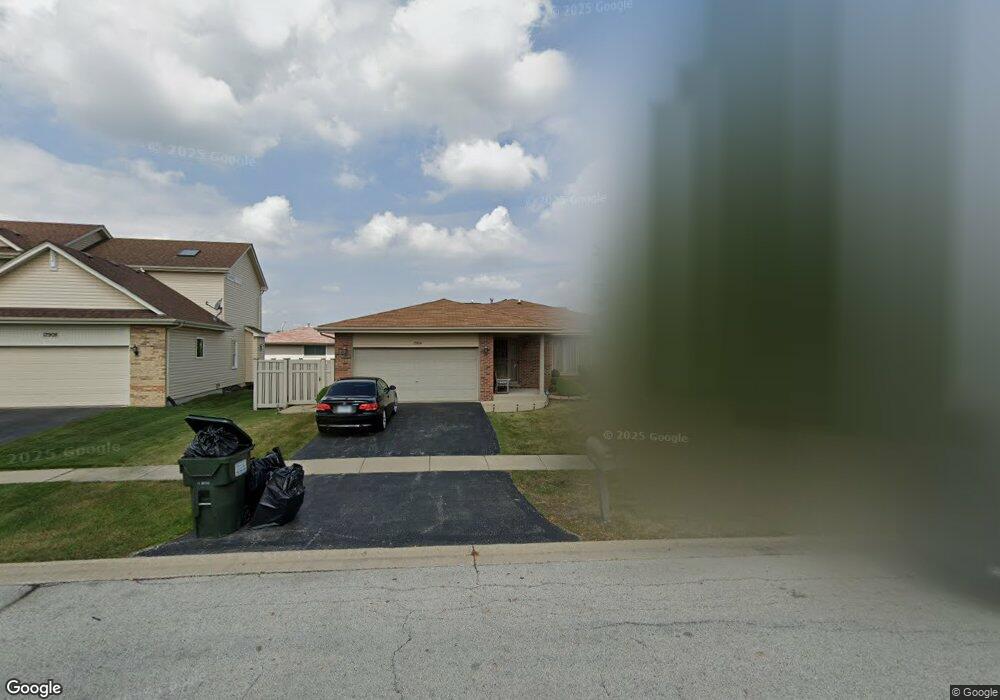

17904 Lavergne Ave Country Club Hills, IL 60478

Estimated Value: $284,291 - $302,000

3

Beds

2

Baths

2,000

Sq Ft

$148/Sq Ft

Est. Value

About This Home

This home is located at 17904 Lavergne Ave, Country Club Hills, IL 60478 and is currently estimated at $296,323, approximately $148 per square foot. 17904 Lavergne Ave is a home located in Cook County with nearby schools including Zenon J Sykuta School, Meadowview Intermediate School, and Southwood Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 6, 2018

Sold by

Tate Mary A

Bought by

Grant Kirsten E

Current Estimated Value

Purchase Details

Closed on

Jun 22, 2007

Sold by

Fairley Hubert and Fairley Ethel

Bought by

Kelly Joanne and Usher Thomas I

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$235,000

Interest Rate

6.42%

Mortgage Type

Unknown

Purchase Details

Closed on

May 2, 2001

Sold by

Cosmopolitan Bank & Trust

Bought by

Fairley Hubert and Fairley Ethel

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$143,150

Interest Rate

7.11%

Purchase Details

Closed on

Sep 9, 2000

Sold by

Fairley Robert and Fairley Ethel

Bought by

Hartz Construction Co Inc

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$196,300

Interest Rate

7.18%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Grant Kirsten E | -- | First American Title Insuran | |

| Kelly Joanne | $248,000 | None Available | |

| Fairley Hubert | $196,500 | -- | |

| Fairley Hubert | $196,500 | -- | |

| Hartz Construction Co Inc | $196,300 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Kelly Joanne | $235,000 | |

| Previous Owner | Fairley Hubert | $143,150 | |

| Previous Owner | Hartz Construction Co Inc | $196,300 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $10,957 | $22,000 | $4,996 | $17,004 |

| 2023 | $13,455 | $22,000 | $4,996 | $17,004 |

| 2022 | $13,455 | $19,115 | $4,282 | $14,833 |

| 2021 | $13,558 | $19,115 | $4,282 | $14,833 |

| 2020 | $13,785 | $19,115 | $4,282 | $14,833 |

| 2019 | $15,368 | $20,825 | $3,925 | $16,900 |

| 2018 | $14,690 | $20,825 | $3,925 | $16,900 |

| 2017 | $14,429 | $20,825 | $3,925 | $16,900 |

| 2016 | $9,235 | $17,910 | $3,390 | $14,520 |

| 2015 | $8,342 | $17,910 | $3,390 | $14,520 |

| 2014 | $8,265 | $17,910 | $3,390 | $14,520 |

| 2013 | $8,615 | $20,013 | $3,390 | $16,623 |

Source: Public Records

Map

Nearby Homes

- 5013 180th St

- 17940 Michael Ave

- 4847 175th St

- 4826 Summerhill Dr

- 18125 S Sligo Way

- 4725 181st St

- 17925 John Ave

- 18300 Lavergne Ave

- 18055 Thomas Ln

- 17608 Anthony Ave

- 17613 Hawthorne Dr

- 4411 177th Place

- 5500 177th St

- 17213 Arrowhead Trace

- 5540 177th St

- 5125 171st St

- 18057 Juneway Ct

- 5048 171st St

- 4200 W 176th Place

- 18115 Idlewild Dr

- 17908 Lavergne Ave

- 17900 Lavergne Ave

- 17831 Fairoaks Dr

- 17831 Fairoak Dr

- 17841 Fairoaks Dr

- 17912 Lavergne Ave

- 4963 Fairoaks Dr

- 4950 179th St

- 17851 Fairoaks Dr

- 4955 Fairoaks Dr

- 17900 Poplar Ln

- 17909 Lavergne Ave

- 17861 Fairoaks Dr

- 17916 Lavergne Ave

- 4940 179th St

- 4947 Fairoaks Dr

- 17901 Fairoaks Dr

- 17910 Poplar Ln

- 17920 Lavergne Ave

- 17919 Lavergne Ave