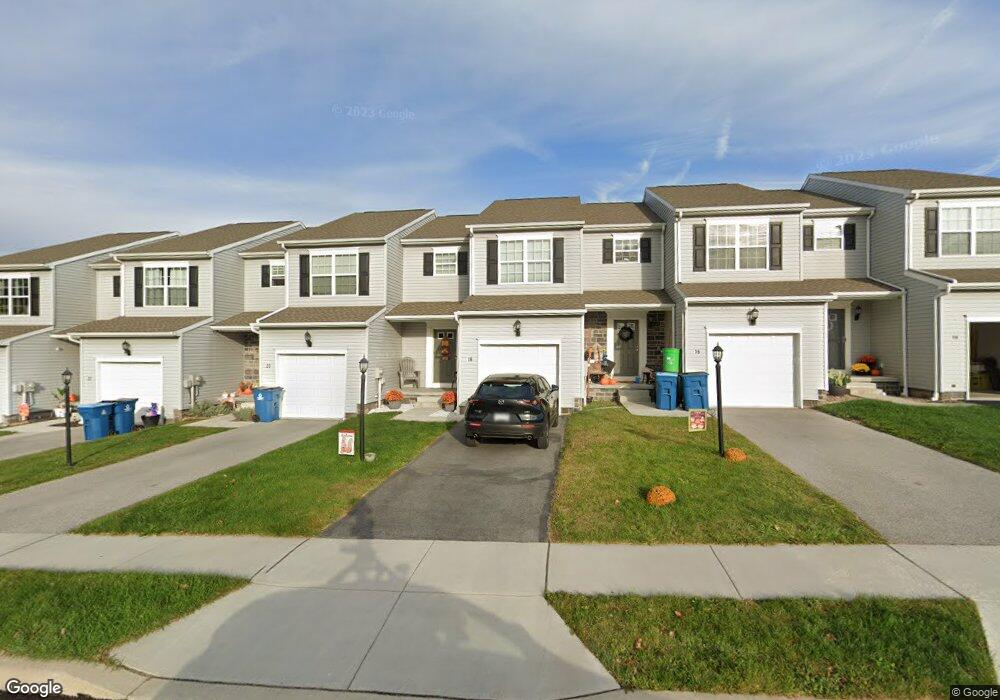

18 N Church St Unit 15 Franklintown, PA 17323

Estimated Value: $238,000 - $290,000

3

Beds

3

Baths

1,347

Sq Ft

$199/Sq Ft

Est. Value

About This Home

This home is located at 18 N Church St Unit 15, Franklintown, PA 17323 and is currently estimated at $267,402, approximately $198 per square foot. 18 N Church St Unit 15 is a home located in York County with nearby schools including Northern Middle School and Northern High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 18, 2019

Sold by

Myers Family Development Lp

Bought by

Levalley Jonathan C and Levalley Kathy Lyn

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$100,000

Outstanding Balance

$65,441

Interest Rate

4%

Mortgage Type

New Conventional

Estimated Equity

$201,961

Purchase Details

Closed on

May 17, 2017

Sold by

South Heights Manor Lp

Bought by

Myers Family Development Lp

Purchase Details

Closed on

Oct 4, 2016

Sold by

Harbold Jere C and Harbold Mary C

Bought by

Richard C Fryogle Inc

Purchase Details

Closed on

Aug 19, 2010

Sold by

Greatbay Real Estate Investments Llc

Bought by

R Carnie Fryfogle Inc

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Levalley Jonathan C | $173,741 | None Available | |

| Myers Family Development Lp | $78,763 | None Available | |

| Richard C Fryogle Inc | -- | None Available | |

| R Carnie Fryfogle Inc | -- | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Levalley Jonathan C | $100,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,182 | $143,690 | $30,160 | $113,530 |

| 2024 | $4,139 | $143,690 | $30,160 | $113,530 |

| 2023 | $4,062 | $143,690 | $30,160 | $113,530 |

| 2022 | $3,981 | $143,690 | $30,160 | $113,530 |

| 2021 | $3,739 | $143,690 | $30,160 | $113,530 |

| 2020 | $3,656 | $143,690 | $30,160 | $113,530 |

| 2019 | $566 | $22,780 | $22,780 | $0 |

| 2018 | $555 | $22,780 | $22,780 | $0 |

| 2017 | $555 | $22,780 | $22,780 | $0 |

| 2016 | $0 | $2,420 | $2,420 | $0 |

| 2015 | -- | $2,420 | $2,420 | $0 |

| 2014 | -- | $2,420 | $2,420 | $0 |

Source: Public Records

Map

Nearby Homes

- 0 Church St Unit PAYK2054218

- 112 W South St

- lot 1 Baltimore St

- 1540 Baltimore Rd

- 81 Tannery Rd

- 612 Range End Rd Unit 11

- 65 Walmar Manor

- 42 Beechwood Dr

- 1160 Park Ave

- 84 Buttonwood Dr

- 78 Walmar Manor

- 0 Range End Rd Unit PAYK2075290

- Carnegie II Plan at Stony Run Single Family Homes

- Cranberry II Plan at Stony Run Single Family Homes

- Edgewood II Plan at Stony Run Single Family Homes

- Whitehall II Plan at Stony Run Single Family Homes

- York II Garage Plan at Stony Run Townhomes

- 4 Windy Ln

- 206 Eagle Rd

- 303 S Baltimore St

- 18 N Church St

- 20 N Church St

- 16 N Church St

- 24 N Church St Unit 18

- 14 N Church St

- 14 N Church St Unit 13

- 22 N Church St

- 22 N Church St Unit 17

- 10 N Church St

- 8 N Church St

- 6 N Church St

- 4 N Church St

- 2 N Church St

- 2 N Church St Unit 7

- 15 Water St

- 115 W Cabin Hollow Rd

- 12 Church St

- 103 W Cabin Hollow Rd

- 11 Water St

- 11 Water St Unit 69