179 Forest Rd Southbury, CT 06488

Estimated Value: $719,174 - $785,000

4

Beds

3

Baths

2,582

Sq Ft

$290/Sq Ft

Est. Value

About This Home

This home is located at 179 Forest Rd, Southbury, CT 06488 and is currently estimated at $748,044, approximately $289 per square foot. 179 Forest Rd is a home located in New Haven County with nearby schools including Long Meadow Elementary School, Memorial Middle School, and Pomperaug Regional High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 21, 2005

Sold by

Relocation Sirva

Bought by

Funk Jeff and Funk Kristen

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$400,000

Outstanding Balance

$203,747

Interest Rate

5%

Estimated Equity

$544,297

Purchase Details

Closed on

Jul 24, 1995

Sold by

Goldbach Kurt and Goldbach Patricia

Bought by

Marshall Charles and Marshall Lisa

Purchase Details

Closed on

Mar 26, 1993

Sold by

Trofa Southbury Dev

Bought by

Goldbach Kurt and Goldbach Patricia

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Funk Jeff | $531,000 | -- | |

| Relocation Sirva | $531,000 | -- | |

| Marshall Charles | $266,400 | -- | |

| Goldbach Kurt | $95,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Goldbach Kurt | $400,000 | |

| Previous Owner | Goldbach Kurt | $25,000 | |

| Previous Owner | Goldbach Kurt | $320,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $8,993 | $371,620 | $99,320 | $272,300 |

| 2024 | $8,770 | $371,620 | $99,320 | $272,300 |

| 2023 | $8,361 | $371,620 | $99,320 | $272,300 |

| 2022 | $7,973 | $278,370 | $103,170 | $175,200 |

| 2021 | $8,156 | $278,370 | $103,170 | $175,200 |

| 2020 | $8,156 | $278,370 | $103,170 | $175,200 |

| 2019 | $8,101 | $278,370 | $103,170 | $175,200 |

| 2018 | $8,073 | $278,370 | $103,170 | $175,200 |

| 2017 | $8,656 | $295,420 | $119,440 | $175,980 |

| 2016 | $8,508 | $295,420 | $119,440 | $175,980 |

| 2015 | $8,390 | $295,420 | $119,440 | $175,980 |

| 2014 | $8,154 | $295,420 | $119,440 | $175,980 |

Source: Public Records

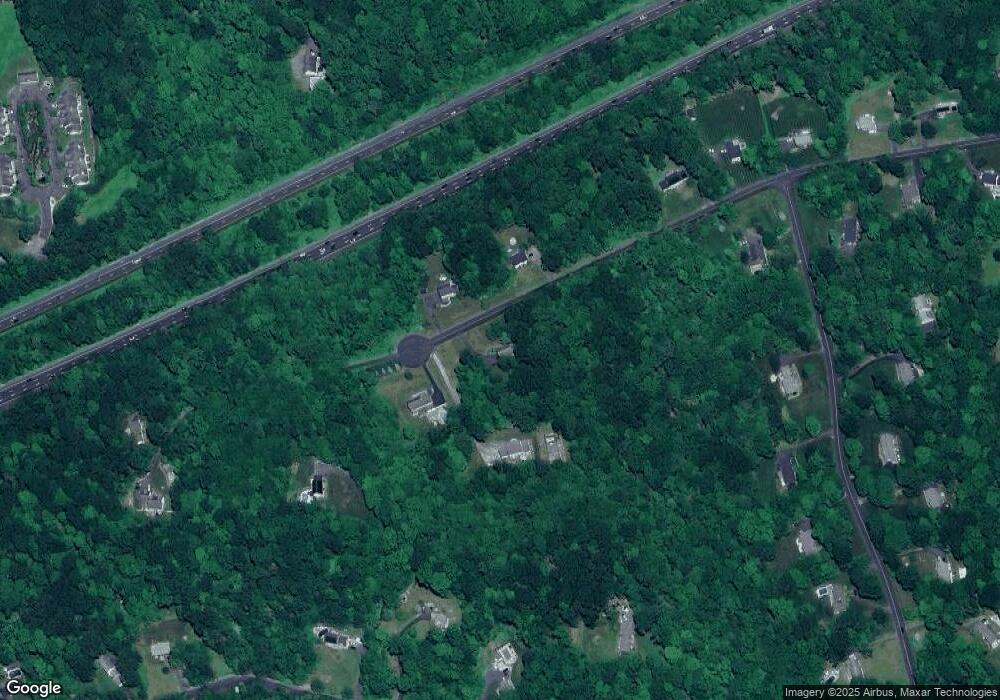

Map

Nearby Homes

- 101 Church Rd Unit 3

- 146 Lantern Park Ln S

- 20 Lantern Park Ln S

- 64 Short Rock Rd

- 11 Far View Commons Unit 11

- 324 Luther Dr

- 101 Settlers Hill Rd

- 280 Jeremy Swamp Rd

- 919 Strongtown Rd

- 369 Strongtown Rd

- 163 Hickory Ln

- 216 Hulls Hill Rd

- 913 Jeremy Swamp Rd

- 33 Old Field Hill Rd Unit 9

- 61 Pope Rd

- 59 Pope Rd

- 57, 59, 61 and Parce Pope Rd

- 57 Pope Rd

- 0 Troupe Trail Unit 24128305

- 70 Diamond Match Rd

- 191 Forest Rd

- 150 Forest Rd

- 184 Forest Rd

- 108 Forest Rd

- 95 Forest Rd

- 233 Wolf Pit Dr

- 189 Lantern Park Ln N

- 171 Lantern Park Ln N

- 53 Wolf Pit Dr

- 205 Wolf Pit Dr

- 213 Lantern Park Ln N

- 90 Forest Rd

- 197 Wolf Pit Dr

- 280 Wolf Pit Dr

- 758 Old Waterbury Rd

- 210 Lantern Park Ln N

- 200 Forest Rd

- 228 Wolf Pit Dr

- 70 Forest Rd

- 51 Wolf Pit Dr