1775 N 925 W West Lafayette, IN 47906

Estimated Value: $465,000 - $499,849

3

Beds

3

Baths

2,112

Sq Ft

$228/Sq Ft

Est. Value

About This Home

This home is located at 1775 N 925 W, West Lafayette, IN 47906 and is currently estimated at $481,462, approximately $227 per square foot. 1775 N 925 W is a home located in Tippecanoe County with nearby schools including Benton Central Junior/Senior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 30, 2011

Sold by

Heck Nathan Brian and Heck Kimberly Diane

Bought by

Barr Charles A and Barr Kristie J

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$63,000

Outstanding Balance

$43,051

Interest Rate

4.14%

Mortgage Type

New Conventional

Estimated Equity

$438,411

Purchase Details

Closed on

Apr 30, 2007

Sold by

Metzinger Stephen R and Metzinger Carol A

Bought by

Heck Nathan Brian and Heck Kimberly Diane

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$158,000

Interest Rate

6.2%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Barr Charles A | -- | None Available | |

| Heck Nathan Brian | -- | Poelstra Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Barr Charles A | $63,000 | |

| Previous Owner | Heck Nathan Brian | $158,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,825 | $383,000 | $44,700 | $338,300 |

| 2023 | $2,825 | $371,600 | $44,700 | $326,900 |

| 2022 | $2,572 | $317,600 | $44,700 | $272,900 |

| 2021 | $2,518 | $314,600 | $44,700 | $269,900 |

| 2020 | $2,082 | $293,500 | $44,700 | $248,800 |

| 2019 | $1,562 | $272,800 | $44,700 | $228,100 |

| 2018 | $1,485 | $255,200 | $31,300 | $223,900 |

| 2017 | $1,410 | $249,100 | $31,300 | $217,800 |

| 2016 | $1,346 | $246,600 | $31,300 | $215,300 |

| 2014 | $1,227 | $225,600 | $31,300 | $194,300 |

| 2013 | $1,284 | $222,200 | $31,300 | $190,900 |

Source: Public Records

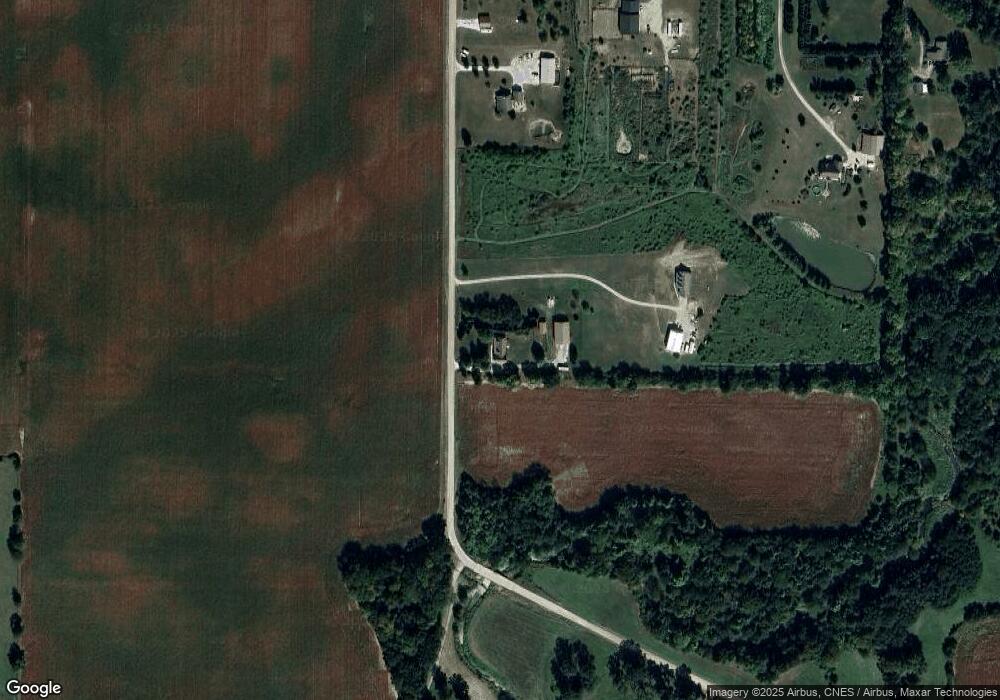

Map

Nearby Homes

- 1 Adeway Ct

- 8213 Division Rd

- 1724 Bent Tree Trail

- 7220 W 350 N

- 7150 Robert Ross Ln

- 10240 E 975 N Unit 35

- 10240 E 975 N Unit 31

- 10240 E 975 N Unit 20

- 10240 E 975 N Unit 23

- 10240 E 975 N Unit 30

- 10240 E 975 N Unit 21

- 10240 E 975 N Unit 37

- 10240 E 975 N Unit 34

- 10240 E 975 N Unit 38

- 10240 E 975 N Unit 36

- 617 S Gregory St

- 513 S Kerkhoff Ave

- 107 E 4th St

- 3728 Gear St

- 5940 Conkright Ln

- 1801 N 925 W

- 1933 N 925 W

- 9163 State Road 26 W

- 1991 N 925 W

- 2008 N 925 W

- 9053 State Road 26 W

- 8675 State Road 26 W

- 2016 N 925 W

- 2026 N 925 W

- 2036 N 925 W

- 2100 N 925 W

- 2228 N 925 W

- 2339 N 925 W

- 2236 N 925 W

- 9901 State Road 26 W

- 2303 N 925 W

- 8601 State Road 26 W

- 8640 W 125 N

- 8515 State Road 26 W

- 8511 State Road 26 W