1801 E Perry St Unit 18 Port Clinton, OH 43452

Estimated Value: $338,000 - $381,000

3

Beds

2

Baths

1,156

Sq Ft

$311/Sq Ft

Est. Value

About This Home

This home is located at 1801 E Perry St Unit 18, Port Clinton, OH 43452 and is currently estimated at $359,582, approximately $311 per square foot. 1801 E Perry St Unit 18 is a home located in Ottawa County with nearby schools including Bataan Memorial Primary School, Bataan Memorial Intermediate School, and Port Clinton Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 28, 2005

Sold by

Hauck Kenneth J and Hauck Mary Christine

Bought by

Hauck Kenneth J

Current Estimated Value

Purchase Details

Closed on

Sep 14, 2004

Sold by

Meisels Et Al Murray

Bought by

Hauck Et Al Kenneth J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$143,910

Outstanding Balance

$72,544

Interest Rate

6.25%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$287,038

Purchase Details

Closed on

Sep 10, 2004

Sold by

Meisels Murray and Meisels Brenda L

Bought by

Hauck Kenneth J and Hauck Mary Christine

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$143,910

Outstanding Balance

$72,544

Interest Rate

6.25%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$287,038

Purchase Details

Closed on

Dec 27, 1993

Bought by

Meisels Murray and Meisels Brenda L S

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Hauck Kenneth J | -- | -- | |

| Hauck Et Al Kenneth J | $159,900 | -- | |

| Hauck Kenneth J | $159,900 | -- | |

| Meisels Murray | $93,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Hauck Kenneth J | $143,910 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,070 | $86,429 | $21,637 | $64,792 |

| 2023 | $3,070 | $75,730 | $16,552 | $59,178 |

| 2022 | $3,010 | $75,730 | $16,552 | $59,178 |

| 2021 | $3,007 | $75,730 | $16,550 | $59,180 |

| 2020 | $2,104 | $55,360 | $10,820 | $44,540 |

| 2019 | $2,083 | $55,360 | $10,820 | $44,540 |

| 2018 | $2,079 | $55,360 | $10,820 | $44,540 |

| 2017 | $2,068 | $54,170 | $10,820 | $43,350 |

| 2016 | $2,072 | $54,170 | $10,820 | $43,350 |

| 2015 | $2,080 | $54,170 | $10,820 | $43,350 |

| 2014 | $988 | $51,000 | $10,820 | $40,180 |

| 2013 | $1,981 | $51,000 | $10,820 | $40,180 |

Source: Public Records

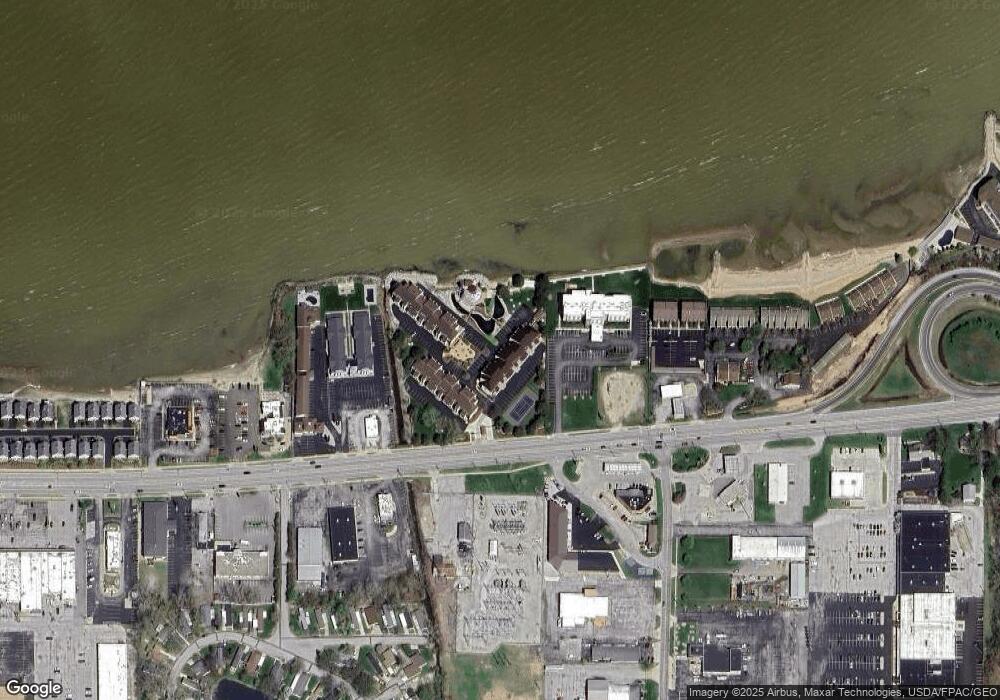

Map

Nearby Homes

- 1801 E Perry St Unit 22

- 1807 E Perry St Unit 69

- 34 Grande Lake Dr Unit C

- 115 Driftwood Dr

- 164 Driftwood Dr

- 188 Driftwood Dr

- 168 Morningside Dr

- 2006 E Harbor Rd

- 2650 E Harbor Rd

- 0 E Harbor Rd

- 183 Driftwood Dr

- 116 Walnut St

- 199 Morningside Dr

- 214 Linden St

- 12 N Beach St

- 19 N Beach St

- 2321 E State Rd

- 1201 E 3rd St

- 1801 E Perry St Unit 13

- 1801 E Perry St Unit 14

- 1801 E Perry St Unit 15

- 1801 E Perry St Unit 9

- 1801 E Perry St Unit 11

- 1801 E Perry St Unit 28

- 1801 E Perry St Unit 29

- 1801 E Perry St Unit 30

- 1801 E Perry St Unit 5

- 1801 E Perry St Unit 6

- 1801 E Perry St Unit 8

- 1801 E Perry St Unit 17

- 1801 E Perry St Unit 19

- 1801 E Perry St Unit 24

- 1801 E Perry St Unit 26

- 1801 E Perry St Unit 27

- 1801 E Perry St Unit 1

- 1801 E Perry St Unit 2

- 1801 E Perry St Unit 22

- 1801 E Perry St Unit 23