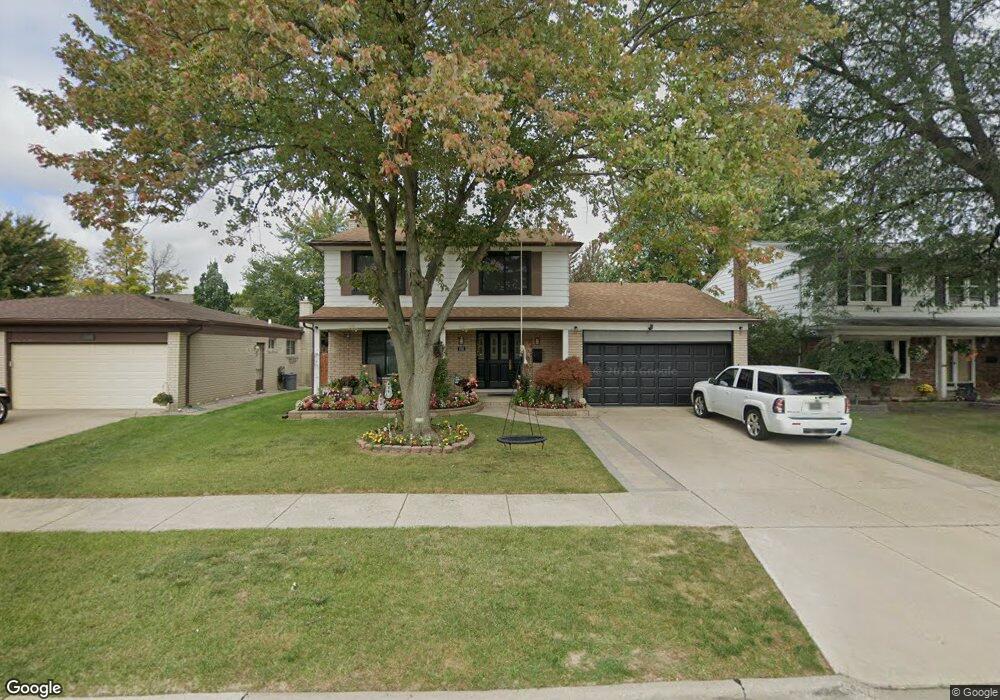

1761 Oakland Dr Unit Bldg-Unit Madison Heights, MI 48071

Estimated Value: $316,000 - $341,000

4

Beds

3

Baths

1,848

Sq Ft

$175/Sq Ft

Est. Value

About This Home

This home is located at 1761 Oakland Dr Unit Bldg-Unit, Madison Heights, MI 48071 and is currently estimated at $324,142, approximately $175 per square foot. 1761 Oakland Dr Unit Bldg-Unit is a home located in Oakland County with nearby schools including Lamphere High School, Immaculate Conception Catholic Schools, and Temple Christian Academy.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 27, 2022

Sold by

Vallee Theodora A

Bought by

Vallee Theodora A and Vallee Christopher G

Current Estimated Value

Purchase Details

Closed on

Jan 24, 2018

Sold by

Wrona Grand Nicole J and Wrona Nicole J

Bought by

Vallee Theodora A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$169,650

Interest Rate

3.93%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jun 10, 2013

Sold by

Wrona Scott M

Bought by

Wrona Nicole J

Purchase Details

Closed on

Oct 12, 2010

Sold by

Lemarbe Russell and Lemarbe Debra

Bought by

Wrona Scott M and Wrona Nicole J

Purchase Details

Closed on

Jun 1, 2010

Sold by

Lemarbe Russell and Lemarbe Debra Ann

Bought by

Citimortgage Inc

Purchase Details

Closed on

Mar 11, 2003

Sold by

Lemarbe Debra Ann and Conklin Debra Ann

Bought by

Lemarbe Russell and Lemarbe Debra Ann

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Vallee Theodora A | -- | -- | |

| Vallee Theodora A | $188,500 | None Available | |

| Wrona Nicole J | -- | None Available | |

| Wrona Scott M | $108,000 | 1St Choice Title Svcs Inc | |

| Citimortgage Inc | $85,200 | None Available | |

| Federal National Mortgage Association | -- | None Available | |

| Lemarbe Russell | -- | Title One Inc |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Vallee Theodora A | $169,650 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $4,458 | $124,100 | $0 | $0 |

| 2023 | $4,281 | $111,510 | $0 | $0 |

| 2022 | $4,980 | $102,520 | $0 | $0 |

| 2021 | $4,920 | $98,960 | $0 | $0 |

| 2020 | $4,006 | $85,380 | $0 | $0 |

| 2019 | $4,687 | $78,210 | $0 | $0 |

| 2018 | $3,386 | $75,240 | $0 | $0 |

| 2017 | $3,333 | $75,240 | $0 | $0 |

| 2016 | $3,198 | $69,400 | $0 | $0 |

| 2015 | -- | $61,060 | $0 | $0 |

| 2014 | -- | $53,400 | $0 | $0 |

| 2011 | -- | $62,480 | $0 | $0 |

Source: Public Records

Map

Nearby Homes

- 30140 Manor Dr

- 30600 Manor Dr

- 30885 Lee Frank Ln

- 1886 E 13 Mile Rd

- 30469 Winthrop Dr

- 1405 Dulong Ave

- 1219 Moulin Ave

- 1563 Beaupre Ave

- 31227 Dequindre Rd

- 29585 Milton Ave

- 761 Tanglewood Dr

- 740 Sheffield Dr

- 1936 Roman Ct

- 1958 Roman Ct

- 2408 Otter St

- 1233 Elliott Ave

- 2338 Walter Ave

- 2403 Walter Ave

- 2362 Walter Ave

- 2415 Otter St

- 1761 Oakland Dr

- 1771 Oakland Dr

- 1751 Oakland Dr

- 1781 Oakland Dr

- 1741 Oakland Dr

- 1770 Castlewood Dr

- 1760 Castlewood Dr

- 30189 Avondale Dr

- 1791 Oakland Dr

- 1780 Castlewood Dr

- 1750 Castlewood Dr

- 30190 Elmhurst Dr

- 1790 Castlewood Dr

- 1740 Castlewood Dr

- 1731 Oakland Dr

- 30179 Avondale Dr

- 30190 Avondale Dr

- 1801 Oakland Dr

- 30180 Elmhurst Dr

- 1730 Castlewood Dr