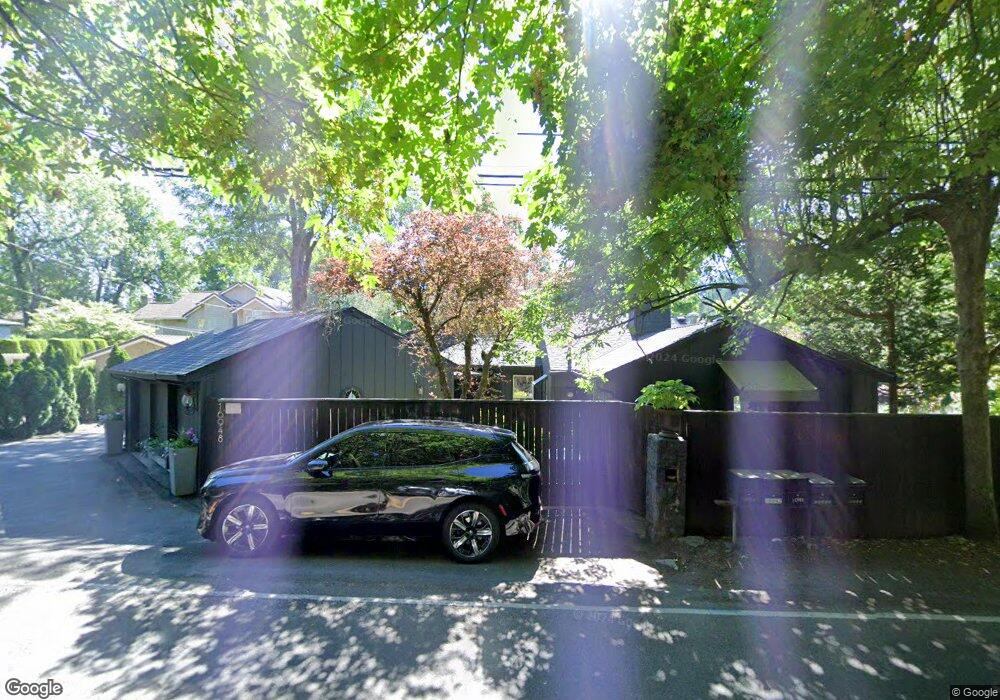

16884 Bryant Rd Lake Oswego, OR 97035

Bryant NeighborhoodEstimated Value: $1,277,000 - $1,554,252

3

Beds

2

Baths

1,968

Sq Ft

$717/Sq Ft

Est. Value

About This Home

This home is located at 16884 Bryant Rd, Lake Oswego, OR 97035 and is currently estimated at $1,410,084, approximately $716 per square foot. 16884 Bryant Rd is a home located in Clackamas County with nearby schools including Westridge Elementary School, Lakeridge Middle School, and Lakeridge High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 12, 2008

Sold by

Apperson Thomas B

Bought by

Clarke Jeffrey Steven and Clarke Kassie Lillian

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$395,000

Outstanding Balance

$252,367

Interest Rate

6.05%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$1,157,717

Purchase Details

Closed on

Apr 9, 2007

Sold by

Apperson Thomas B and Apperson Nancy E

Bought by

Apperson Thomas B

Purchase Details

Closed on

Mar 3, 2007

Sold by

Apperson Thomas B and Apperson Thomas B

Bought by

Apperson Thomas B

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Clarke Jeffrey Steven | $665,000 | First American Title Insuran | |

| Apperson Thomas B | -- | First American Title Insuran | |

| Apperson Thomas B | -- | First American Title Insuran |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Clarke Jeffrey Steven | $395,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $14,703 | $765,608 | -- | -- |

| 2024 | $14,311 | $743,309 | -- | -- |

| 2023 | $14,311 | $721,660 | $0 | $0 |

| 2022 | $13,478 | $700,641 | $0 | $0 |

| 2021 | $12,449 | $680,234 | $0 | $0 |

| 2020 | $12,136 | $660,422 | $0 | $0 |

| 2019 | $11,837 | $641,187 | $0 | $0 |

| 2018 | $11,257 | $622,512 | $0 | $0 |

| 2017 | $9,821 | $546,441 | $0 | $0 |

| 2016 | $8,941 | $530,525 | $0 | $0 |

| 2015 | $8,638 | $515,073 | $0 | $0 |

| 2014 | $8,526 | $500,071 | $0 | $0 |

Source: Public Records

Map

Nearby Homes

- 4264 Westbay Rd

- 4470 Lakeview Blvd

- 4368 Lakeview Blvd

- 4160 Westbay Rd

- 4640 Lower Dr

- 4610 Lower Dr

- 4241 Cobb Way

- 16755 Graef Cir

- 4480 Upper Dr

- 4224 Haven St

- 4971 Lakeview Blvd

- 17367 Canal Cir

- 17595 Kelok Rd

- 5189 Rosewood St

- 17810 Sarah Hill Ln

- 17855 Deerbrush Ave

- 5057 W Sunset Dr

- 5328 Lower Dr

- 18121 Deerbrush Ave

- 17239 Rebecca Ln

- 16946 Bryant Rd

- 16868 Bryant Rd

- 16942 Bryant Rd

- 16948 Bryant Rd

- 16842 Bryant Rd

- 4490 Lakeview Blvd

- 4464 Lakeview Blvd

- 4434 Lakeview Blvd

- 16931 Bryant Rd

- 4449 Westbay Rd

- 4423 Westbay Rd

- 4487 Westbay Rd

- 4424 Lakeview Blvd

- 4431 W Bay Rd

- 4423 W Bay Rd

- 4365 Westbay Rd

- 16911 Bryant Rd

- 4355 Westbay Rd

- 4398 Lakeview Blvd