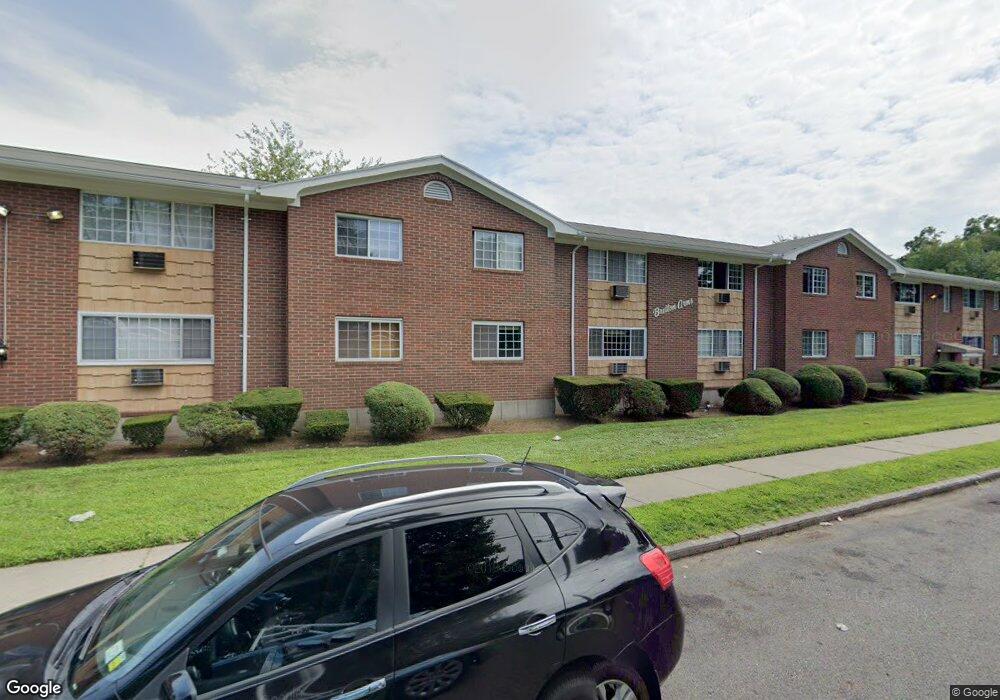

175 Bretton St Unit A8 Bridgeport, CT 06606

North End NeighborhoodEstimated Value: $128,000 - $197,627

1

Bed

1

Bath

623

Sq Ft

$259/Sq Ft

Est. Value

About This Home

This home is located at 175 Bretton St Unit A8, Bridgeport, CT 06606 and is currently estimated at $161,157, approximately $258 per square foot. 175 Bretton St Unit A8 is a home located in Fairfield County with nearby schools including Blackham School, Central High School, and Capital Prep Harbor Upper School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 1, 2025

Sold by

Hasani Enkelejda

Bought by

Olken Llc

Current Estimated Value

Purchase Details

Closed on

Nov 29, 2004

Sold by

Ali Liaquat

Bought by

Kaminski Lalitha

Purchase Details

Closed on

Sep 1, 2004

Sold by

Ali Liaquat

Bought by

Hasani Enkelejda

Purchase Details

Closed on

Mar 1, 2000

Sold by

Larobina Michael D

Bought by

Li Iaquat A

Purchase Details

Closed on

Jul 2, 1996

Sold by

Larobina Michael D

Bought by

Larobina Michael D

Purchase Details

Closed on

Jun 21, 1995

Sold by

Larobina Michael

Bought by

Michael D Larobina Spa

Purchase Details

Closed on

Apr 13, 1995

Sold by

Dillon Jean

Bought by

Larobina Michael D

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Olken Llc | -- | None Available | |

| Olken Llc | -- | None Available | |

| Kaminski Lalitha | $85,000 | -- | |

| Kaminski Lalitha | $85,000 | -- | |

| Hasani Enkelejda | $70,000 | -- | |

| Hasani Enkelejda | $70,000 | -- | |

| Li Iaquat A | $31,000 | -- | |

| Li Iaquat A | $31,000 | -- | |

| Larobina Michael D | $17,500 | -- | |

| Larobina Michael D | $17,500 | -- | |

| Michael D Larobina Spa | $17,500 | -- | |

| Michael D Larobina Spa | $17,500 | -- | |

| Larobina Michael D | $21,500 | -- | |

| Larobina Michael D | $21,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Larobina Michael D | $50,000 | |

| Previous Owner | Larobina Michael D | $15,100 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,056 | $47,330 | $0 | $47,330 |

| 2024 | $2,056 | $47,330 | $0 | $47,330 |

| 2023 | $2,056 | $47,330 | $0 | $47,330 |

| 2022 | $2,056 | $47,330 | $0 | $47,330 |

| 2021 | $2,056 | $47,330 | $0 | $47,330 |

| 2020 | $1,543 | $28,580 | $0 | $28,580 |

| 2019 | $1,543 | $28,580 | $0 | $28,580 |

| 2018 | $1,554 | $28,580 | $0 | $28,580 |

| 2017 | $1,554 | $28,580 | $0 | $28,580 |

| 2016 | $1,554 | $28,580 | $0 | $28,580 |

| 2015 | $2,489 | $58,970 | $0 | $58,970 |

| 2014 | $2,489 | $58,970 | $0 | $58,970 |

Source: Public Records

Map

Nearby Homes

- 520 Savoy St

- 376 Savoy St

- 485 Westfield Ave

- 631 Fairview Ave

- 681 Westfield Ave

- 234 Savoy St

- 604 Birmingham St

- 105 Tremont Ave Unit E

- 105 Tremont Ave Unit B

- 252 Harlem Ave Unit B6

- 252 Harlem Ave Unit B5

- 605 Merritt St

- 783 Clark St

- 113 Clark St

- 214 Burnsford Ave

- 3200 Park Ave Unit 11C2

- 3200 Park Ave Unit 11E2

- 203 Wayne St

- 375 Ruth St

- 932 Thorme St

- 175 Bretton St Unit B12

- 175 Bretton St Unit B11

- 175 Bretton St Unit B9

- 175 Bretton St Unit A12

- 175 Bretton St Unit A11

- 175 Bretton St Unit A10

- 175 Bretton St Unit A9

- 175 Bretton St Unit A7

- 175 Bretton St Unit A6

- 175 Bretton St Unit A5

- 175 Bretton St Unit A4

- 175 Bretton St Unit A3

- 175 Bretton St Unit A2

- 175 Bretton St Unit A1

- 175 Bretton St Unit B7

- 185 Bretton St Unit B12

- 185 Bretton St Unit B10

- 185 Bretton St Unit B8

- 185 Bretton St Unit B7

- 185 Bretton St Unit B6