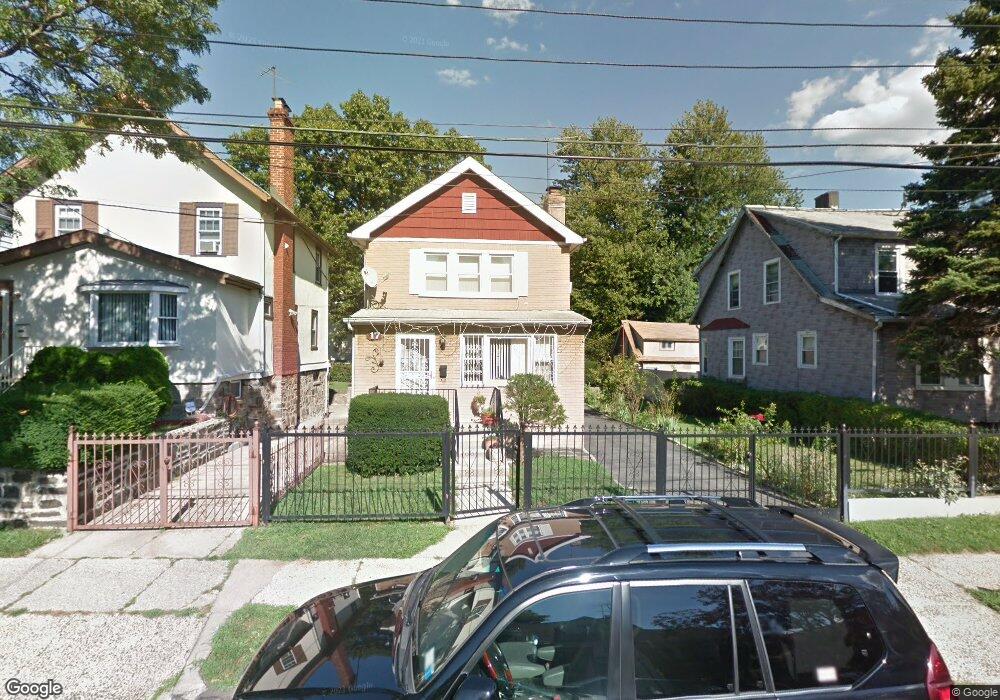

17 Johnson St Mount Vernon, NY 10550

Estimated Value: $559,000 - $684,000

Studio

--

Bath

--

Sq Ft

4,792

Sq Ft

About This Home

This home is located at 17 Johnson St, Mount Vernon, NY 10550 and is currently estimated at $601,147. 17 Johnson St is a home located in Westchester County with nearby schools including Rebecca Turner Elementary School, Benjamin Turner Middle School, and Mount Vernon High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 28, 2014

Sold by

Gibson Norman and Gibson Beryl

Bought by

Gibson Norman and Gibson Berlyl

Current Estimated Value

Purchase Details

Closed on

Dec 7, 2013

Sold by

Gibson Norman and Gibson Beryl

Bought by

Gibson Norman and Gibson Beryl

Purchase Details

Closed on

Aug 9, 2006

Sold by

Gibson Beryl

Bought by

Gibson Norman and Gibson Beryl

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$387,000

Interest Rate

6.83%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Jul 6, 2006

Sold by

Rojas Dorcas

Bought by

Gibson Beryl G

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$387,000

Interest Rate

6.83%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Gibson Norman | -- | Tgi Title Guarantee Inc | |

| Gibson Norman | -- | Multiple | |

| Gibson Norman | -- | The Judicial Title Ins Agenc | |

| Gibson Beryl G | $430,000 | The Judicial Title Ins Agenc |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Gibson Beryl G | $387,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $8,236 | $7,400 | $2,300 | $5,100 |

| 2023 | $5,141 | $7,400 | $2,300 | $5,100 |

| 2022 | $7,307 | $7,400 | $2,300 | $5,100 |

| 2021 | $11,457 | $7,400 | $2,300 | $5,100 |

| 2020 | $6,235 | $7,400 | $2,300 | $5,100 |

| 2019 | $10,777 | $7,400 | $2,300 | $5,100 |

| 2018 | $0 | $7,400 | $2,300 | $5,100 |

| 2017 | $0 | $7,400 | $2,300 | $5,100 |

| 2016 | $10,540 | $7,400 | $2,300 | $5,100 |

| 2015 | -- | $7,400 | $2,300 | $5,100 |

| 2014 | -- | $7,400 | $2,300 | $5,100 |

| 2013 | -- | $7,400 | $2,300 | $5,100 |

Source: Public Records

Map

Nearby Homes

- 4048 Harper Ave

- 4040 Pratt Ave

- 3946 Secor Ave

- 42 Wildwood Ave

- 62 Washington Blvd

- 75 W Kingsbridge Rd

- 3968 Duryea Ave

- 3964 Duryea Ave

- 724 S 4th Ave

- 3963 Duryea Ave

- 3924 Duryea Ave

- 1461 E 233rd St

- 3919 Pratt Ave

- 2181 Strang Ave

- 29 Bell Ave

- 15 Saint Pauls Place

- 138 W Kingsbridge Rd

- 605 S 6th Ave

- 2110 Light St

- 3735 Rombouts Ave

Your Personal Tour Guide

Ask me questions while you tour the home.