1746 Emerald Glade Ln Unit 7D Cincinnati, OH 45255

Estimated Value: $323,000 - $365,000

3

Beds

4

Baths

2,155

Sq Ft

$158/Sq Ft

Est. Value

About This Home

This home is located at 1746 Emerald Glade Ln Unit 7D, Cincinnati, OH 45255 and is currently estimated at $340,624, approximately $158 per square foot. 1746 Emerald Glade Ln Unit 7D is a home located in Hamilton County with nearby schools including Sherwood Elementary School, Nagel Middle School, and Turpin High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 4, 2004

Sold by

Segerberg Kenneth M and Segerberg Terry S

Bought by

Kincaid Timothy K

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$140,000

Outstanding Balance

$65,146

Interest Rate

5.5%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$275,478

Purchase Details

Closed on

May 28, 2002

Sold by

Naticchioni William G and Naticchioni Mary M

Bought by

Segerberg Kenneth M and Segerberg Terry S

Purchase Details

Closed on

Feb 27, 1996

Sold by

Vorys Yolanda V and Smith Charles L

Bought by

Naticchioni William G and Naticchioni Mary M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$25,000

Interest Rate

7.07%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Kincaid Timothy K | $179,000 | Chicago Title Insurance Comp | |

| Segerberg Kenneth M | $162,000 | First Title Agency Inc | |

| Naticchioni William G | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Kincaid Timothy K | $140,000 | |

| Previous Owner | Naticchioni William G | $25,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $5,494 | $100,552 | $9,975 | $90,577 |

| 2023 | $5,271 | $100,552 | $9,975 | $90,577 |

| 2022 | $3,875 | $59,752 | $8,330 | $51,422 |

| 2021 | $3,214 | $59,752 | $8,330 | $51,422 |

| 2020 | $3,264 | $59,752 | $8,330 | $51,422 |

| 2019 | $3,542 | $50,211 | $7,000 | $43,211 |

| 2018 | $3,318 | $50,211 | $7,000 | $43,211 |

| 2017 | $3,129 | $50,211 | $7,000 | $43,211 |

| 2016 | $3,218 | $50,449 | $7,238 | $43,211 |

| 2015 | $3,125 | $50,449 | $7,238 | $43,211 |

| 2014 | $3,127 | $50,449 | $7,238 | $43,211 |

| 2013 | $3,360 | $57,330 | $8,225 | $49,105 |

Source: Public Records

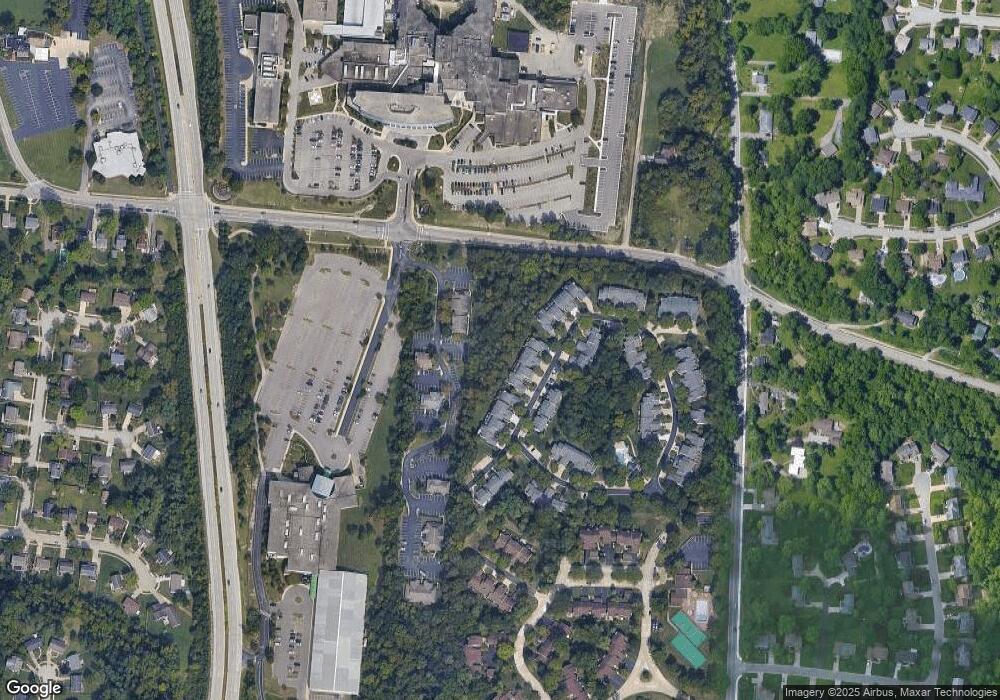

Map

Nearby Homes

- 1629 Cohasset Dr

- 7633 Brannon Dr

- 1731 Rudyard Ln

- 1791 Rusticwood Ln

- 1786 Woodpine Ln

- 1419 Wolfangel Rd

- 1353 Crotty Ct

- 7827 State Rd

- 7114 Paddison Rd

- 2105 Clough Chase Dr

- 2121 Clough Chase Dr

- 1903 Robinway Dr

- 7249 State Rd

- 7053 Paddison Rd

- 1886 Kingsway Ct

- 7197 Woodridge Dr

- 7216 Bridges Rd

- 1395 Tallberry Dr

- 7080 Petri Dr

- 1363 Oak Ct

- 1742 Emerald Glade Ln Unit 7F

- 1748 Emerald Glade Ln

- 1750 Emerald Glade Ln Unit 7B

- 1752 Emerald Glade Ln

- 7566 Greenarbor Dr Unit 14D

- 7569 Greenarbor Dr Unit 9B

- 1759 Emerald Glade Ln

- 7562 Greenarbor Dr Unit 14B

- 1763 Emerald Glade Ln Unit 8E

- 7567 Greenarbor Dr Unit 9C

- 1738 Emerald Glade Ln

- 1736 Emerald Glade Ln

- 1734 Emerald Glade Ln

- 1744 Emerald Glade Ln

- 7570 Greenarbor Dr

- 7561 Greenarbor Dr

- 7565 Greenarbor Dr

- 1728 Emerald Glade Ln

- 1732 Emerald Glade Ln Unit 6D

- 1755 Emerald Glade Ln Unit 8A