175 N Club Cabins Ct Unit 3 Heber City, UT 84032

Estimated Value: $1,909,000 - $2,277,000

3

Beds

3

Baths

2,500

Sq Ft

$823/Sq Ft

Est. Value

About This Home

This home is located at 175 N Club Cabins Ct Unit 3, Heber City, UT 84032 and is currently estimated at $2,057,987, approximately $823 per square foot. 175 N Club Cabins Ct Unit 3 is a home located in Wasatch County with nearby schools including J.R. Smith Elementary School and Wasatch High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 24, 2020

Sold by

Johnson Michael Eugene and Johnson Sarah S

Bought by

Johnson Michael E and Johnson Sarah S

Current Estimated Value

Purchase Details

Closed on

Mar 10, 2020

Sold by

Slc Properties Llc

Bought by

Johnson Michael Eugene and Johnson Sarah S

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$896,000

Interest Rate

3.4%

Mortgage Type

New Conventional

Purchase Details

Closed on

Dec 9, 2019

Sold by

Hendrickson Jeffrey Blaine and Hendrickson Jennifer Dianne

Bought by

Slc Properties Llc

Purchase Details

Closed on

Apr 11, 2016

Sold by

Widdison Suzanne

Bought by

Henrichsen Marcus R and Henrichsen Kelsie

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$275,200

Interest Rate

3.64%

Mortgage Type

New Conventional

Purchase Details

Closed on

Dec 28, 2015

Sold by

The Club Cabins At Red Ledges Llc

Bought by

The Hendrickson Revocable Trust and Hendrickson Jennifer Dianne

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Johnson Michael E | -- | None Available | |

| Johnson Family Trust | -- | Andrewsen Brent A | |

| Johnson Michael Eugene | -- | Summit Escrow & Title | |

| Slc Properties Llc | -- | None Available | |

| Henrichsen Marcus R | -- | First American Title Insuran | |

| The Hendrickson Revocable Trust | -- | Summit Escrow & Title | |

| The Club Cabins At Red Ledges Llc | -- | Summit Escrow & Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Johnson Michael Eugene | $896,000 | |

| Previous Owner | Henrichsen Marcus R | $275,200 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $17,976 | $2,030,670 | $350,000 | $1,680,670 |

| 2024 | $17,976 | $1,942,925 | $300,000 | $1,642,925 |

| 2023 | $17,976 | $1,629,550 | $300,000 | $1,329,550 |

| 2022 | $16,486 | $1,629,550 | $300,000 | $1,329,550 |

| 2021 | $13,570 | $1,065,475 | $205,000 | $860,475 |

| 2020 | $11,305 | $830,883 | $205,000 | $625,883 |

| 2019 | $10,295 | $830,883 | $0 | $0 |

| 2018 | $10,295 | $830,883 | $0 | $0 |

| 2017 | $10,352 | $830,883 | $0 | $0 |

| 2016 | $10,631 | $830,883 | $0 | $0 |

| 2015 | $3,173 | $260,000 | $260,000 | $0 |

| 2014 | $2,187 | $175,000 | $175,000 | $0 |

Source: Public Records

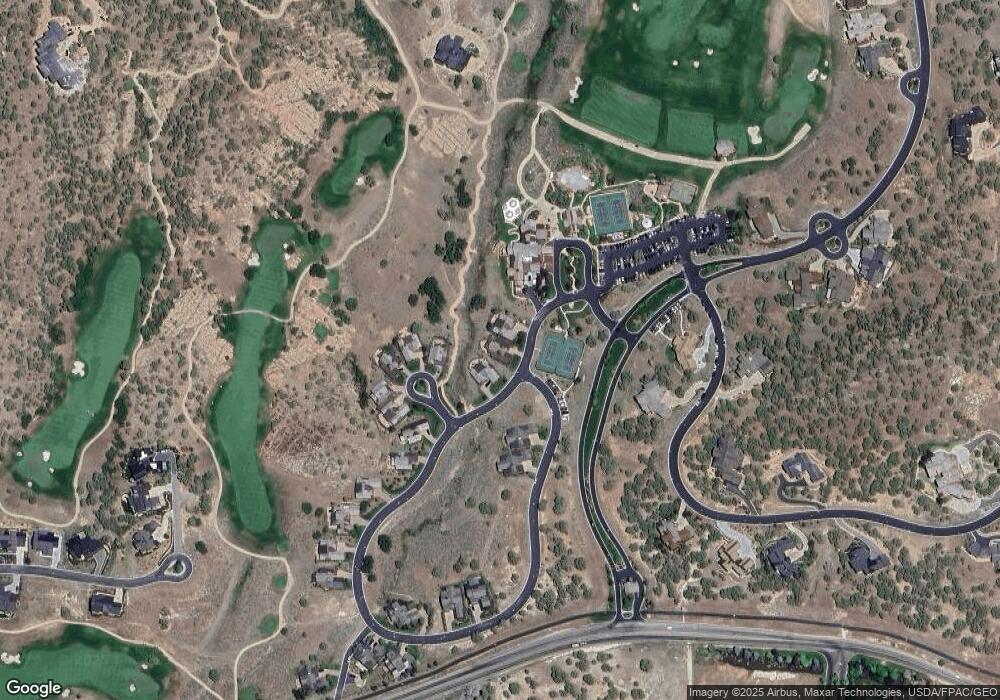

Map

Nearby Homes

- 181 N Club Cabins Ct

- 93 N Club Cabins Way

- 93 N Club Cabins Way Unit CC-24

- 223 N Ibapah Peak Dr

- 223 N Ibapah Peak Dr Unit 129

- 295 Red Ledges Blvd

- 295 Red Ledges Blvd Unit 121

- 549 N Red Mountain Ct

- 311 Red Ledges Blvd

- 311 Red Ledges Blvd Unit 120

- 310 Red Ledges Blvd

- 581 N Red Mountain Ct Unit 211

- 581 N Red Mountain Ct

- 4701 E Lake Creek Rd

- 4769 E Lake Creek Rd

- 1212 E Grouse Ridge Cir

- 1207 E Grouse Ridge Cir

- 1207 E Grouse Ridge Cir Unit 208

- 1164 E Grouse Ridge Cir

- 1164 E Grouse Ridge Cir Unit 200

- 175 N Club Cabins Ct

- 181 N Club Cabin Court (Cc-2) Heber Ut 84032

- 181 N Club Cabins Ct Unit 2

- 181 N Club Cabins Ct Unit CC-2

- 165 N Club Cabins Ct Unit 4

- 165 N Club Cabins Ct

- 185 N Club Cabins Ct (Lot 1)

- 165 N Club Cabins Ct Unit 4

- 185 N Club Cabins Ct

- 155 N Club Cabins Ct Unit 5

- 155 N Club Cabins Ct

- 155 N Club Cabins Ct Unit 5

- 159 N Club Cabins Way

- 159 N Club Cabins Way Unit CC32

- 153 N Club Cabins Ct

- 153 N Club Cabins Ct Unit 6

- 153 N Club Cabins Ct Unit CC-6

- 143 N Club Cabins Ct Unit CC-31

- 143 N Club Cabins Ct

- 151 N Club Cabins Ct Unit 7