17 Maid Marian Ct Waynesboro, VA 22980

Estimated Value: $424,034 - $462,000

3

Beds

3

Baths

2,510

Sq Ft

$176/Sq Ft

Est. Value

About This Home

This home is located at 17 Maid Marian Ct, Waynesboro, VA 22980 and is currently estimated at $442,759, approximately $176 per square foot. 17 Maid Marian Ct is a home located in Augusta County with nearby schools including Stuarts Draft Elementary School, Stuarts Draft Middle School, and Stuarts Draft High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 7, 2012

Sold by

Martin Robert J and Martin Cynthia A

Bought by

Moneymaker Kim R

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$224,900

Outstanding Balance

$154,490

Interest Rate

3.87%

Mortgage Type

New Conventional

Estimated Equity

$288,269

Purchase Details

Closed on

Feb 16, 2010

Sold by

Snavely Stephen B and Snavely Sarah J

Bought by

Martin Robert J and Martin Cynthia A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$233,357

Interest Rate

4.39%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Moneymaker Kim R | $249,900 | Dccu Title Services | |

| Martin Robert J | $236,500 | Southern Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Moneymaker Kim R | $224,900 | |

| Previous Owner | Martin Robert J | $233,357 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,072 | $398,400 | $65,000 | $333,400 |

| 2024 | $2,072 | $398,400 | $65,000 | $333,400 |

| 2023 | $1,703 | $270,300 | $60,000 | $210,300 |

| 2022 | $1,703 | $270,300 | $60,000 | $210,300 |

| 2021 | $1,703 | $270,300 | $60,000 | $210,300 |

| 2020 | $1,703 | $270,300 | $60,000 | $210,300 |

| 2019 | $1,703 | $270,300 | $60,000 | $210,300 |

| 2018 | $1,588 | $252,023 | $60,000 | $192,023 |

| 2017 | $1,462 | $252,023 | $60,000 | $192,023 |

| 2016 | $1,462 | $252,023 | $60,000 | $192,023 |

| 2015 | $1,286 | $252,023 | $60,000 | $192,023 |

| 2014 | $1,286 | $252,023 | $60,000 | $192,023 |

| 2013 | $1,286 | $267,900 | $60,000 | $207,900 |

Source: Public Records

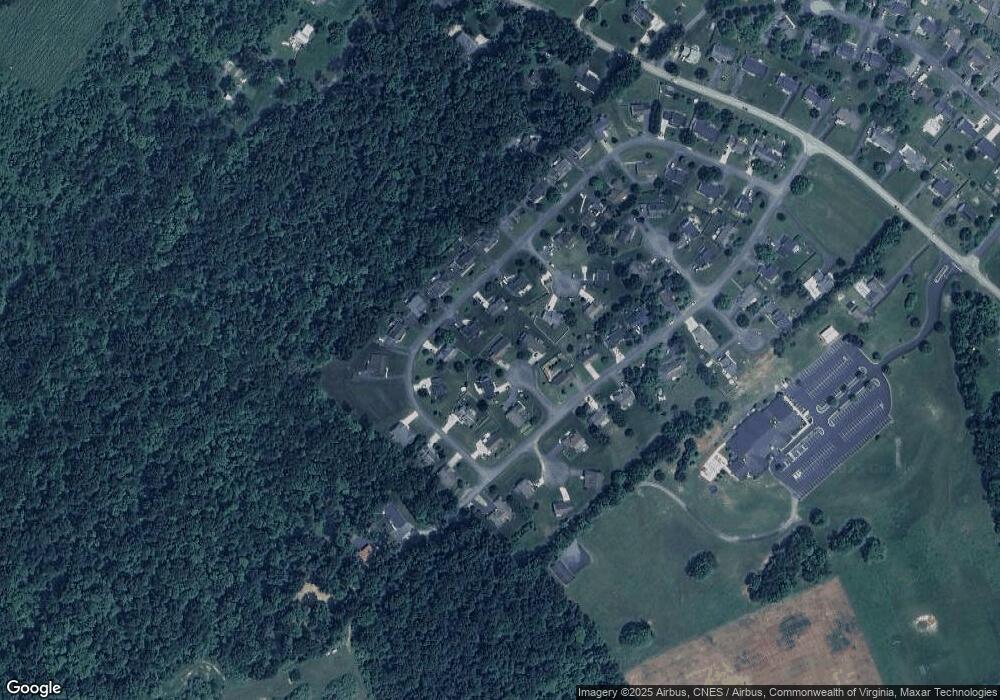

Map

Nearby Homes

- TBD7 Ladd Rd

- TBD6 Ladd Rd

- 257 Camden Coyner Ln

- 232 Camden Coyner Ln

- 244 Camden Coyner Ln

- 256 Camden Coyner Ln

- 248 Camden Coyner Ln

- 249 Camden Coyner Ln

- 252 Camden Coyner Ln

- 236 Camden Coyner Ln

- 253 Camden Coyner Ln

- 260 Camden Coyner Ln

- 850 Shenandoah Village Dr

- 14 Stuart James Ct

- 200 Shenandoah Village Dr

- 159 Langley Dr

- 155 Langley Dr

- 12 Laura Jean Ct

- 141 Lucy Ln

- 1767 Goose Creek Rd

- 15 Maid Marian Ct

- 98 Long Bow Rd

- 16 Maid Marian Ct

- 90 Long Bow Rd

- 108 Long Bow Rd

- 15 Prince John Ct

- 81 Sir Robin Rd

- 12 Maid Marian Ct

- 120 Long Bow Rd

- 84 Long Bow Rd

- 134 Long Bow Rd

- 77 Sir Robin Rd

- 95 Long Bow Rd Unit 13

- 95 Long Bow Rd

- 142 Long Bow Rd

- 103 Long Bow Rd

- 89 Long Bow Rd

- 18 Prince John Ct

- 109 Long Bow Rd

- 81 Long Bow Rd