hillcrest Rd

- 15503 Crawford-Day Rd

- Ac Greenbush Rd W

- 15316 Bodman Rd

- 17914 Gauche Rd

- 5092 County Highway 8-C

- 2756 Bardwell West Rd

- 5176 E Greenbush Rd

- 15070 Bodman Rd

- 0 Steward Harbough Rd Unit 1839956

- 0 Karampas Unit 1850784

- 16704 Us Highway 68

- 16704 Us Highway 68

- 16714 Us Highway 68

- 16724 Us Highway 68

- 16680 Us Highway 68

- 16680 Us Highway 68

- 16680 Us Rt 68

- 16665 St Rt 68

- 16760 Us Highway 68

- 16665 U S 68

- 16664 Us Highway 68

- 16649 Us Rt 68

- 16773 Us Rt 68

- 16793 Us Route 68

- 16793 Us Highway 68

- 16793 Us Rt 68

- 16806 Us Highway 68

- 16793 U S 68

- 16618 Us Highway 68

- 16629 Us Rt 68