Estimated Value: $128,000 - $1,200,000

2

Beds

1

Bath

4,856

Sq Ft

$137/Sq Ft

Est. Value

About This Home

This home is located at 1805 Adamson Rd, Cocoa, FL 32926 and is currently estimated at $664,000, approximately $136 per square foot. 1805 Adamson Rd is a home located in Brevard County with nearby schools including Cocoa High School and Fairglen Elementary School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 13, 2025

Sold by

Hammons Raymond M and Hammons Jennifer

Bought by

Paradise At Limestone Stables Llc

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$2,350,000

Outstanding Balance

$2,308,495

Interest Rate

6.76%

Mortgage Type

Seller Take Back

Estimated Equity

-$1,644,495

Purchase Details

Closed on

Mar 14, 2024

Sold by

Hammons Raymond M

Bought by

Hammons Raymond M

Purchase Details

Closed on

Apr 24, 2019

Sold by

Hammons Raymond M and Hammons Annette M

Bought by

Hammons Raymond M

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Paradise At Limestone Stables Llc | $2,600,000 | Mangrove Title | |

| Paradise At Limestone Stables Llc | $2,600,000 | Mangrove Title | |

| Hammons Raymond M | $100 | None Listed On Document | |

| Hammons Raymond M | $63,992 | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Paradise At Limestone Stables Llc | $2,350,000 | |

| Closed | Paradise At Limestone Stables Llc | $2,350,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,915 | $130,290 | -- | -- |

| 2024 | $1,976 | $112,420 | -- | -- |

| 2023 | $1,976 | $114,240 | $0 | $0 |

| 2022 | $1,998 | $121,450 | $0 | $0 |

| 2021 | $1,956 | $111,330 | $0 | $0 |

| 2020 | $1,856 | $114,170 | $0 | $0 |

| 2019 | $1,718 | $100,910 | $0 | $0 |

| 2018 | $1,759 | $102,360 | $0 | $0 |

| 2015 | $836 | $55,630 | $13,950 | $41,680 |

| 2014 | $837 | $55,300 | $13,950 | $41,350 |

Source: Public Records

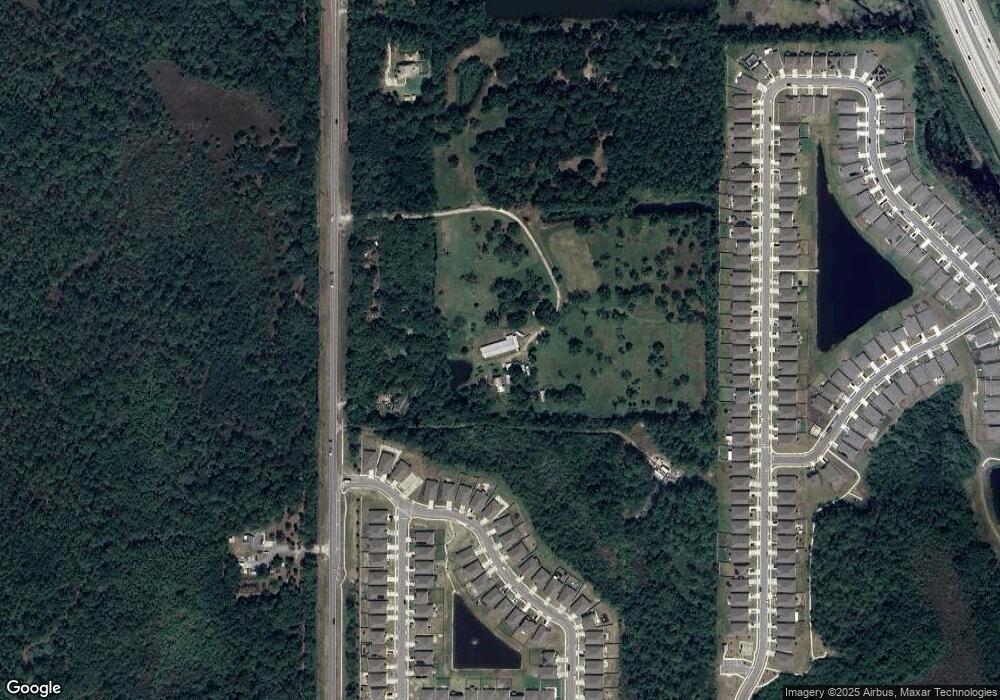

Map

Nearby Homes

- 1821 Saxton Rd

- 1701 Saxton Rd

- 4552 Talbot Blvd

- 5221 Talbot Blvd

- 4742 Talbot Blvd

- 4892 Talbot Blvd

- 1809 Morely Dr

- 4972 Talbot Blvd

- 4941 Talbot Blvd

- 5632 Talbot Blvd

- 344 Outer Dr Unit 323

- 365 Outer Dr

- 336 Horseshoe Bend Cir Unit 197

- 495 Outer Dr Unit 201

- 494 Outer Dr

- 655 Outer Dr Unit 123

- 634 Outer Dr

- 181 Woodsmill Blvd Unit 101

- 0 Burning Tree Ave Unit 1042503

- 755 Outer Dr Unit 362

- 1895 Adamson Rd

- 1725 Adamson Rd

- 1791 Saxton Rd

- 1771 Saxton Rd

- 1781 Saxton Rd

- 1801 Saxton Rd

- 1761 Saxton Rd

- 1831 Saxton Rd

- 1751 Saxton Rd

- 1741 Saxton Rd

- 6135 Orsino Ln

- 1731 Saxton Rd

- 6154 Orsino Ln

- 1752 Saxton Rd

- 0000 Adamson Rd

- 6125 Orsino Ln

- 1721 Saxton Rd

- 6144 Orsino Ln

- 1742 Saxton Rd

- 6115 Orsino Ln