1710 SE 22nd Ave Battle Ground, WA 98604

Estimated Value: $520,095 - $587,000

3

Beds

2

Baths

1,705

Sq Ft

$323/Sq Ft

Est. Value

About This Home

This home is located at 1710 SE 22nd Ave, Battle Ground, WA 98604 and is currently estimated at $550,524, approximately $322 per square foot. 1710 SE 22nd Ave is a home located in Clark County with nearby schools including Tukes Valley Primary School, Tukes Valley Middle School, and Battle Ground High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 16, 2021

Sold by

Leighton Rachel D and Leighton Clifford A

Bought by

Biczo Melba

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$350,000

Outstanding Balance

$317,571

Interest Rate

2.9%

Mortgage Type

New Conventional

Estimated Equity

$232,953

Purchase Details

Closed on

Mar 10, 2021

Sold by

Leighton Rachel D and Schwartz Rachel

Bought by

Leighton Rachel D and Leighton Clifford A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$296,800

Interest Rate

2.73%

Mortgage Type

New Conventional

Purchase Details

Closed on

Feb 22, 2017

Sold by

Cascade Meadows Development Llc

Bought by

Schwartz Rachel

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$313,405

Interest Rate

4.12%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Biczo Melba | $490,000 | Wfg Natl Ttl Co Of Clark Cnt | |

| Leighton Rachel D | -- | Chicago Title | |

| Schwartz Rachel | $329,900 | Fidelity Title Fl Vancouver |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Biczo Melba | $350,000 | |

| Previous Owner | Leighton Rachel D | $296,800 | |

| Previous Owner | Schwartz Rachel | $313,405 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,254 | $519,315 | $135,000 | $384,315 |

| 2024 | $3,643 | $521,772 | $135,000 | $386,772 |

| 2023 | $3,757 | $508,324 | $135,000 | $373,324 |

| 2022 | $3,770 | $477,987 | $94,250 | $383,737 |

| 2021 | $3,619 | $416,836 | $81,250 | $335,586 |

| 2020 | $3,105 | $366,929 | $74,750 | $292,179 |

| 2019 | $2,642 | $356,760 | $76,700 | $280,060 |

| 2018 | $3,183 | $355,157 | $0 | $0 |

| 2017 | $654 | $314,416 | $0 | $0 |

| 2016 | -- | $70,000 | $0 | $0 |

Source: Public Records

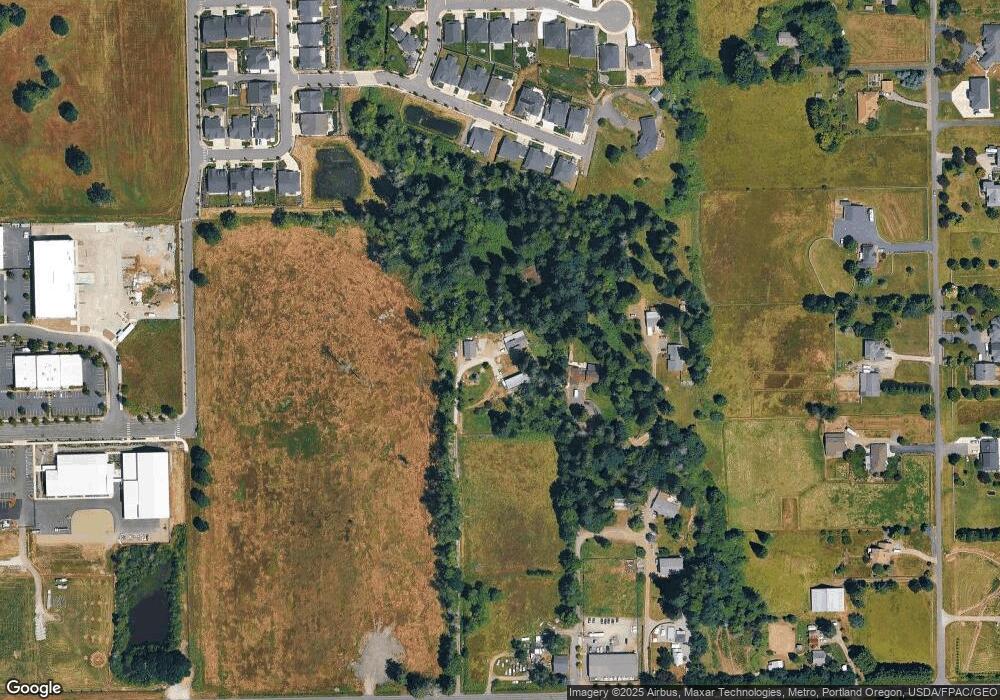

Map

Nearby Homes

- 2004 SE 15th St

- 2312 SE Eaton Blvd

- 3301 SE 12th Ave

- 1128 33rd St

- 1124 SE 33rd St

- 1116 SE 33rd St

- 1116 SE 6th St

- 1106 SE 6th St

- 902 SE 11th Way

- 1001 30th St

- 1121 SE 33rd St

- 2344 SE 27th St

- 1125 SE Clark Ave

- 2706 SE 22nd Ave

- 2036 SE 27th St

- 2137 SW 5th Place

- 2155 SW 5th Place

- 2201 SW 5th Place

- 2207 SW 5th Place

- 2703 SE 18th Ave

- 1702 SE 22nd Ave

- 1210 SE 22nd Ave

- 1301 SE 22nd Ave

- 1613 SE 22nd Ave

- 1204 SE 22nd Ave

- 1203 SE 22nd Ave

- 2204 SE 13th St

- 2203 SE 13th St

- 2214 SE 14th St

- 2210 SE 13th St

- 2209 SE 13th St

- 1301 SE 21st Ave

- 1307 SE 21st Ave

- 1215 SE 21st Ave

- 1215 SE 21st Ave

- 2215 SE 13th St

- 1301 SE 21st Ave

- 2220 SE 14th St

- 1311 SE 21st Ave

- 2216 SE 13th St