17 Lemoyne Ln Kiawah Island, SC 29455

Estimated Value: $5,636,794 - $6,236,000

4

Beds

7

Baths

5,220

Sq Ft

$1,156/Sq Ft

Est. Value

About This Home

This home is located at 17 Lemoyne Ln, Kiawah Island, SC 29455 and is currently estimated at $6,035,931, approximately $1,156 per square foot. 17 Lemoyne Ln is a home located in Charleston County with nearby schools including Mt. Zion Elementary School, Haut Gap Middle School, and St. Johns High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 23, 2023

Sold by

Seabrook 3480 Llc

Bought by

James H Wooten Jr Revocable Trust and Gertrude Dyane Wooten Revocable Trust

Current Estimated Value

Purchase Details

Closed on

Jun 19, 2019

Sold by

Gillespie Patrick C M

Bought by

Seabrook 3480 Llc

Purchase Details

Closed on

Jul 2, 2014

Sold by

Rhyne Joseph M N and Rhyne Lauren C

Bought by

Ervin Michael E

Purchase Details

Closed on

May 25, 2010

Sold by

Royal Beach 11 Partnership

Bought by

Gillespie Patrick C M

Purchase Details

Closed on

Feb 15, 2006

Sold by

Fishburn Richard J and Fishburn Kathleen G

Bought by

Royal Beach 11 Partnership and 17 Lemoyne Lane Llc

Purchase Details

Closed on

Dec 19, 2000

Sold by

Kiawah Development Partners Inc

Bought by

Fishburn Kathleen G and Fishburn Richard J

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| James H Wooten Jr Revocable Trust | -- | None Listed On Document | |

| Seabrook 3480 Llc | $640,000 | None Available | |

| Ervin Michael E | $450,000 | -- | |

| Gillespie Patrick C M | $850,000 | -- | |

| Royal Beach 11 Partnership | $1,250,000 | None Available | |

| Fishburn Kathleen G | $641,250 | -- |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $12,222 | $136,000 | $0 | $0 |

| 2023 | $12,222 | $138,000 | $0 | $0 |

| 2022 | $8,670 | $38,400 | $0 | $0 |

| 2021 | $8,568 | $38,400 | $0 | $0 |

| 2020 | $8,449 | $38,400 | $0 | $0 |

| 2019 | $6,246 | $27,000 | $0 | $0 |

| 2017 | $5,907 | $27,000 | $0 | $0 |

| 2016 | $5,675 | $27,000 | $0 | $0 |

| 2015 | $5,359 | $27,000 | $0 | $0 |

| 2014 | $6,204 | $0 | $0 | $0 |

| 2011 | -- | $0 | $0 | $0 |

Source: Public Records

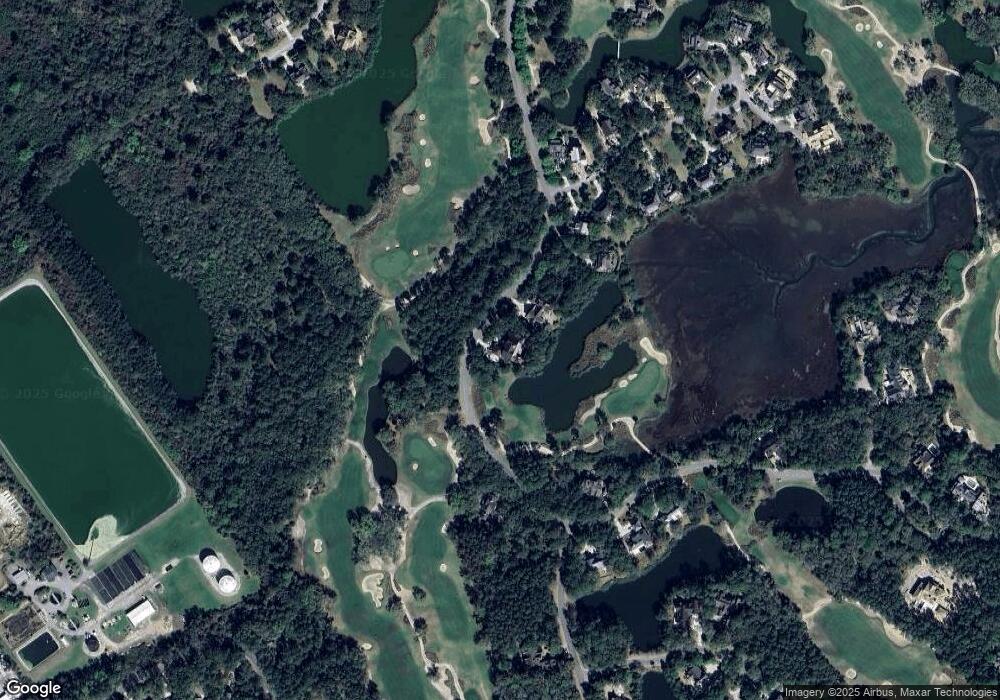

Map

Nearby Homes

- 512 Claret Way

- 515 Claret Way

- 2860 Old Drake Dr

- 2824 Old Drake Dr

- 4005 Bridle Trail Dr

- 4021 Bridle Trail Dr

- 2128 Royal Pine Dr

- 2106 Kings Pine Dr

- 3121 Marshgate Dr

- 2706 Old Oak Walk

- 2123 Kings Pine Dr

- 2160 Royal Pine Dr

- 79 Trailing Vine Way

- 3067 Marshgate Dr

- 2931 Deer Point Dr

- 2472 Racquet Club Dr

- 2465 Racquet Club Dr

- 1142 Turtle Watch Ln

- 1614 Live Oak Park Unit 1614

- 1627 Live Oak Park