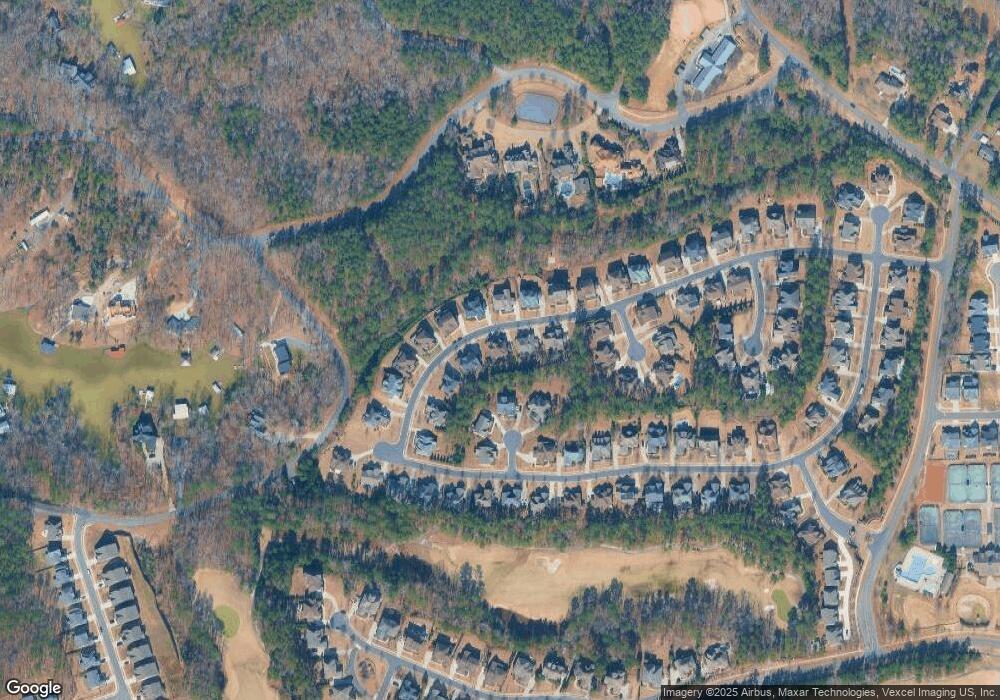

18001 Pawleys Plantation Ln Unit 72 Charlotte, NC 28278

The Palisades NeighborhoodEstimated Value: $1,055,070 - $1,079,000

5

Beds

5

Baths

4,257

Sq Ft

$251/Sq Ft

Est. Value

About This Home

This home is located at 18001 Pawleys Plantation Ln Unit 72, Charlotte, NC 28278 and is currently estimated at $1,066,518, approximately $250 per square foot. 18001 Pawleys Plantation Ln Unit 72 is a home located in Mecklenburg County with nearby schools including Palisades Park Elementary School, Southwest Middle School, and Unity Classical Charter School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 11, 2025

Sold by

Mccormick Thomas Joseph and Mccormick Ann Lowe

Bought by

Mcgehee Kristen and Mcgehee Matthew

Current Estimated Value

Purchase Details

Closed on

Nov 1, 2022

Sold by

Johnson Joel A and Johnson Melissa Snyder

Bought by

Mccormick Thomas Joseph and Mccormick Ann Lowe

Purchase Details

Closed on

Dec 15, 2017

Sold by

Rider Kirk and Rider Lynn

Bought by

Johnson Joel A and Johnson Melissa Snyder

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$484,000

Interest Rate

3.36%

Mortgage Type

Adjustable Rate Mortgage/ARM

Purchase Details

Closed on

Oct 8, 2015

Sold by

Standard Pacific Of The Carolinas Llc

Bought by

Rider Kirk and Rider Lynn

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$491,200

Interest Rate

3.88%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Mcgehee Kristen | $965,000 | None Listed On Document | |

| Mccormick Thomas Joseph | $950,000 | -- | |

| Johnson Joel A | $605,000 | None Available | |

| Rider Kirk | $614,000 | None Available | |

| Rider Kirk | $614,000 | Attorney |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Johnson Joel A | $484,000 | |

| Previous Owner | Rider Kirk | $491,200 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | -- | $903,300 | $125,000 | $778,300 |

| 2024 | -- | $903,300 | $125,000 | $778,300 |

| 2023 | $5,396 | $903,300 | $125,000 | $778,300 |

| 2022 | $5,396 | $597,500 | $70,000 | $527,500 |

| 2021 | $5,268 | $597,500 | $70,000 | $527,500 |

| 2020 | $5,238 | $597,500 | $70,000 | $527,500 |

| 2019 | $5,182 | $597,500 | $70,000 | $527,500 |

| 2018 | $5,077 | $451,700 | $80,000 | $371,700 |

| 2017 | $5,039 | $451,700 | $80,000 | $371,700 |

| 2016 | $4,976 | $48,000 | $48,000 | $0 |

| 2015 | $522 | $48,000 | $48,000 | $0 |

| 2014 | $513 | $48,000 | $48,000 | $0 |

Source: Public Records

Map

Nearby Homes

- 18021 Pawleys Plantation Ln

- 19419 Youngblood Rd W

- 19419 Youngblood Rd W Unit 2

- Monterey Plan at The Ranch at The Palisades

- Solana Plan at The Ranch at The Palisades

- Huntley Plan at The Ranch at The Palisades

- Balboa Plan at The Ranch at The Palisades

- Marin Plan at The Ranch at The Palisades

- Newport II Plan at The Ranch at The Palisades

- Napa Plan at The Ranch at The Palisades

- Santa Fe Ranch Plan at The Ranch at The Palisades

- Coronado Plan at The Ranch at The Palisades

- Marin-Expanded Plan at The Ranch at The Palisades

- 19329 Youngblood Rd W

- 19329 Youngblood Rd W Unit 4

- 16532 Flintrock Falls Ln

- 16402 Doves Canyon Ln

- 16411 Doves Canyon Ln

- 13217 Terrace Court Dr

- 15614 Aviary Orchard Way

- 18011 Pawleys Plantation Ln Unit 71

- 17921 Pawleys Plantation Ln Unit 73

- 13202 Coyote Creek Ct

- 17915 Pawleys Plantation Ln Unit 74

- 18044 Pawleys Plantation Ln

- 18004 Pawleys Plantation Ln Unit 29

- 17924 Pawleys Plantation Ln Unit 30

- 13206 Coyote Creek Ct

- 18010 Pawleys Plantation Ln Unit 28

- 13203 Coyote Creek Ct

- 18016 Pawleys Plantation Ln Unit 27

- 18016 Pawleys Plantation Ln

- 17918 Pawleys Plantation Ln Unit 31

- 18029 Pawleys Plantation Ln

- 18022 Pawleys Plantation Ln

- 17912 Pawleys Plantation Ln Unit 32

- 17912 Pawleys Plantation Ln

- 13214 Coyote Creek Ct

- 13214 Coyote Creek Ct Unit 67

- 13102 Indigo Run Ct Unit 75