17717 79th Avenue Ct E Unit 23 Puyallup, WA 98375

Estimated Value: $351,000 - $364,000

3

Beds

3

Baths

1,387

Sq Ft

$258/Sq Ft

Est. Value

About This Home

This home is located at 17717 79th Avenue Ct E Unit 23, Puyallup, WA 98375 and is currently estimated at $358,501, approximately $258 per square foot. 17717 79th Avenue Ct E Unit 23 is a home located in Pierce County with nearby schools including Frederickson Elementary School, Liberty Middle School, and Graham Kapowsin High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 6, 2011

Sold by

The Secretary Of Housing & Urban Develop

Bought by

Walsh Jacob

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$82,650

Interest Rate

3.62%

Mortgage Type

New Conventional

Purchase Details

Closed on

Feb 9, 2011

Sold by

Wells Fargo Bank Na

Bought by

The Secretary Of Housing & Urban Develop

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$82,650

Interest Rate

3.62%

Mortgage Type

New Conventional

Purchase Details

Closed on

Dec 15, 2010

Sold by

Wood Rachel S and Stillman Melissa N

Bought by

Wells Fargo Bank Na

Purchase Details

Closed on

Aug 28, 2008

Sold by

Thornbury Llc

Bought by

Wood Rachel S and Stillman Melissa N

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$194,927

Interest Rate

6.27%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Walsh Jacob | -- | Chicago Title | |

| The Secretary Of Housing & Urban Develop | -- | None Available | |

| Wells Fargo Bank Na | $207,806 | None Available | |

| Wood Rachel S | $197,500 | Ticor |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Walsh Jacob | $82,650 | |

| Previous Owner | Wood Rachel S | $194,927 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,201 | $335,000 | $141,400 | $193,600 |

| 2024 | $4,201 | $322,300 | $137,600 | $184,700 |

| 2023 | $4,201 | $296,400 | $133,800 | $162,600 |

| 2022 | $4,071 | $306,300 | $133,800 | $172,500 |

| 2021 | $4,196 | $239,500 | $79,700 | $159,800 |

| 2019 | $2,290 | $199,000 | $66,100 | $132,900 |

| 2018 | $2,298 | $181,600 | $61,100 | $120,500 |

| 2017 | $2,065 | $145,500 | $53,300 | $92,200 |

| 2016 | $1,421 | $88,200 | $30,700 | $57,500 |

| 2014 | $1,330 | $81,700 | $30,700 | $51,000 |

| 2013 | $1,330 | $77,300 | $28,100 | $49,200 |

Source: Public Records

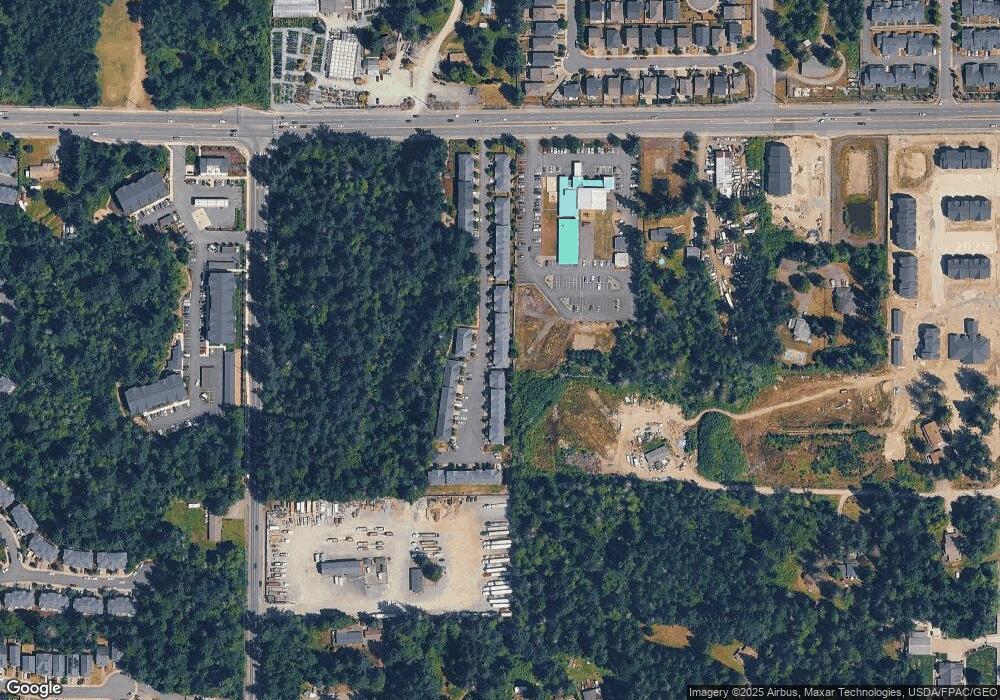

Map

Nearby Homes

- 17817 79th Avenue Ct E

- 8022 175th Street Ct E

- 8337 175th St E

- 7604 173rd Street Ct E

- 17314 82nd Ave E

- 17310 82nd Ave E

- 17306 82nd Ave E

- 17313 82nd Ave E

- 17309 82nd Ave E

- The Juniper Plan at Emerald Grove

- The Evergreen Plan at Emerald Grove

- The Pinewood Plan at Emerald Grove

- The Alpine Plan at Emerald Grove

- 17401 75th Avenue Ct E

- 18138 75th Ave E

- 13904 178th St E

- 13924 178th St E

- 13916 178th St E

- 7401 174th Street Ct E

- 17318 74th Avenue Ct E

- 17711 79th E Unit 20

- 17711 79th Avenue Ct E Unit 20

- 17719 79th Avenue Ct E Unit 24

- 17715 79th E Unit 22

- 17715 79th Avenue Ct E Unit 22

- 17719 79th E

- 17709 79th Avenue Ct E Unit 19

- 17717 79th E Unit 23

- 17713 79th Avenue Ct E Unit 21

- 17707 79th Avenue Ct E Unit 18

- 17705 79th Avenue Ct E Unit 17

- 17712 79th Avenue Ct E Unit 55

- 17703 79th Avenue Ct E Unit 16

- 17803 79th Avenue Ct E Unit 25

- 17701 79th Ave Ct E

- 17701 79th Avenue Ct E Unit 15

- 17805 79th Av Ct E

- 17800 79th Avenue Ct E

- 17800 79th Avenue Ct E Unit 1-10