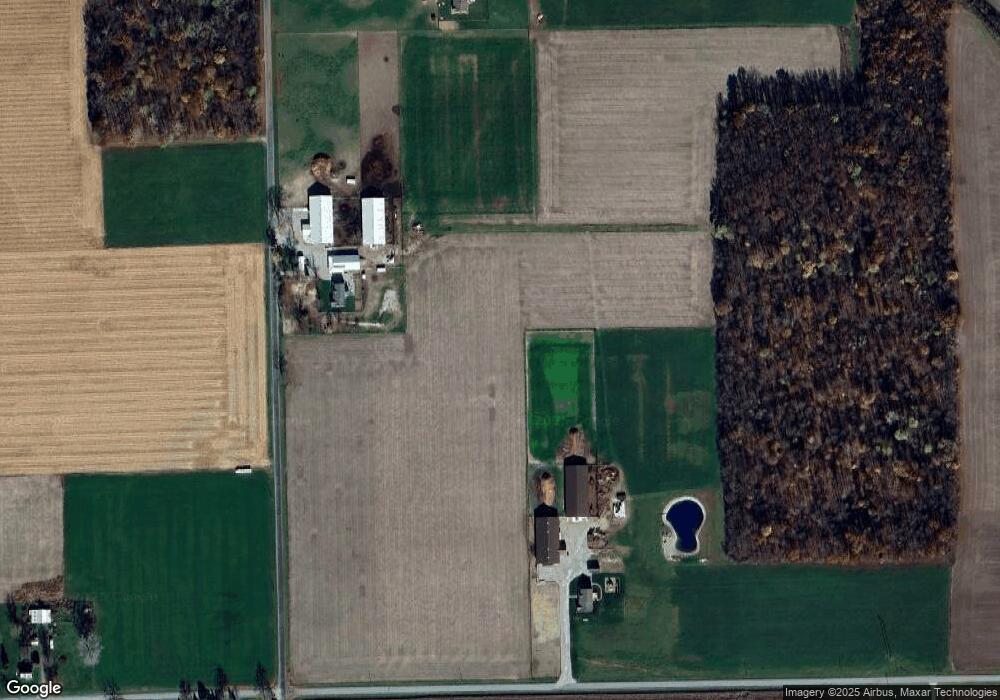

16716 Allen Rd Harlan, IN 46743

Estimated Value: $242,000 - $707,442

2

Beds

2

Baths

3,600

Sq Ft

$137/Sq Ft

Est. Value

About This Home

This home is located at 16716 Allen Rd, Harlan, IN 46743 and is currently estimated at $494,111, approximately $137 per square foot. 16716 Allen Rd is a home located in Allen County with nearby schools including Woodlan Junior/Senior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 29, 2015

Sold by

Bryson Susan I

Bought by

Schwartz John D and Schwartz Sharon R

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$266,810

Outstanding Balance

$109,957

Interest Rate

3.91%

Estimated Equity

$384,154

Purchase Details

Closed on

Oct 24, 2015

Sold by

Bryson Susan I

Bought by

Schwartz Matthew D and Schwartz Susanna R

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$266,810

Outstanding Balance

$109,957

Interest Rate

3.91%

Estimated Equity

$384,154

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Schwartz John D | -- | None Available | |

| Graber Marvin Lee | -- | None Available | |

| Schwartz Matthew D | -- | None Available | |

| Schwartz Daniel | -- | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Schwartz John D | $266,810 | |

| Closed | Schwartz Daniel | $261,057 | |

| Closed | Schwartz Matthew D | $272,301 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $5,817 | $572,400 | $90,200 | $482,200 |

| 2023 | $5,817 | $548,700 | $81,500 | $467,200 |

| 2022 | $4,127 | $452,000 | $72,200 | $379,800 |

| 2021 | $3,755 | $426,100 | $67,300 | $358,800 |

| 2020 | $2,950 | $366,300 | $67,100 | $299,200 |

| 2019 | $2,881 | $340,100 | $73,600 | $266,500 |

| 2018 | $2,781 | $315,100 | $74,800 | $240,300 |

| 2017 | $1,600 | $186,300 | $80,300 | $106,000 |

| 2016 | $1,943 | $191,700 | $82,800 | $108,900 |

| 2014 | $2,897 | $239,000 | $165,200 | $73,800 |

| 2013 | $2,676 | $220,500 | $147,100 | $73,400 |

Source: Public Records

Map

Nearby Homes

- TBD Allen Rd

- 24502 Indiana 37

- 26100 Worden Rd

- 60+/- acres County Road 75

- 11309 State Route 49

- 11234 State Route 49

- 3190 Road 204

- 338 Chicago Ave

- 6785 County Road 64

- 319 W High St

- 110 Sholl Terrace

- 307 Spencerville St

- 217 W Edgerton St

- 410 N Bryan St

- 950 Haver Dr

- Cr 71

- 00 Cr 71

- 516 Ogen St

- 1258 Road 192

- 505 E Smith St

- 17108 Allen Rd

- 24603 Hurshtown Rd

- 16313 Allen Rd

- 25302 Hurshtown Rd

- 24217 Hurshtown Rd

- 23626 Hurshtown Rd

- 24008 State Road 37

- 24030 State Road 37

- 25715 Hurshtown Rd

- 15716 Allen Rd

- 23532 State Road 37

- 24502 State Road 37

- 15629 Allen Rd

- 17818 Allen Rd

- 15704 Allen Rd

- 15617 Allen Rd

- 24418 State Road 37

- 23815 State Road 37

- 24319 State Road 37

- 17909 Allen Rd