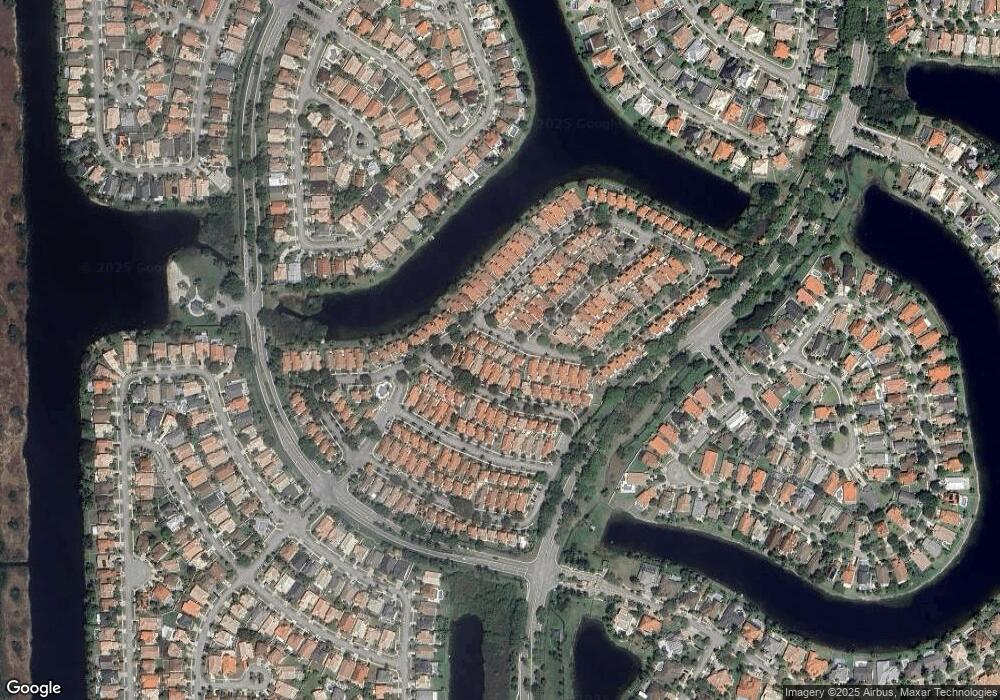

17926 SW 10th Ln Pembroke Pines, FL 33029

Silver Lakes NeighborhoodEstimated Value: $515,000 - $534,000

3

Beds

3

Baths

1,517

Sq Ft

$346/Sq Ft

Est. Value

About This Home

This home is located at 17926 SW 10th Ln, Pembroke Pines, FL 33029 and is currently estimated at $525,204, approximately $346 per square foot. 17926 SW 10th Ln is a home located in Broward County with nearby schools including Silver Lakes Elementary School, Glades Middle School, and Everglades High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 4, 2009

Sold by

Orellana Victoria and Zevallos Jose

Bought by

Hernandez Luis F and Hernandez Cori L

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$195,106

Outstanding Balance

$127,079

Interest Rate

5.11%

Mortgage Type

VA

Estimated Equity

$398,125

Purchase Details

Closed on

Apr 25, 2002

Sold by

Blanco Julio A and Blanco Maria G

Bought by

Orellana Victoria

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$144,400

Interest Rate

6.92%

Purchase Details

Closed on

May 3, 2000

Sold by

Associates Relocation Management Co

Bought by

Blanco Julio A and Blanco Maria G

Purchase Details

Closed on

Oct 20, 1994

Sold by

Broward Lowell

Bought by

Kehrer Scott and Kehrer Loir

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$92,843

Interest Rate

8.68%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Hernandez Luis F | $191,000 | West Coast Abstract & Title | |

| Orellana Victoria | $152,000 | -- | |

| Blanco Julio A | $121,800 | -- | |

| Associates Relocation Management Co | $121,800 | -- | |

| Kehrer Scott | $92,900 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Hernandez Luis F | $195,106 | |

| Previous Owner | Orellana Victoria | $144,400 | |

| Previous Owner | Kehrer Scott | $92,843 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $6,533 | $172,750 | -- | -- |

| 2024 | $3,898 | $167,890 | -- | -- |

| 2023 | $3,898 | $163,000 | $0 | $0 |

| 2022 | $3,718 | $158,260 | $0 | $0 |

| 2021 | $3,644 | $153,660 | $0 | $0 |

| 2020 | $3,614 | $151,540 | $0 | $0 |

| 2019 | $3,551 | $148,140 | $0 | $0 |

| 2018 | $3,451 | $145,380 | $0 | $0 |

| 2017 | $3,417 | $142,390 | $0 | $0 |

| 2016 | $2,239 | $139,470 | $0 | $0 |

| 2015 | $2,268 | $138,510 | $0 | $0 |

| 2014 | $2,259 | $137,420 | $0 | $0 |

| 2013 | -- | $140,350 | $24,650 | $115,700 |

Source: Public Records

Map

Nearby Homes

- 965 SW 180th Terrace

- 17825 SW 10th Ct

- 895 SW 180th Terrace

- 1115 SW 180th Terrace

- 18021 SW 11th Ct

- 17957 SW 8th St Unit 4403

- 17686 SW 10th St

- 18022 SW 12th Ct

- 17646 SW 10th St

- 545 SW 180th Ave

- 612 SW 179th Ave

- 530 SW 182nd Way

- 18232 SW 5th St

- 495 SW 183rd Way

- 17511 SW 12th St

- 18249 SW 3rd St

- 651 SW 176th Ave

- 335 SW 183rd Way

- 212 SW 179th Ave

- 214 SW 180th Ave

- 17936 SW 10th Ln

- 17916 SW 10th Ln

- 17946 SW 10th Ln

- 17906 SW 10th Ln

- 17905 SW 10th Ct

- 17915 SW 10th Ct

- 17915 17915 Sw 10 Ct

- 17895 SW 10th Ct

- 17925 SW 10th Ct

- 984 SW 179th Ave

- 17956 SW 10th Ln

- 985 SW 180th Terrace

- 17935 SW 10th Ct

- 17885 SW 10th Ct

- 935 SW 180th Te

- 974 SW 179th Ave

- 975 SW 180th Terrace

- 17856 SW 10th Ln

- 17945 SW 10th Ct