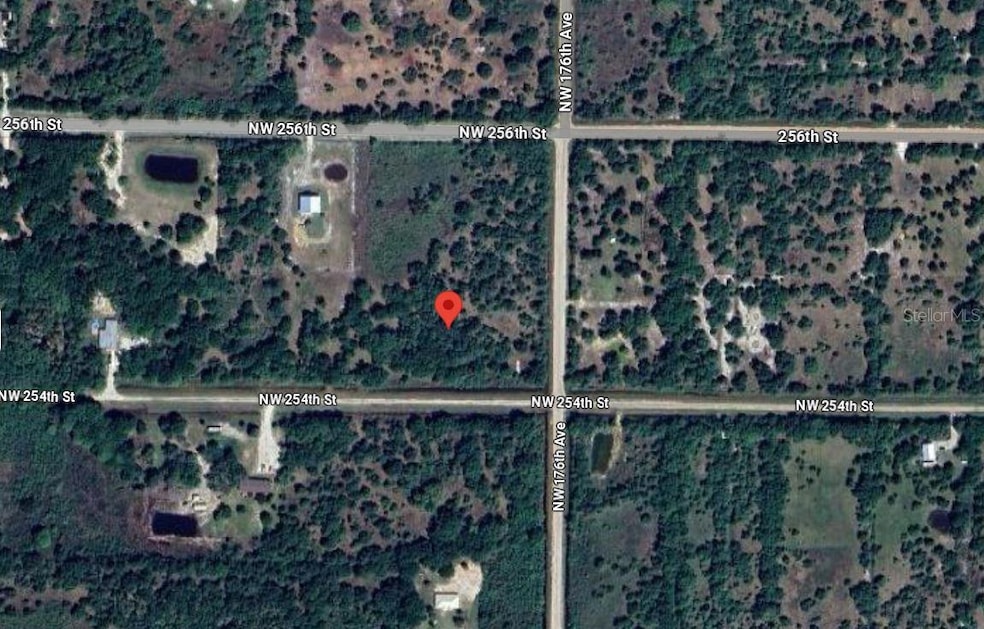

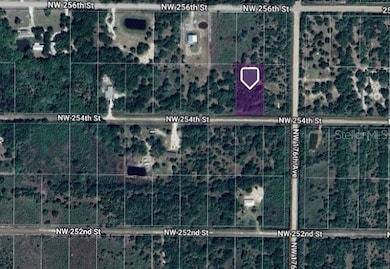

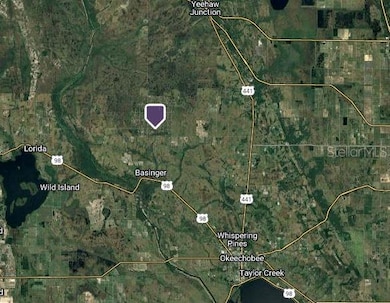

17667 NW 254th St Okeechobee, FL 34972

Estimated payment $156/month

Total Views

649

1.25

Acres

$18,400

Price per Acre

54,450

Sq Ft Lot

About This Lot

1.25 Acre Parcel of Land in Viking Subdivision. Power lines are right at the road, making an easy setup. Build your new Dream Home with Plenty of room to roam. Located centrally near Okeechobee.

Listing Agent

FLORIDA HOMES REALTY & MORTGAGE Brokerage Phone: 904-996-9144 License #3524286 Listed on: 10/17/2025

Property Details

Property Type

- Land

Est. Annual Taxes

- $418

Lot Details

- 1.25 Acre Lot

- 164 Ft Wide Lot

- Dirt Road

- Property is zoned R1

Utilities

- Well Required

- Septic Needed

Community Details

- No Home Owners Association

Listing and Financial Details

- Legal Lot and Block G / 17

- Assessor Parcel Number R1-34-34-33-0A00-00001-G000

Map

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $396 | $18,125 | $18,125 | -- |

| 2023 | $396 | $16,500 | $16,500 | $0 |

| 2022 | $356 | $13,000 | $13,000 | $0 |

| 2021 | $305 | $7,600 | $7,600 | $0 |

| 2020 | $293 | $6,750 | $6,750 | $0 |

| 2019 | $285 | $6,750 | $6,750 | $0 |

| 2018 | $266 | $6,500 | $6,500 | $0 |

| 2017 | $257 | $6,000 | $0 | $0 |

| 2016 | $211 | $6,200 | $0 | $0 |

| 2015 | $211 | $6,200 | $0 | $0 |

| 2014 | -- | $6,500 | $0 | $0 |

Source: Public Records

Property History

| Date | Event | Price | List to Sale | Price per Sq Ft |

|---|---|---|---|---|

| 11/06/2025 11/06/25 | Price Changed | $23,000 | -8.0% | -- |

| 10/17/2025 10/17/25 | For Sale | $25,000 | -- | -- |

Source: Stellar MLS

Purchase History

| Date | Type | Sale Price | Title Company |

|---|---|---|---|

| Warranty Deed | $31,100 | -- | |

| Interfamily Deed Transfer | -- | -- |

Source: Public Records

Source: Stellar MLS

MLS Number: A4668921

APN: R1-34-34-33-0A00-00001-G000

Nearby Homes

- 17823 NW 254th St

- 17774 NW 254th St

- 18989 NW 254th St

- 18034 NW 254th St

- 18937 NW 254th St

- 19946 NW 254th St

- 17875 NW 254th St

- 15789 NW 254th St

- 19026 NW 254th St

- 15618 NW 254th St

- 19376 NW 256th St

- 15839 NW 252nd St

- 15527 NW 252nd St

- 15215 NW 252nd St

- 17980 NW 252nd St

- 19039 NW 252nd St

- 2129 NW 252nd St

- 17926 OKEECH NW 250th St

- 19882 NW 258th St

- 16432 NW 252nd St

- 405 NE 131st Ln

- 3006 Country Lake Dr

- 14725 NW 1st Pkwy Unit RV4

- 3442 NW 36th Ave

- 6116 Aquavista Dr

- 6217 Candler Terrace

- 111 Friendly Cir

- 6609 Concord St

- 260 Spanish Moss Cir Unit 107

- 260 Spanish Moss Cir Unit 207

- 260 Spanish Moss Cir

- 260 Spanish Moss Cir Unit 101

- 424 Holly Dr

- 6909 Salem Ct

- 103 Villaway

- 332 Oak Knolls Cir

- 916 Dogwood Cir

- 1006 Villaway W

- 7208 Spring Hill Rd

- 7420 Valencia Rd