17407 W Chestnut Ln Unit 14A Gurnee, IL 60031

Estimated Value: $230,698 - $239,000

--

Bed

2

Baths

1,320

Sq Ft

$178/Sq Ft

Est. Value

About This Home

This home is located at 17407 W Chestnut Ln Unit 14A, Gurnee, IL 60031 and is currently estimated at $235,175, approximately $178 per square foot. 17407 W Chestnut Ln Unit 14A is a home located in Lake County with nearby schools including Woodland Primary School, Woodland Elementary School, and Woodland Intermediate School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 3, 2005

Sold by

Paul Scott M

Bought by

Mirek Stanley and Mirek Maria

Current Estimated Value

Purchase Details

Closed on

Feb 23, 2000

Sold by

Glissman Paul Mary A

Bought by

Paul Scott M

Purchase Details

Closed on

May 17, 1999

Sold by

The Northern Trust Company

Bought by

Colamatteo Dino and Colamatteo Ellen

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$186,450

Interest Rate

6.75%

Purchase Details

Closed on

Aug 28, 1997

Sold by

Nelson John P and Nelson Christina M

Bought by

Paul Scott M and Glissman Paul Mary A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$80,000

Interest Rate

7.44%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Mirek Stanley | $162,500 | -- | |

| Paul Scott M | -- | -- | |

| Colamatteo Dino | $207,500 | Ticor Title | |

| Paul Scott M | $66,666 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Colamatteo Dino | $186,450 | |

| Previous Owner | Paul Scott M | $80,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $929 | $65,707 | $6,574 | $59,133 |

| 2023 | $1,468 | $55,894 | $5,592 | $50,302 |

| 2022 | $1,468 | $49,690 | $5,593 | $44,097 |

| 2021 | $1,387 | $47,697 | $5,369 | $42,328 |

| 2020 | $1,370 | $46,525 | $5,237 | $41,288 |

| 2019 | $1,367 | $45,174 | $5,085 | $40,089 |

| 2018 | $1,370 | $29,295 | $3,279 | $26,016 |

| 2017 | $1,394 | $28,456 | $3,185 | $25,271 |

| 2016 | $1,459 | $27,189 | $3,043 | $24,146 |

| 2015 | $1,502 | $25,786 | $2,886 | $22,900 |

| 2014 | $1,845 | $29,193 | $2,847 | $26,346 |

| 2012 | $1,869 | $29,417 | $2,869 | $26,548 |

Source: Public Records

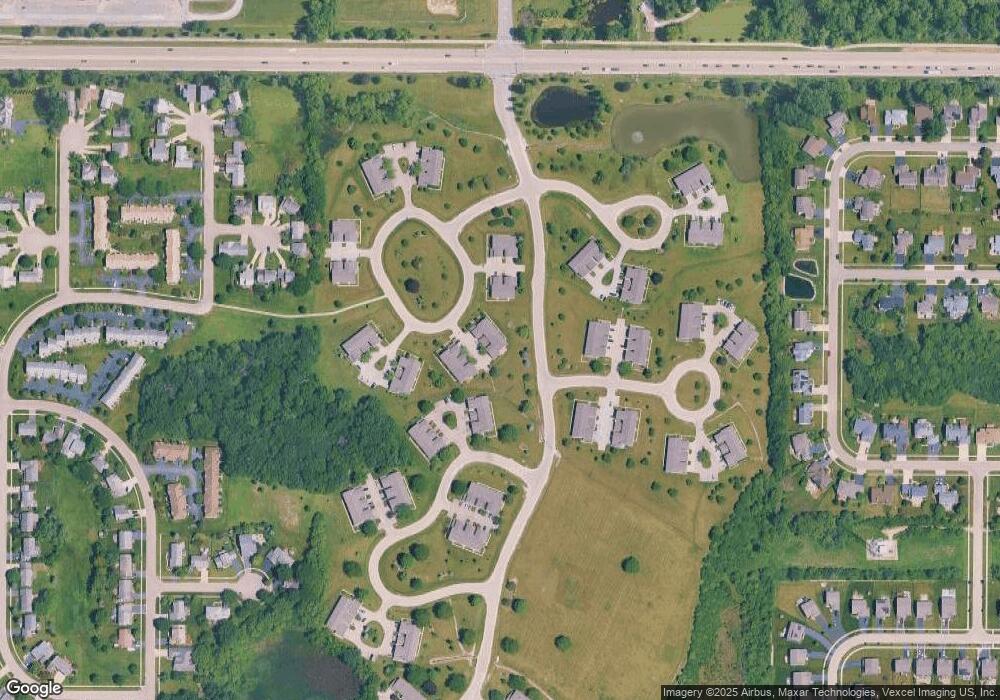

Map

Nearby Homes

- 17298 W Maple Ln

- 17404 W Walnut Ln Unit 2C

- 17438 W Walnut Ln Unit 2F

- 34026 N White Oak Ln Unit 48C

- 34395 W Saddle Ct

- 34110 N White Oak Ln Unit 37B

- 17716 W Horseshoe Ln Unit 3

- 17490 Pin Oak Ln

- 17444 Pin Oak Ln

- 35051 N Oak Knoll Cir

- 6183 Old Farm Ln Unit 3

- 6296 Doral Dr

- 7449 Brentwood Ln

- 17613 W Meadowbrook Dr

- 18238 W Gages Lake Rd

- 17603 W Windslow Dr

- 1075 Suffolk Ct

- 17830 W Winnebago Dr

- 415 Kingsport Dr

- 706 Owl Creek Ln

- 17409 W Chestnut Ln Unit 14B

- 17409 W Chestnut Ln Unit B

- 17411 W Chestnut Ln Unit 14C

- 17411 W Chestnut Ln

- 17413 W Chestnut Ln Unit 3

- 17413 W Chestnut Ln Unit 14D

- 17415 W Chestnut Ln Unit 14E

- 17417 W Chestnut Ln Unit 14F

- 17421 W Chestnut Ln Unit 13E

- 17425 W Chestnut Ln Unit 13C

- 17419 W Chestnut Ln Unit 13F

- 17423 W Chestnut Ln Unit 13D

- 17427 W Chestnut Ln Unit 13B

- 17429 W Chestnut Ln Unit 13A

- 17399 W Chestnut Ln Unit 5D

- 34328 N Birch Ln Unit 15F

- 34328 N Birch Ln Unit F

- 17403 W Chestnut Ln Unit 5B

- 34326 N Birch Ln Unit 15E

- 34326 N Birch Ln Unit E