1722 Graces Terrace Edmond, OK 73025

West Edmond NeighborhoodEstimated Value: $440,475 - $480,000

4

Beds

3

Baths

2,610

Sq Ft

$176/Sq Ft

Est. Value

About This Home

This home is located at 1722 Graces Terrace, Edmond, OK 73025 and is currently estimated at $458,369, approximately $175 per square foot. 1722 Graces Terrace is a home located in Oklahoma County with nearby schools including Prairie Vale Elementary School, Deer Creek Middle School, and Deer Creek Intermediate School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 16, 2023

Sold by

Birdwell Jeffrey Todd

Bought by

Jeffrey T Birdwell Revocable Trust

Current Estimated Value

Purchase Details

Closed on

Sep 12, 2013

Sold by

Graham Scot and Graham Leann

Bought by

Birdwell Jefrey Todd

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$162,477

Interest Rate

4.45%

Mortgage Type

New Conventional

Purchase Details

Closed on

Nov 30, 2011

Sold by

Steele Tilton W and Steele Summer R

Bought by

Graham Scot and Graham Leann

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$236,425

Interest Rate

4.4%

Mortgage Type

FHA

Purchase Details

Closed on

Aug 20, 2003

Sold by

Southerly Farms Llc

Bought by

Homes By Taber Llc

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Jeffrey T Birdwell Revocable Trust | -- | -- | |

| Birdwell Jefrey Todd | $258,000 | The Oklahoma City Abstract & | |

| Graham Scot | $245,000 | Capitol Abstract & Title Com | |

| Homes By Taber Llc | $77,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Birdwell Jefrey Todd | $162,477 | |

| Previous Owner | Graham Scot | $236,425 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $4,526 | $38,306 | $4,713 | $33,593 |

| 2023 | $4,526 | $36,482 | $4,852 | $31,630 |

| 2022 | $3,989 | $34,744 | $5,258 | $29,486 |

| 2021 | $3,736 | $33,090 | $5,597 | $27,493 |

| 2020 | $3,926 | $31,515 | $5,478 | $26,037 |

| 2019 | $224 | $30,690 | $5,478 | $25,212 |

| 2018 | $215 | $29,480 | $0 | $0 |

| 2017 | $218 | $29,810 | $5,478 | $24,332 |

| 2016 | $3,676 | $29,272 | $5,154 | $24,118 |

| 2015 | $3,216 | $27,879 | $5,346 | $22,533 |

| 2014 | $3,287 | $28,192 | $5,346 | $22,846 |

Source: Public Records

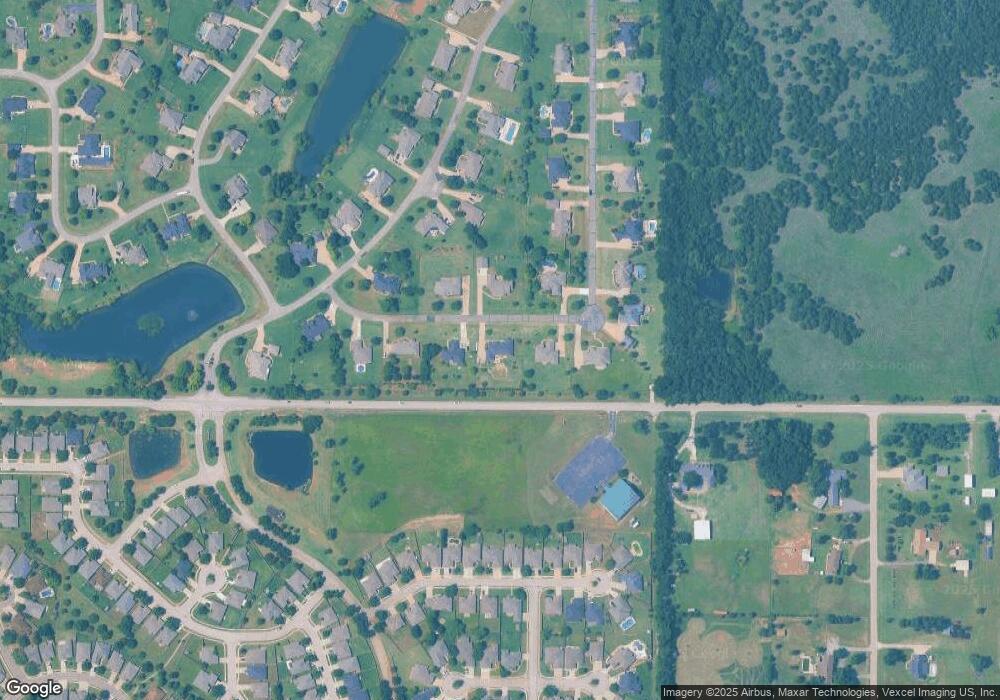

Map

Nearby Homes

- 1701 Birchfield Rd

- 21919 Pleasant Ridge Rd

- 22622 Graces Terrace

- 21998 Homesteaders Rd

- 21930 Homesteaders Place

- 1855 Graces Cir

- 21877 Homesteaders Rd

- 21900 N Douglas Ave

- 21755 Long Trail

- 22301 Pine Bluff Way

- 22576 Pine Bluff Way

- 1988 Tall Grass Cir

- 3324 Courtney Creek Dr

- 3308 Holland Cir

- 3324 Holland Cir

- 3316 Holland Cir

- 2300 NW 220th Terrace

- 3325 Poppey Ln

- 3300 Porter Dr

- 3233 Porter Dr

- 1744 Graces Terrace

- 1700 Graces Terrace

- 1727 Graces Terrace

- 1766 Graces Terrace

- 1731 Graces Terrace

- 1721 Graces Terrace

- 1777 Graces Terrace

- 22488 Southerly Farms Blvd

- 1788 Graces Terrace

- 22460 Laras Ln

- 22544 Southerly Farms Blvd

- 22511 Laras Ln

- 22488 Laras Ln

- 22222 Southerly Farms Blvd

- 22444 Southerly Farms Blvd

- 22500 Laras Ln

- 1723 Birchfield Rd

- 1747 Birchfield Rd

- 22533 Laras Ln

- 1683 Birchfield Rd