1713 Orchid Bend Weston, FL 33327

Savanna NeighborhoodEstimated Value: $1,049,000 - $1,125,000

5

Beds

4

Baths

2,798

Sq Ft

$388/Sq Ft

Est. Value

About This Home

This home is located at 1713 Orchid Bend, Weston, FL 33327 and is currently estimated at $1,086,347, approximately $388 per square foot. 1713 Orchid Bend is a home located in Broward County with nearby schools including Gator Run Elementary School, Falcon Cove Middle School, and Cypress Bay High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 15, 2008

Sold by

Nicholsberg Eric and Slakman Lisa S

Bought by

Garzaro Karen P and Maraone Vittorio

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$306,000

Outstanding Balance

$198,836

Interest Rate

5.96%

Mortgage Type

New Conventional

Estimated Equity

$887,511

Purchase Details

Closed on

Aug 13, 1999

Sold by

Arvida/Jmb Partners

Bought by

Nicholsberg Eric and Slakman Lisa S

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$203,000

Interest Rate

7.7%

Mortgage Type

Balloon

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Garzaro Karen P | $510,000 | Weston Professional Title Gr | |

| Nicholsberg Eric | $253,800 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Garzaro Karen P | $306,000 | |

| Previous Owner | Nicholsberg Eric | $203,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $10,123 | $465,070 | -- | -- |

| 2024 | $9,830 | $451,970 | -- | -- |

| 2023 | $9,830 | $438,810 | $0 | $0 |

| 2022 | $9,247 | $426,030 | $0 | $0 |

| 2021 | $8,985 | $413,630 | $0 | $0 |

| 2020 | $8,700 | $407,920 | $0 | $0 |

| 2019 | $8,448 | $398,750 | $0 | $0 |

| 2018 | $8,101 | $391,320 | $0 | $0 |

| 2017 | $7,732 | $383,280 | $0 | $0 |

| 2016 | $7,689 | $375,400 | $0 | $0 |

| 2015 | $7,808 | $372,800 | $0 | $0 |

| 2014 | $7,851 | $369,850 | $0 | $0 |

| 2013 | -- | $423,330 | $127,280 | $296,050 |

Source: Public Records

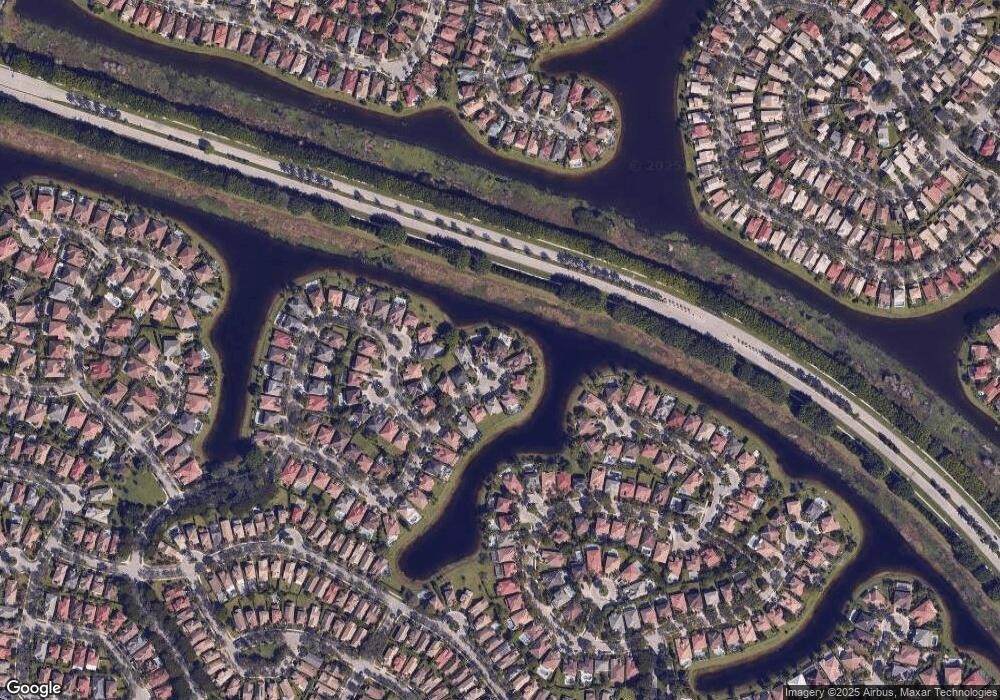

Map

Nearby Homes

- 649 Willow Bend Rd

- 757 Tanglewood Cir

- 800 Tanglewood Cir

- 942 Briar Ridge Rd

- 675 Maplewood Ct

- 1600 Blue Jay Cir

- 1381 Sago Ln

- 1400 Blue Jay Cir

- 1561 Banyan Way

- 1684 Eagle Bend

- 1032 Sequoia Ln

- 872 Tanglewood Cir

- 1012 Tupelo Way

- 1469 Kite Ct

- 804 Crestview Cir

- 558 Slippery Rock Rd

- 1107 Fairfield Meadows Dr

- 1206 Falls Blvd

- 845 Crestview Cir

- 550 Slippery Rock Rd

- 1718 Orchid Bend

- 1701 Orchid Bend

- 1712 Orchid Bend

- 1695 Orchid Bend

- 1706 Orchid Bend

- 1700 Orchid Bend

- 1689 Orchid Bend

- 1703 Royal Grove Way

- 1709 Royal Grove Way

- 1694 Orchid Bend

- 1717 Royal Grove Way

- 1691 Royal Grove Way

- 1688 Orchid Bend

- 1743 Royal Grove Way

- 1731 Royal Grove Way

- 1744 Sparrow Ln Unit 127

- 1685 Royal Grove Way

- 1682 Orchid Bend

- 1737 Sparrow Ln