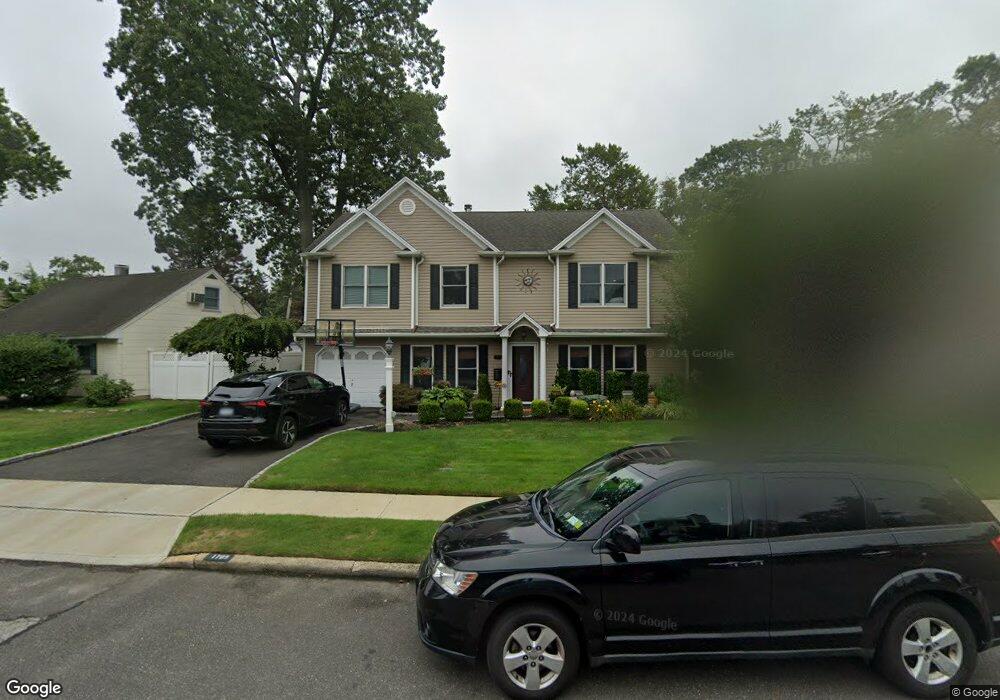

1709 Auburn Rd Wantagh, NY 11793

Estimated Value: $896,399 - $1,043,000

--

Bed

2

Baths

2,370

Sq Ft

$409/Sq Ft

Est. Value

About This Home

This home is located at 1709 Auburn Rd, Wantagh, NY 11793 and is currently estimated at $969,700, approximately $409 per square foot. 1709 Auburn Rd is a home located in Nassau County with nearby schools including Wantagh Middle School, Wantagh Senior High School, and Maplewood School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 22, 2009

Sold by

Russo Victor

Bought by

Ecker Edward and Freiman Julie

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$399,200

Interest Rate

4.78%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Dec 16, 2009

Sold by

Russo Victor and Padulo Lisa

Bought by

Russo Victor

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$399,200

Interest Rate

4.78%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

May 20, 2005

Sold by

Dvorznak Daniel

Bought by

Russo Victor

Purchase Details

Closed on

Nov 21, 2000

Sold by

Schwartzman Kenneth and Schwartzman Joan R

Bought by

Dvorznak Daniel

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Ecker Edward | $499,000 | -- | |

| Russo Victor | -- | -- | |

| Russo Victor | $535,000 | -- | |

| Dvorznak Daniel | $320,000 | Anthony F Russo, Esq. |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Ecker Edward | $399,200 | |

| Previous Owner | Russo Victor | $399,200 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $15,373 | $535 | $192 | $343 |

| 2024 | $3,933 | $553 | $198 | $355 |

| 2023 | $15,650 | $594 | $213 | $381 |

| 2022 | $15,650 | $569 | $204 | $365 |

| 2021 | $20,030 | $582 | $209 | $373 |

| 2020 | $13,980 | $827 | $467 | $360 |

| 2019 | $13,483 | $886 | $501 | $385 |

| 2018 | $13,571 | $1,154 | $0 | $0 |

| 2017 | $11,153 | $1,154 | $652 | $502 |

| 2016 | $16,191 | $1,154 | $652 | $502 |

| 2015 | $4,702 | $1,154 | $652 | $502 |

| 2014 | $4,702 | $1,154 | $652 | $502 |

| 2013 | $4,124 | $1,079 | $652 | $427 |

Source: Public Records

Map

Nearby Homes

- 3615 Franklin St

- 1808 Oakland Ave

- 3637 John St

- 3462 Ella Rd

- 1630 Temple Dr

- 1605 Henry Rd

- 1555 Henry Rd

- 3674 Park Ave Unit 1D

- 1480 Adam Place

- 3731 Park Ave

- 3809 Lincoln St

- 1519 Wantagh Ave

- 3799 Mansfield Dr

- 3418 Silverton Ave

- 3862 Clark St

- 3860 Maplewood Dr

- 2090 Beech St

- 3405 Lufberry Ave

- 3902 Beechwood Place

- 3783 Charlotte Ct