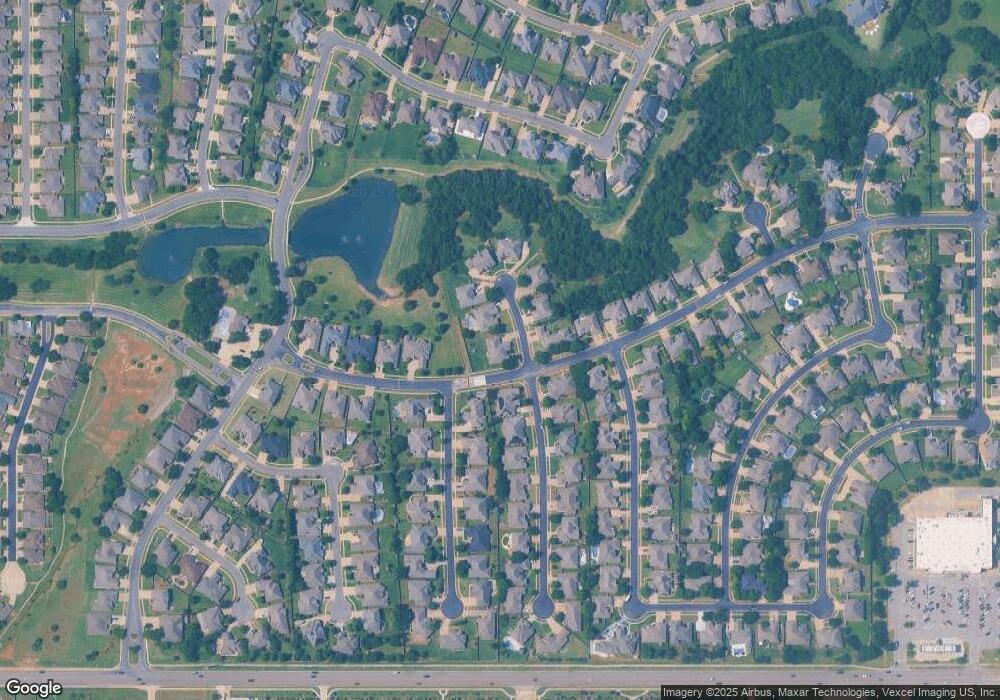

16901 Bradbury Cir Edmond, OK 73012

Fenwick NeighborhoodEstimated Value: $449,454 - $471,000

5

Beds

4

Baths

3,225

Sq Ft

$143/Sq Ft

Est. Value

About This Home

This home is located at 16901 Bradbury Cir, Edmond, OK 73012 and is currently estimated at $459,614, approximately $142 per square foot. 16901 Bradbury Cir is a home located in Oklahoma County with nearby schools including West Field Elementary School, Summit Middle School, and Santa Fe High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 21, 2011

Sold by

Khichi Mahmood H and Khichi Leslie

Bought by

Luper Deangelo and Stanton Luper Teresa

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$263,625

Outstanding Balance

$180,796

Interest Rate

4.52%

Mortgage Type

New Conventional

Estimated Equity

$278,818

Purchase Details

Closed on

Mar 20, 2003

Sold by

Williams Aldred and Williams Daphne

Bought by

Khichi Mahmood H and Khichi Leslie

Purchase Details

Closed on

Feb 14, 2002

Sold by

Williams Aldred E and Williams Daphne

Bought by

Williams Aldred and Williams Daphne

Purchase Details

Closed on

Apr 28, 2000

Sold by

J & J Custom Homes Inc

Bought by

Williams Aldred E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$187,000

Interest Rate

7.37%

Purchase Details

Closed on

Jan 29, 1999

Sold by

Fenwick L L C

Bought by

J & J Custom Homes Inc

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Luper Deangelo | $277,500 | The Oklahoma City Abstract & | |

| Khichi Mahmood H | $257,000 | Oklahoma Title & Closing Co | |

| Williams Aldred | -- | Lawyers Title | |

| Williams Aldred E | $234,000 | Capitol Abstract & Title Co | |

| J & J Custom Homes Inc | $34,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Luper Deangelo | $263,625 | |

| Previous Owner | Williams Aldred E | $187,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $4,785 | $42,212 | $5,562 | $36,650 |

| 2023 | $4,785 | $40,202 | $5,490 | $34,712 |

| 2022 | $4,598 | $38,288 | $6,117 | $32,171 |

| 2021 | $4,335 | $36,465 | $6,572 | $29,893 |

| 2020 | $4,227 | $35,035 | $6,919 | $28,116 |

| 2019 | $4,170 | $34,375 | $6,919 | $27,456 |

| 2018 | $4,156 | $34,045 | $0 | $0 |

| 2017 | $4,184 | $34,485 | $6,919 | $27,566 |

| 2016 | $4,121 | $34,155 | $6,281 | $27,874 |

| 2015 | $4,034 | $33,252 | $6,281 | $26,971 |

| 2014 | $3,926 | $32,440 | $6,281 | $26,159 |

Source: Public Records

Map

Nearby Homes

- 1401 NW 168th St

- 1425 NW 165th Ct

- 16608 Halbrooke Rd

- 2304 NW 170th St

- 2300 NW 170th St

- 2244 NW 170th St

- 2240 NW 170th St

- 2236 NW 170th St

- 2232 NW 170th St

- 2224 NW 170th St

- 2228 NW 170th St

- 1216 NW 165th St

- 16632 Parkhurst Rd

- 16409 Loire Dr W

- 16401 Burgundy Dr W

- 16408 Bordeaux Dr

- 17009 Wales Green Ave

- 16500 Farmington Way

- 17104 Wales Green Ave

- 16704 Tonka Trail

- 16905 Bradbury Cir

- 16805 Bradbury Cir

- 16800 Thorton Ln

- 16909 Bradbury Cir

- 16900 Bradbury Cir

- 16904 Bradbury Cir

- 1421 NW 168th St

- 16804 Bradbury Cir

- 16908 Bradbury Cir

- 16801 Bradbury Cir

- 16913 Bradbury Cir

- 16805 Thorton Ln

- 16704 Thorton Ln

- 16800 Bradbury Cir

- 16912 Bradbury Cir

- 16705 Bradbury Cir

- 16817 Kingsley Rd

- 16801 Thorton Ln

- 16704 Bradbury Cir

- 16809 Kingsley Rd