17636 SW 6th Ct Pembroke Pines, FL 33029

Silver Lakes NeighborhoodEstimated Value: $577,000 - $637,000

3

Beds

2

Baths

1,412

Sq Ft

$421/Sq Ft

Est. Value

About This Home

This home is located at 17636 SW 6th Ct, Pembroke Pines, FL 33029 and is currently estimated at $594,874, approximately $421 per square foot. 17636 SW 6th Ct is a home located in Broward County with nearby schools including Silver Lakes Elementary School, Glades Middle School, and Everglades High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 5, 2008

Sold by

Smith Conan R

Bought by

Wright Marvin D and Wright Glorie B

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$262,874

Outstanding Balance

$174,513

Interest Rate

6.48%

Mortgage Type

FHA

Estimated Equity

$420,361

Purchase Details

Closed on

Feb 28, 2003

Sold by

Barreto Eli M and Barreto Elizabeth

Bought by

Smith Conan R

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$194,750

Interest Rate

5.82%

Purchase Details

Closed on

Apr 29, 1994

Sold by

Adrian Dev Corp

Bought by

Barreto Eli M and Barreto Elizabeth

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$75,000

Interest Rate

7.81%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Wright Marvin D | $267,000 | Town & Country Title Guarant | |

| Smith Conan R | $205,000 | Agents Title Inc | |

| Barreto Eli M | $126,400 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Wright Marvin D | $262,874 | |

| Previous Owner | Smith Conan R | $194,750 | |

| Previous Owner | Barreto Eli M | $75,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,866 | $228,450 | -- | -- |

| 2024 | $3,736 | $222,020 | -- | -- |

| 2023 | $3,736 | $215,560 | $0 | $0 |

| 2022 | $3,515 | $209,290 | $0 | $0 |

| 2021 | $3,433 | $203,200 | $0 | $0 |

| 2020 | $3,395 | $200,400 | $0 | $0 |

| 2019 | $3,324 | $195,900 | $0 | $0 |

| 2018 | $3,194 | $192,250 | $0 | $0 |

| 2017 | $3,151 | $188,300 | $0 | $0 |

| 2016 | $3,130 | $184,430 | $0 | $0 |

| 2015 | $3,173 | $183,150 | $0 | $0 |

| 2014 | $3,166 | $181,700 | $0 | $0 |

| 2013 | -- | $179,020 | $40,050 | $138,970 |

Source: Public Records

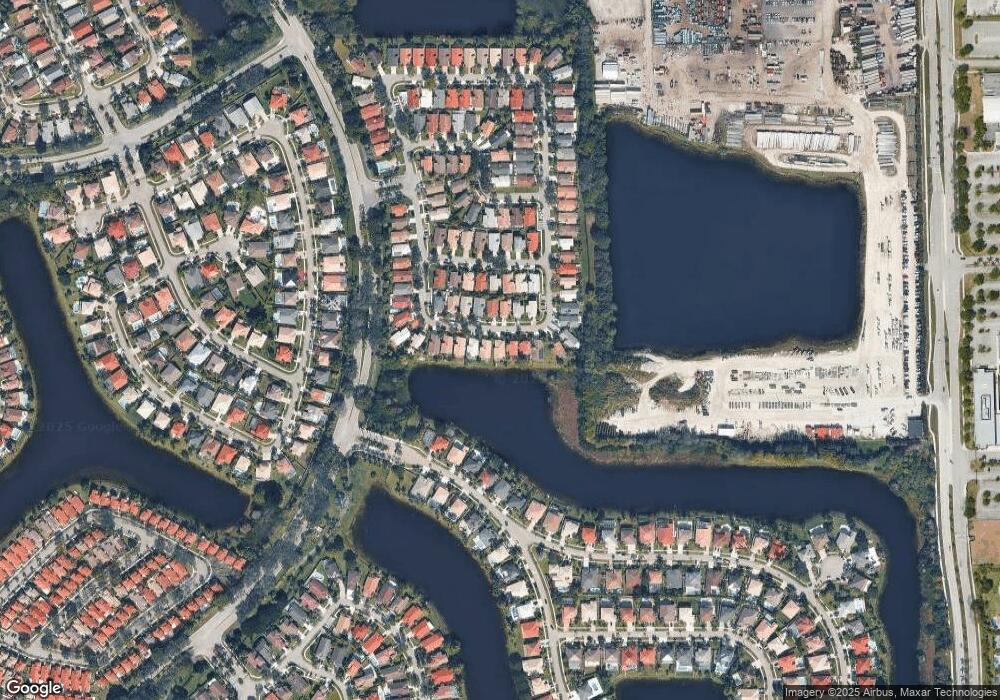

Map

Nearby Homes

- 17677 SW 6th Ct

- 17610 SW 4th Ct

- 612 SW 179th Ave

- 862 SW 176th Ave

- 17180 SW 2nd Cir

- 17646 SW 10th St

- 17164 SW 2nd Cir

- 895 SW 180th Terrace

- 17116 SW 2nd Cir

- 965 SW 180th Terrace

- 17825 SW 10th Ct

- 212 SW 179th Ave

- 110 SW 171st Way

- Wesley Plan at Merrick Square

- Stranahan Plan at Merrick Square

- Bonnet Plan at Merrick Square

- Gilliam Plan at Merrick Square

- 17925 SW 10th Ct

- 17042 SW 1st St

- 17033 SW 1st St

- 17644 SW 6th St

- 17635 SW 6th St

- 17625 SW 6th St

- 17645 SW 6th St

- 17615 SW 6th St

- 17634 SW 5th Ct

- 17655 SW 6th St

- 17624 SW 5th Ct

- 17644 SW 5th Ct

- 17634 SW 6th St

- 17624 SW 6th St

- 17665 SW 6th St

- 17614 SW 6th St

- 17664 SW 6th St

- 17675 SW 6th St

- 533 SW 176th Way

- 571 SW 176th Ave

- 561 SW 176th Ave

- 581 SW 176th Ave