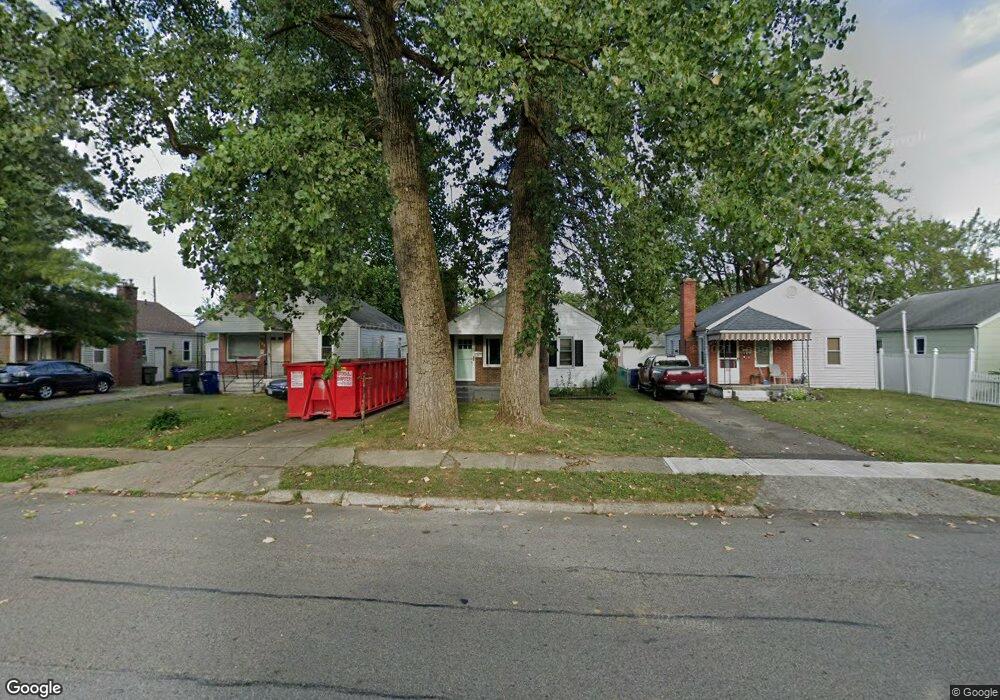

181 S Weyant Ave Columbus, OH 43213

Eastmoor NeighborhoodEstimated Value: $115,000 - $136,000

2

Beds

1

Bath

720

Sq Ft

$172/Sq Ft

Est. Value

About This Home

This home is located at 181 S Weyant Ave, Columbus, OH 43213 and is currently estimated at $124,109, approximately $172 per square foot. 181 S Weyant Ave is a home located in Franklin County with nearby schools including Fairmoor Elementary School, Johnson Park Middle School, and Walnut Ridge High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 2, 2019

Sold by

Total Resource Contractors Llc

Bought by

Vb One Llc

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$54,588

Outstanding Balance

$47,798

Interest Rate

4%

Mortgage Type

Commercial

Estimated Equity

$76,311

Purchase Details

Closed on

Nov 20, 2018

Sold by

Chu Carlene

Bought by

Patrick Alexander

Purchase Details

Closed on

Oct 2, 2018

Sold by

Port Gregory

Bought by

Chu Ashley Zeigler and Chu Carlene

Purchase Details

Closed on

Sep 19, 2018

Sold by

Zeigler Chu Ashley and Chu Carlene

Bought by

Chu Carlene

Purchase Details

Closed on

Apr 16, 2018

Sold by

Saver Lodge Inc

Bought by

Estate Of Fu Ih Chu

Purchase Details

Closed on

Sep 5, 2008

Sold by

Hud

Bought by

Chu Fu Ih and Saver Lodge Inc

Purchase Details

Closed on

Sep 14, 2006

Sold by

Bishop Joan Patricia and U S Bank Na

Bought by

Hud

Purchase Details

Closed on

Apr 23, 1998

Sold by

Nelson John P and Nelson Virginia P

Bought by

Bishop Joan Patricia

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Vb One Llc | $62,000 | Total Title Services | |

| Total Resource Contractors Llc | $55,000 | Total Title Services | |

| Patrick Alexander | $23,000 | None Available | |

| Chu Ashley Zeigler | -- | None Available | |

| Chu Carlene | -- | None Available | |

| Estate Of Fu Ih Chu | -- | None Available | |

| Chu Fu Ih | $20,000 | Lakeside Ti | |

| Hud | $32,000 | None Available | |

| Bishop Joan Patricia | $52,900 | Chicago Title West |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Total Resource Contractors Llc | $54,588 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,659 | $36,200 | $11,660 | $24,540 |

| 2023 | $1,638 | $36,190 | $11,655 | $24,535 |

| 2022 | $968 | $18,210 | $5,080 | $13,130 |

| 2021 | $969 | $18,210 | $5,080 | $13,130 |

| 2020 | $971 | $18,210 | $5,080 | $13,130 |

| 2019 | $1,114 | $17,650 | $4,240 | $13,410 |

| 2018 | $1,210 | $18,420 | $4,240 | $14,180 |

| 2017 | $1,298 | $18,420 | $4,240 | $14,180 |

| 2016 | $1,292 | $16,520 | $3,780 | $12,740 |

| 2015 | $1,115 | $16,520 | $3,780 | $12,740 |

| 2014 | $1,024 | $16,520 | $3,780 | $12,740 |

| 2013 | $532 | $17,395 | $3,990 | $13,405 |

Source: Public Records

Map

Nearby Homes

- 178 S Weyant Ave

- 201 S Weyant Ave

- 91 Maplewood Ave

- 46 N Everett Ave

- 59 N Everett Ave

- 88-90 N Waverly St

- 73 N Everett Ave

- 94 N Hampton Rd

- 247 S James Rd

- 277 S James Rd

- 239 S Kellner Rd

- 320 Collingwood Ave

- 3814 Elbern Ave

- 430 S James Rd

- 3235 Maryland Ave

- 91 Robinwood Ave

- 526 Collingwood Ave

- 3160 Fair Ave

- 253 N James Rd

- 177 N James Rd

- 175 S Weyant Ave

- 185 S Weyant Ave

- 191 S Weyant Ave

- 195 S Weyant Ave

- 159 S Weyant Ave

- 182 S Weyant Ave

- 188 S Weyant Ave

- 153 S Weyant Ave

- 207 S Weyant Ave

- 192 S Weyant Ave

- 172 S Weyant Ave

- 198 S Weyant Ave

- 168 S Weyant Ave

- 149 S Weyant Ave

- 211 S Weyant Ave

- 202 S Weyant Ave

- 162 S Weyant Ave

- 208 S Weyant Ave

- 156 S Weyant Ave

- 143 S Weyant Ave