1715 Villa Ct Corinth, TX 76210

Estimated Value: $428,157 - $485,000

3

Beds

2

Baths

2,217

Sq Ft

$207/Sq Ft

Est. Value

About This Home

This home is located at 1715 Villa Ct, Corinth, TX 76210 and is currently estimated at $458,539, approximately $206 per square foot. 1715 Villa Ct is a home located in Denton County with nearby schools including Hawk Elementary School, Crownover Middle School, and Guyer High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 10, 2015

Sold by

Davis Gary W and Davis Donna P

Bought by

Vanderlaan David J and Vanderlaan Debbie R

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$150,000

Outstanding Balance

$61,791

Interest Rate

3.9%

Mortgage Type

New Conventional

Estimated Equity

$396,748

Purchase Details

Closed on

Jul 18, 2013

Sold by

Beach George and Beach Linda

Bought by

Davis Gary W and Davis Donna P

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$168,000

Interest Rate

3.94%

Mortgage Type

New Conventional

Purchase Details

Closed on

Aug 14, 2008

Sold by

Martin Barbara Stein and Martin Robert S

Bought by

Beach George and Beach Linda

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$208,701

Interest Rate

6.42%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Feb 19, 1999

Sold by

Lewis Mike and Lewis Construction Company

Bought by

Stein Barbara

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Vanderlaan David J | -- | Title Resources | |

| Davis Gary W | -- | Allegiance Title Company | |

| Beach George | -- | Landam | |

| Stein Barbara | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Vanderlaan David J | $150,000 | |

| Previous Owner | Davis Gary W | $168,000 | |

| Previous Owner | Beach George | $208,701 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $8,548 | $455,990 | $110,466 | $345,524 |

| 2024 | $8,549 | $459,901 | $110,466 | $349,435 |

| 2023 | $8,428 | $451,000 | $110,466 | $340,534 |

| 2022 | $7,147 | $340,000 | $77,326 | $262,674 |

| 2021 | $6,743 | $305,000 | $55,233 | $249,767 |

| 2020 | $6,609 | $295,000 | $55,233 | $239,767 |

| 2019 | $7,004 | $305,099 | $55,233 | $249,866 |

| 2018 | $6,747 | $291,500 | $55,233 | $237,347 |

| 2017 | $6,281 | $265,000 | $55,233 | $209,767 |

| 2016 | $5,964 | $251,608 | $55,233 | $196,375 |

| 2015 | $4,944 | $215,000 | $55,233 | $159,767 |

| 2013 | -- | $212,386 | $55,233 | $157,153 |

Source: Public Records

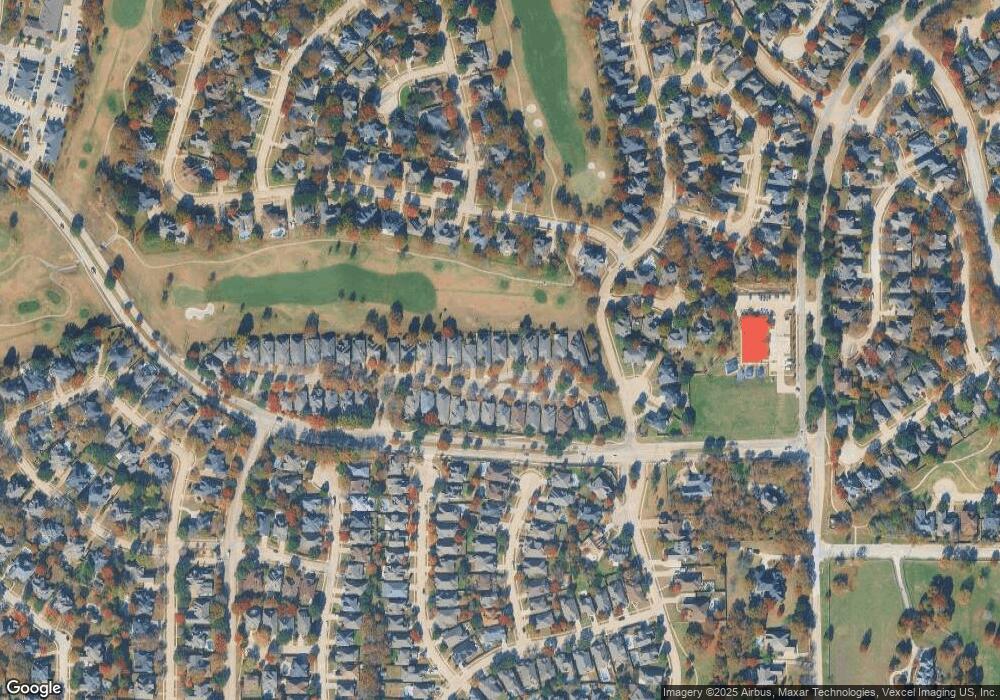

Map

Nearby Homes

- 1702 Osprey Ct

- 1614 Villa Ct

- 1869 Vintage Ct

- 1605 Villa Ct

- 1600 Oak Ridge Dr

- 2031 Vintage Cir

- 1501 Oakhollow Dr

- 1506 Pecan Valley Ct

- 1601 Eagle Ridge Dr

- 1634 Oak Ridge Dr

- 2201 Vista Ct

- 1728 Tealwood Ln

- 2016 Postwood Ct

- 2204 Woods Edge Ct

- 1107 Postwood Dr

- 2006 Ledgestone Dr

- 2204 Church Dr

- 1900 Durance Ct

- 1920 Ainsley Ct

- 1607 Fairway Vista Dr