Estimated Value: $283,589 - $491,000

3

Beds

--

Bath

1,437

Sq Ft

$284/Sq Ft

Est. Value

About This Home

This home is located at 171 Country Club Dr Unit 8, Union, NJ 07083 and is currently estimated at $407,647, approximately $283 per square foot. 171 Country Club Dr Unit 8 is a home located in Union County with nearby schools including Connecticut Farms Elementary School, Union High School, and St. Theresa School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 6, 2008

Sold by

Scannavino Marie C and Munger Dorothy M

Bought by

King Debra

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$274,050

Outstanding Balance

$180,484

Interest Rate

6.4%

Mortgage Type

FHA

Estimated Equity

$227,163

Purchase Details

Closed on

Jul 15, 2002

Sold by

Hernandez Daniel D

Bought by

Scannavino Marie C and Munger Dorothy M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$215,370

Interest Rate

6.73%

Purchase Details

Closed on

Oct 30, 2001

Sold by

Paragano John and Paragano Sharon

Bought by

Hernandez Daniel D

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$200,350

Interest Rate

6.77%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| King Debra | $290,000 | Old Republic National Title | |

| Scannavino Marie C | $239,300 | -- | |

| Hernandez Daniel D | $205,000 | Lawyers Title Insurance Corp |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | King Debra | $274,050 | |

| Previous Owner | Scannavino Marie C | $215,370 | |

| Previous Owner | Hernandez Daniel D | $200,350 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $7,733 | $34,600 | $14,000 | $20,600 |

| 2024 | $7,497 | $34,600 | $14,000 | $20,600 |

| 2023 | $7,497 | $34,600 | $14,000 | $20,600 |

| 2022 | $7,237 | $34,600 | $14,000 | $20,600 |

| 2021 | $7,062 | $34,600 | $14,000 | $20,600 |

| 2020 | $6,921 | $34,600 | $14,000 | $20,600 |

| 2019 | $6,828 | $34,600 | $14,000 | $20,600 |

| 2018 | $6,711 | $34,600 | $14,000 | $20,600 |

| 2017 | $6,612 | $34,600 | $14,000 | $20,600 |

| 2016 | $6,451 | $34,600 | $14,000 | $20,600 |

| 2015 | $6,344 | $34,600 | $14,000 | $20,600 |

| 2014 | -- | $34,600 | $14,000 | $20,600 |

Source: Public Records

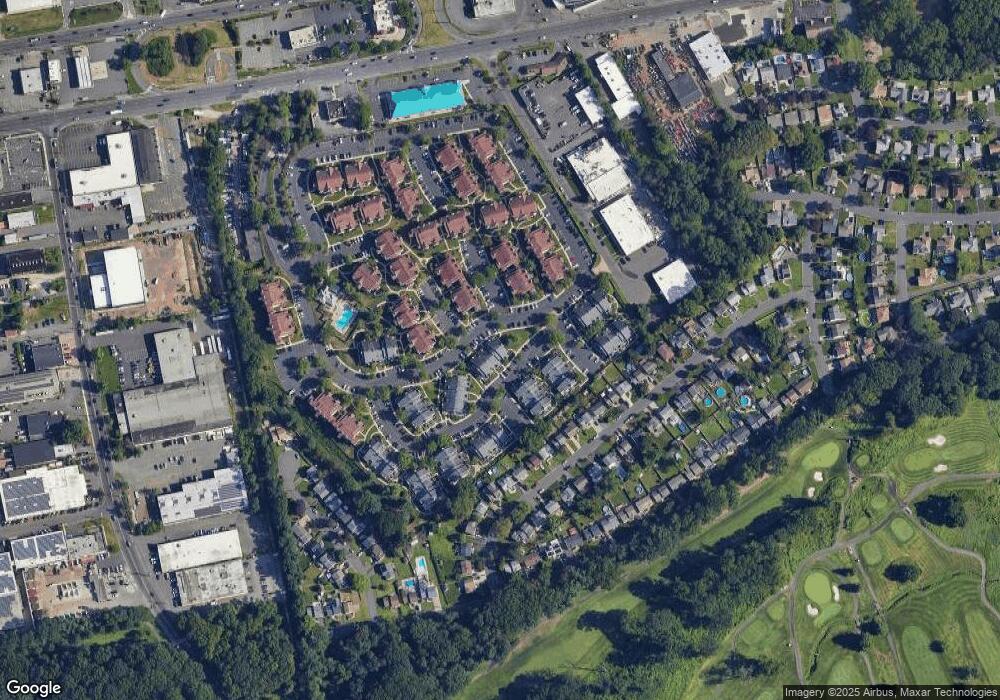

Map

Nearby Homes

- 161 Country Club Dr Unit 5

- 151 Country Club Dr

- 221 Broadmoor-4

- 221 Broadmoor Ct Unit 7

- 647 Evergreen Pkwy

- 694 Evergreen Pkwy

- 341 N 19th St

- 18 Boyd Terrace

- 10 Sadie Cir

- 7 Sadie Cir Unit 7103

- 750 Lafayette Ave

- 1114 W Chestnut St

- 768 Fairway Dr

- 827 Savitt Place

- 809 Caldwell Ave

- 136 N 21st St

- 224 N 17th St

- 126 N 19th St

- 46 N 22nd St

- 881 Garden St

- 171 Country Club Dr Unit 5

- 171 Country Club Dr Unit 6

- 171 Country Club Dr Unit 7

- 171 Country Club Dr Unit 5

- 171 Country Club Dr Unit 1

- 171 Country Club Dr Unit 6

- 171 Country Club Dr Unit 2

- 171 Country Club Dr Unit CLUB3

- 171 Country Club Dr Unit 4

- 171 Country Club Dr

- 171 Country Club Dr Unit 1

- 171 Country Club Dr Unit 1

- 171 Country Club Dr

- 702 Pinehurst-2 Unit 2

- 312 Greenbriar-4 Unit 4

- 312 Greenbriar-3 Unit 3

- 312 Greenbriar-3

- 531 Country Club Dr

- 602 Deepdale-10

- 602 Deepdale Ct - 9