17 Darien New Hope, PA 18938

Estimated Value: $477,171 - $522,000

--

Bed

2

Baths

1,768

Sq Ft

$286/Sq Ft

Est. Value

About This Home

This home is located at 17 Darien, New Hope, PA 18938 and is currently estimated at $505,043, approximately $285 per square foot. 17 Darien is a home located in Bucks County with nearby schools including New Hope-Solebury Upper Elementary School, New Hope-Solebury Lower Elementary School, and New Hope-Solebury Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 26, 2013

Sold by

Ogiony John and Ogiony Patricia A

Bought by

Gardiner Andrew J and Van Gorder Averil

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$240,000

Outstanding Balance

$179,780

Interest Rate

4.42%

Mortgage Type

New Conventional

Estimated Equity

$325,263

Purchase Details

Closed on

Aug 12, 1994

Sold by

Arrington Wendell S

Bought by

Ogiony John L and Ogiony Patricia A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$102,500

Interest Rate

8.65%

Mortgage Type

Seller Take Back

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Gardiner Andrew J | $320,000 | Stewart Title Guaranty Co | |

| Ogiony John L | $110,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Gardiner Andrew J | $240,000 | |

| Previous Owner | Ogiony John L | $102,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,212 | $21,040 | $3,480 | $17,560 |

| 2024 | $3,212 | $21,040 | $3,480 | $17,560 |

| 2023 | $3,101 | $21,040 | $3,480 | $17,560 |

| 2022 | $3,101 | $21,040 | $3,480 | $17,560 |

| 2021 | $3,034 | $21,040 | $3,480 | $17,560 |

| 2020 | $2,978 | $21,040 | $3,480 | $17,560 |

| 2019 | $2,909 | $21,040 | $3,480 | $17,560 |

| 2018 | $2,860 | $21,040 | $3,480 | $17,560 |

| 2017 | $2,754 | $21,040 | $3,480 | $17,560 |

| 2016 | $2,754 | $21,040 | $3,480 | $17,560 |

| 2015 | -- | $21,040 | $3,480 | $17,560 |

| 2014 | -- | $21,040 | $3,480 | $17,560 |

Source: Public Records

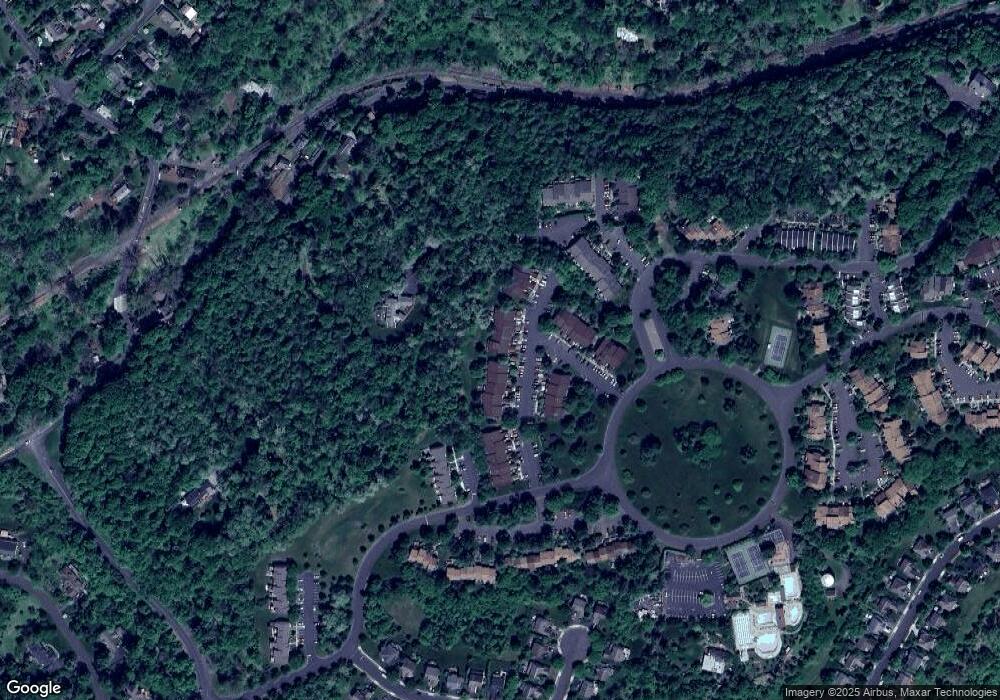

Map

Nearby Homes

- 24 Tahoe

- 2 Runnemede

- 121 Kiltie Dr

- 100 W Bridge St

- 38 W Ferry St

- 15 Riverstone Cir

- 727 Brighton Way

- 218 Towpath St

- 64 N Main St

- 705 Brighton Way

- 130 N Main St Unit C

- 1 Rabbit Run Dr

- 27 Lambert La

- 74 Sunset Dr

- 266 Deerfield Ct

- 14 Lambert Ln

- 16 Lambert Ln

- 142 Shire Dr Unit 14B

- 23 Swan St

- 22 Meadow Ln Unit 2B