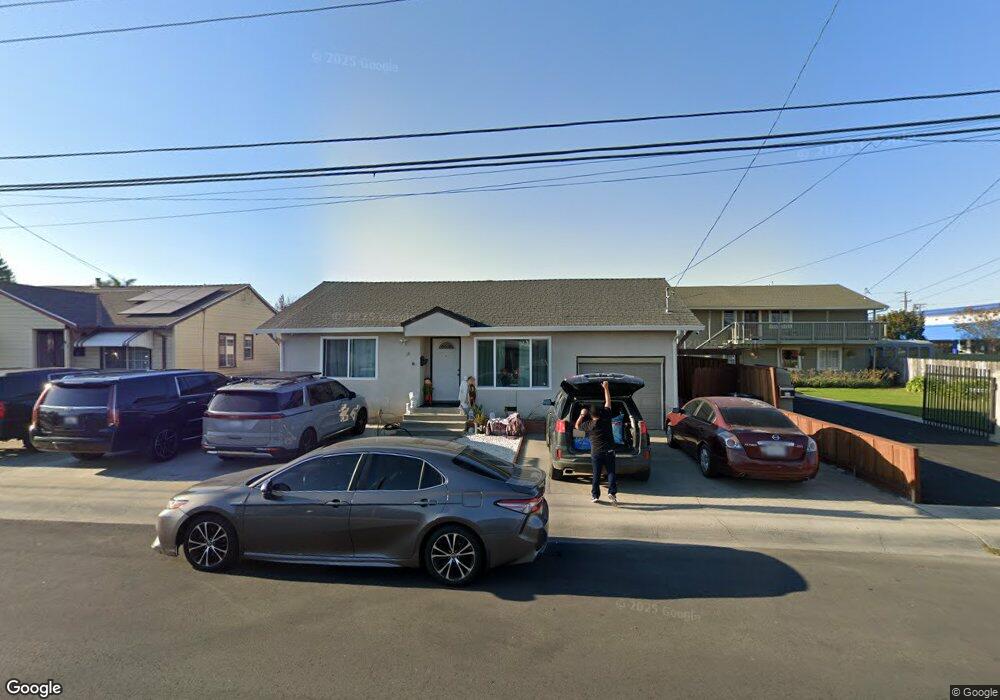

18 Arthur Rd Watsonville, CA 95076

Estimated Value: $383,000 - $830,000

4

Beds

2

Baths

1,615

Sq Ft

$424/Sq Ft

Est. Value

About This Home

This home is located at 18 Arthur Rd, Watsonville, CA 95076 and is currently estimated at $684,923, approximately $424 per square foot. 18 Arthur Rd is a home located in Santa Cruz County with nearby schools including H.A. Hyde Elementary School, Cesar E. Chavez Middle School, and Pajaro Valley High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 27, 2012

Sold by

Carrasco Martha R and Carrasco Faviola

Bought by

Lemus Nancy Hipolito

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$238,789

Outstanding Balance

$163,089

Interest Rate

3.75%

Mortgage Type

FHA

Estimated Equity

$521,834

Purchase Details

Closed on

Dec 3, 2003

Sold by

Carrasco Martha R and Carrasco Vincent F

Bought by

Carrasco Martha R and Carrasco Faviola

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$377,100

Interest Rate

5.55%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Lemus Nancy Hipolito | $245,000 | Old Republic Title Company | |

| Carrasco Martha R | -- | Santa Cruz Title Company | |

| Carrasco Martha R | -- | Santa Cruz Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Lemus Nancy Hipolito | $238,789 | |

| Previous Owner | Carrasco Martha R | $377,100 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,621 | $307,734 | $184,640 | $123,094 |

| 2023 | $3,565 | $295,785 | $177,471 | $118,314 |

| 2022 | $3,503 | $289,985 | $173,991 | $115,994 |

| 2021 | $3,444 | $284,299 | $170,579 | $113,720 |

| 2020 | $3,395 | $281,383 | $168,830 | $112,553 |

| 2019 | $3,335 | $275,867 | $165,520 | $110,347 |

| 2018 | $3,251 | $270,457 | $162,274 | $108,183 |

| 2017 | $3,223 | $265,154 | $159,092 | $106,062 |

| 2016 | $3,140 | $259,955 | $155,973 | $103,982 |

| 2015 | $3,129 | $256,050 | $153,630 | $102,420 |

| 2014 | $3,062 | $251,035 | $150,621 | $100,414 |

Source: Public Records

Map

Nearby Homes

- 38 Clifford Ave

- 417 Annie Dr

- 45 Crescent Dr

- 1060 Sunbird Dr

- 49 Blanca Ln Unit 523

- 49 Blanca Ln Unit 310

- 49 Blanca Ln Unit 715

- 20 Marin St

- 52 Winding Way

- 176 Crestview Ct

- 35 Sycamore St

- 221 Carey Ave Unit A

- 501 S Green Valley Rd Unit 89

- 149 Cherry Blossom Dr

- 229 Bronson St

- 254 Rogers Ave

- 110 Crespi Cir Unit 110

- 202 Stanford St

- 67 Roosevelt St

- 27 Burchell Ave