1720 County Road 703a Alvarado, TX 76009

Estimated Value: $590,000 - $950,000

3

Beds

2

Baths

1,680

Sq Ft

$452/Sq Ft

Est. Value

About This Home

This home is located at 1720 County Road 703a, Alvarado, TX 76009 and is currently estimated at $760,010, approximately $452 per square foot. 1720 County Road 703a is a home located in Johnson County with nearby schools including Alvarado High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 8, 2010

Sold by

Houghton Daniel Andrew

Bought by

King Edwar L and King Lisa

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$102,000

Interest Rate

4.53%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Oct 4, 2007

Sold by

Adams Maynard

Bought by

Houghton Daniel Andrew and Daniel Andrew Houghton Trust

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$102,000

Interest Rate

6.37%

Mortgage Type

Future Advance Clause Open End Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| King Edwar L | -- | Stewart Title | |

| Houghton Daniel Andrew | -- | Fatco |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | King Edwar L | $102,000 | |

| Previous Owner | Houghton Daniel Andrew | $102,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $7,850 | $552,633 | $12,000 | $540,633 |

| 2024 | $9,792 | $552,633 | $12,000 | $540,633 |

| 2023 | $7,912 | $553,633 | $13,000 | $540,633 |

| 2022 | $9,645 | $553,633 | $13,000 | $540,633 |

| 2021 | $8,876 | $0 | $0 | $0 |

| 2020 | $8,495 | $0 | $0 | $0 |

| 2019 | $8,667 | $0 | $0 | $0 |

| 2018 | $8,667 | $0 | $0 | $0 |

| 2017 | $8,753 | $0 | $0 | $0 |

| 2016 | $8,451 | $0 | $0 | $0 |

| 2015 | $302 | $0 | $0 | $0 |

| 2014 | $302 | $0 | $0 | $0 |

Source: Public Records

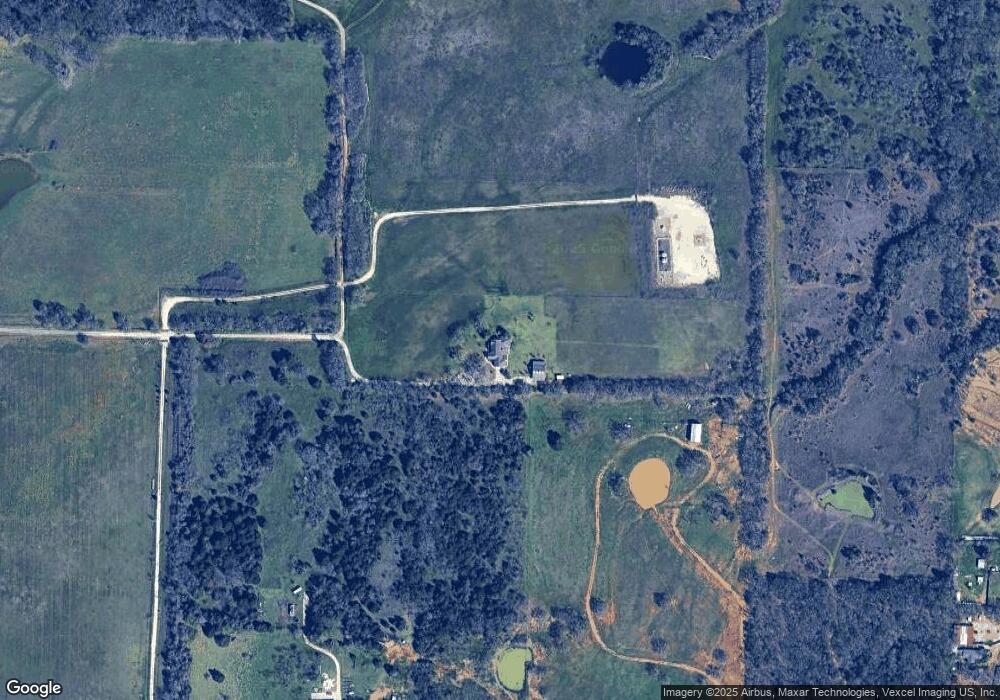

Map

Nearby Homes

- 5227 County Road 703

- TBD County Road 703a

- 4916 County Road 707

- 5405 County Road 704d

- 2001 Beauty Berry Ct

- 5109 E Highway 67

- 4105 Highland Oaks Ln

- 4032 Highland Oaks Ln

- 200 Day Miar Rd

- 2108 N County Road 810

- 5708 Pecan Cir

- 5434 E Hwy 67

- 100 Donna St

- 6045 Cr 319

- 6045 County Rd 319

- 6045 County Road 319

- 309 Forestwood Dr

- 803 Lakewood Dr

- 3301 S County Road 810

- 6209 Baker Ln

- 5151 County Road 703

- 5185 County Road 703

- 5317 County Road 703

- 1021 N County Road 810

- 1021 N County Road 810

- 1017 N County Road 810

- 5220 County Road 703

- 5216 County Road 703

- 5200 County Road 703

- 5208 County Road 703

- 1015 N County Road 810

- 5325 County Road 703

- 1029 N County Road 810

- 1013 N County Road 810

- 5112 County Road 703

- 5100 County Road 703

- 5329 County Road 703

- 5333 County Road 703

- TBD County Road 703 A

- 3341 County Road 703