175 Copperfield Dr Dayton, OH 45415

Estimated Value: $269,523 - $305,000

3

Beds

4

Baths

2,096

Sq Ft

$137/Sq Ft

Est. Value

About This Home

This home is located at 175 Copperfield Dr, Dayton, OH 45415 and is currently estimated at $286,381, approximately $136 per square foot. 175 Copperfield Dr is a home located in Montgomery County with nearby schools including Northmoor Elementary School, Northmont High School, and Imagine Schools - Woodbury Academy.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 28, 2025

Sold by

Fernandez Dana Lynn

Bought by

Smart Dana Lynn

Current Estimated Value

Purchase Details

Closed on

Sep 16, 2020

Sold by

Gilbert Peggy J

Bought by

Fernandez Dana L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$190,000

Interest Rate

2.9%

Mortgage Type

New Conventional

Purchase Details

Closed on

Apr 29, 2011

Sold by

Ary David W and Ary Yvonne

Bought by

Gilbert B Eugene and Gilbert Peggy J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$55,000

Interest Rate

2.99%

Mortgage Type

New Conventional

Purchase Details

Closed on

Apr 30, 2001

Sold by

Tr Kress Edward M Tr And Maureen Shull

Bought by

Ary David W and Ary Yvonne

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$152,000

Interest Rate

6.95%

Purchase Details

Closed on

Dec 3, 1999

Sold by

Kress David R and Kress Estelle C

Bought by

Kress Edward M and Shuller Maureen

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Smart Dana Lynn | -- | None Listed On Document | |

| Fernandez Dana L | $200,000 | Home Services Title Llc | |

| Gilbert B Eugene | $195,000 | Attorney | |

| Ary David W | $190,000 | -- | |

| Kress Edward M | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Fernandez Dana L | $190,000 | |

| Previous Owner | Gilbert B Eugene | $55,000 | |

| Previous Owner | Ary David W | $152,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,661 | $78,240 | $13,730 | $64,510 |

| 2024 | $4,517 | $78,240 | $13,730 | $64,510 |

| 2023 | $4,517 | $78,240 | $13,730 | $64,510 |

| 2022 | $5,393 | $71,630 | $12,600 | $59,030 |

| 2021 | $5,543 | $71,630 | $12,600 | $59,030 |

| 2020 | $4,748 | $71,630 | $12,600 | $59,030 |

| 2019 | $5,262 | $71,550 | $12,600 | $58,950 |

| 2018 | $5,276 | $71,550 | $12,600 | $58,950 |

| 2017 | $5,241 | $71,550 | $12,600 | $58,950 |

| 2016 | $4,532 | $61,890 | $12,600 | $49,290 |

| 2015 | $4,165 | $61,890 | $12,600 | $49,290 |

| 2014 | $4,165 | $61,890 | $12,600 | $49,290 |

| 2012 | -- | $57,440 | $12,600 | $44,840 |

Source: Public Records

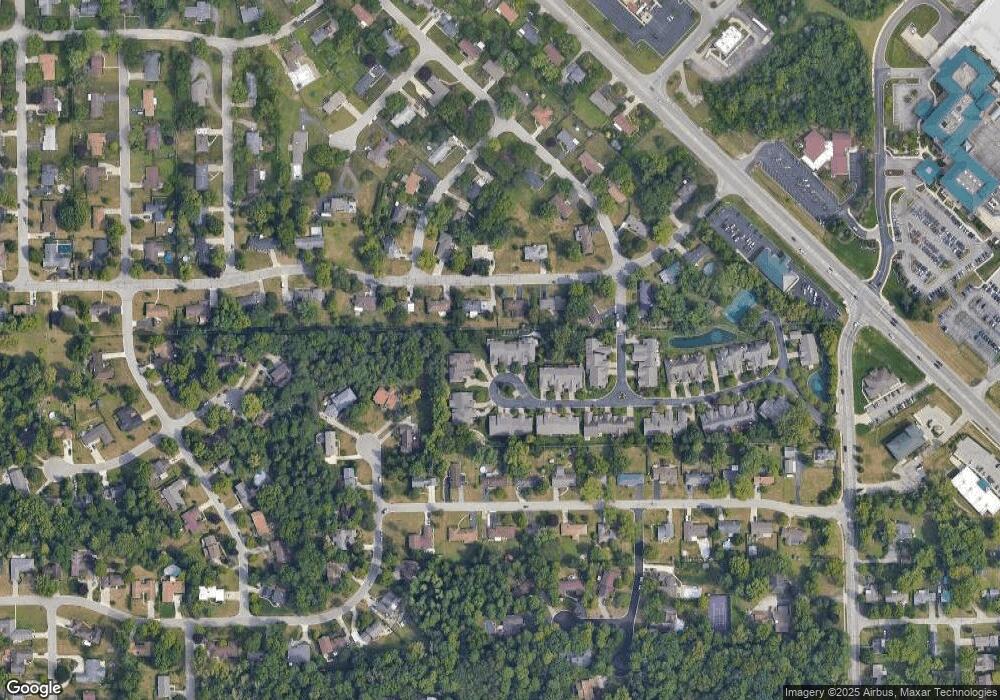

Map

Nearby Homes

- 173 Copperfield Dr

- 133 Copperfield Dr

- 5282 Rahway Ct

- 5420 Savina Ave

- 4936 Pacemont Ave

- 6885 Garber Rd

- 7116 Dominican Dr

- 7182 Pugliese Place

- 14 Dorchester Dr

- 23 Glenhaven Rd

- 3799 Old Salem Rd

- 8915 Meeker Rd

- 117 Candle Ct Unit 740

- 4011 Shell Ave

- 6600 Afton Dr

- 916 S Main St

- 301 Autumn Ct

- 320 Autumn Ct

- 4311 Reeves Ct

- 6781 Taywood Rd

- 171 Copperfield Dr

- 181 Copperfield Dr

- 5212 Savina Ave

- 5196 Savina Ave

- 183 Copperfield Dr

- 165 Copperfield Dr

- 182 Copperfield Dr

- 163 Copperfield Dr

- 5234 Savina Ave

- 5172 Savina Ave

- 174 Copperfield Dr

- 161 Copperfield Dr

- 170 Copperfield Dr

- 180 Copperfield Dr

- 162 Copperfield Dr

- 5207 Savina Ave

- 5258 Savina Ave

- 6905 Lockwood St

- 6903 Lockwood St

- 5152 Savina Ave