1807 Phillip St Auburn, IN 46706

Estimated Value: $138,000 - $191,000

3

Beds

1

Bath

1,152

Sq Ft

$138/Sq Ft

Est. Value

About This Home

This home is located at 1807 Phillip St, Auburn, IN 46706 and is currently estimated at $158,594, approximately $137 per square foot. 1807 Phillip St is a home located in DeKalb County with nearby schools including DeKalb High School and Lakewood Park Christian School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 25, 2025

Sold by

Hoeppner Kevin D

Bought by

Hoeppner Kevin D and Shatto Crystal L

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$171,000

Outstanding Balance

$170,711

Interest Rate

6.86%

Mortgage Type

VA

Estimated Equity

-$12,117

Purchase Details

Closed on

Sep 7, 2006

Sold by

Amstutz Rex and Amstutz Debra

Bought by

Hoeppner Kevin D

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$52,000

Interest Rate

6.77%

Mortgage Type

New Conventional

Purchase Details

Closed on

Sep 21, 2000

Sold by

Brooks Lucille and Jamieson Margare

Bought by

Amstutz Rex and Amstutz Debra

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Hoeppner Kevin D | -- | None Listed On Document | |

| Hoeppner Kevin D | -- | None Available | |

| Amstutz Rex | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Hoeppner Kevin D | $171,000 | |

| Previous Owner | Hoeppner Kevin D | $52,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $217 | $108,800 | $20,700 | $88,100 |

| 2023 | $130 | $102,400 | $19,400 | $83,000 |

| 2022 | $40 | $91,400 | $17,000 | $74,400 |

| 2021 | $0 | $79,900 | $14,600 | $65,300 |

| 2020 | $848 | $71,700 | $13,300 | $58,400 |

| 2019 | $868 | $71,700 | $13,300 | $58,400 |

| 2018 | $815 | $65,300 | $13,300 | $52,000 |

| 2017 | $749 | $62,800 | $13,300 | $49,500 |

| 2016 | $732 | $60,900 | $13,300 | $47,600 |

| 2014 | $677 | $54,500 | $10,500 | $44,000 |

Source: Public Records

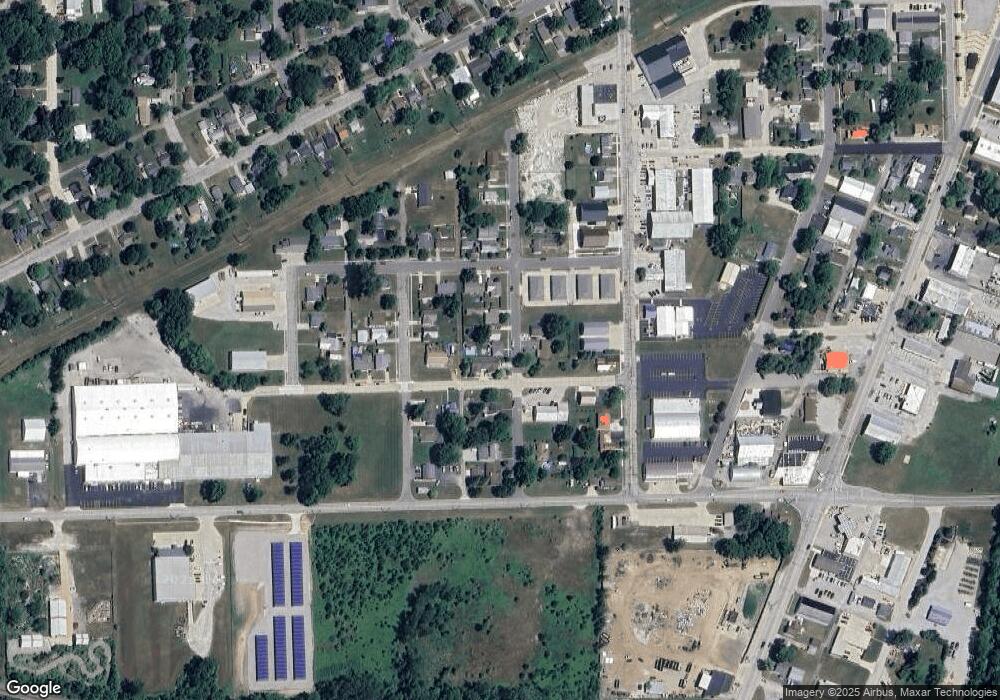

Map

Nearby Homes

- 1804 Phillip St

- 1425 Urban Ave

- 518 S Indiana Ave

- 901 S Van Buren St

- 18780 Eisley Cove

- 603 Roselawn Ct

- 350 W 9th St

- 5013 County Road 23

- 5048 County Road 31

- 300 E 7th St

- 904 Elm St

- 410 N Cedar St

- 271 N Mcclellan St Unit 105

- 1011 Elm St

- 812 E 9th St

- 218 Iwo St

- 1408 Duesenberg Dr

- 1801 Golfview Dr

- 2217 Golfview Dr

- 2116 Golfview Dr Unit 138

- 1805 Phillip St

- 606 Dekalb Ave Unit 606 and 608

- 1803 Phillip St

- 1803 Phillip St

- 1823 Phillip St

- 1806 Dallas St

- 1804 Dallas St

- 603 Helen Ave

- 1806 Phillip St

- 619 Dekalb Ave

- 601 Helen Ave

- 605 Helen Ave

- 1810 Dallas St Unit 1812

- 607 Helen Ave

- 1700 Dallas St

- 1814 Dallas St

- 700 Dekalb Ave

- 1713 Phillip St

- 1827 Phillip St

- 1824 S Phillip St