1706 SW 318th Place Unit D Federal Way, WA 98023

Lakota NeighborhoodEstimated Value: $284,000 - $336,000

2

Beds

2

Baths

1,207

Sq Ft

$249/Sq Ft

Est. Value

About This Home

This home is located at 1706 SW 318th Place Unit D, Federal Way, WA 98023 and is currently estimated at $300,373, approximately $248 per square foot. 1706 SW 318th Place Unit D is a home located in King County with nearby schools including Adelaide Elementary School, Lakota Middle School, and Decatur High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 22, 2003

Sold by

Young Lea J and Young Brad K

Bought by

Kauer Roy A and Kauer Josephine R

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$138,500

Outstanding Balance

$60,107

Interest Rate

5.77%

Mortgage Type

VA

Estimated Equity

$240,266

Purchase Details

Closed on

Dec 31, 1998

Sold by

Bair Harry D and Bair Hazel E

Bought by

Krueger Lea J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$75,250

Interest Rate

6.73%

Mortgage Type

FHA

Purchase Details

Closed on

Oct 20, 1997

Sold by

Quimby Jerome R and Quimby Dorothy

Bought by

Bair Harry D and Bair Hazel E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$67,500

Interest Rate

7.49%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Kauer Roy A | $134,500 | Lawyers Title | |

| Krueger Lea J | $77,100 | -- | |

| Bair Harry D | $75,000 | Chicago Title Ins Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Kauer Roy A | $138,500 | |

| Previous Owner | Krueger Lea J | $75,250 | |

| Previous Owner | Bair Harry D | $67,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,405 | $286,000 | $55,800 | $230,200 |

| 2023 | $2,627 | $289,000 | $38,300 | $250,700 |

| 2022 | $2,415 | $261,000 | $34,800 | $226,200 |

| 2021 | $2,403 | $208,000 | $31,300 | $176,700 |

| 2020 | $2,146 | $195,000 | $31,300 | $163,700 |

| 2018 | $2,052 | $162,000 | $27,900 | $134,100 |

| 2017 | $1,798 | $141,000 | $27,900 | $113,100 |

| 2016 | $1,669 | $123,000 | $24,400 | $98,600 |

| 2015 | $1,402 | $109,000 | $24,400 | $84,600 |

| 2014 | -- | $93,000 | $20,900 | $72,100 |

| 2013 | -- | $64,000 | $20,900 | $43,100 |

Source: Public Records

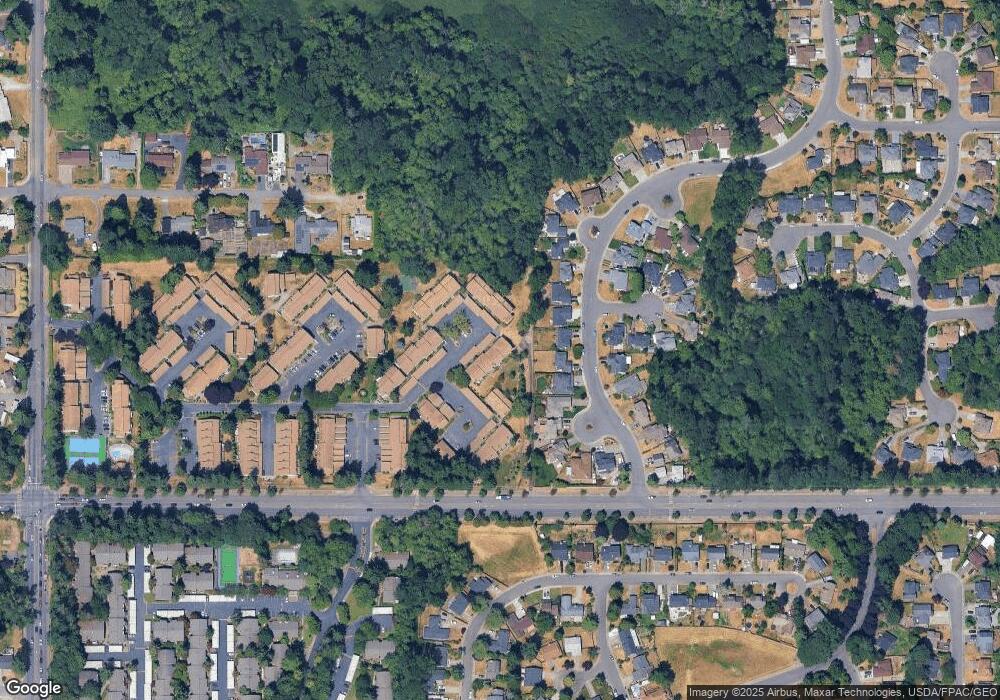

Map

Nearby Homes

- 1922 SW 318th Place Unit 13C

- 2020 SW 318th Place Unit C3

- 2019 SW 318th Place Unit 4C

- 1723 SW 324th St

- 1119 SW 325th Place

- 2625 SW 320th Place

- 1112 SW 326th Place

- 32528 26th Ave SW

- 1073 SW 326th St

- 2738 SW 323rd St

- 31114 29th Ct SW

- 2004 SW 306th Place

- 2229 SW 330th St

- 2730 SW 327th St Unit D-18

- 529 SW 324th St

- 3207 SW 319th St Unit 48

- 32520 30th Ave SW

- 32738 6th Ave SW

- 31500 33rd Place SW Unit N103

- 31500 33rd Place SW Unit U101

- 1706 SW 318th Place Unit 45B

- 1706 SW 318th Place Unit B

- 1706 SW 318th Place Unit A

- 1706 SW 318th Place Unit 45C

- 1710 SW 318th Place Unit C

- 1710 SW 318th Place Unit 44C

- 1710 SW 318th Place Unit 44A

- 1710 SW 318th Place Unit 44D

- 1720 SW 318th Place Unit C

- 1720 SW 318th Place

- 31917 14th Way SW

- 31909 14th Way SW

- 31921 14th Way SW

- 31903 14th Way SW

- 1714 SW 318th Place Unit 43D

- 1714 SW 318th Place Unit 43B

- 1714 SW 318th Place Unit 43C

- 1714 SW 318th Place Unit 43A

- 1714 SW 318th Place Unit C

- 1726 SW 318th Place Unit C