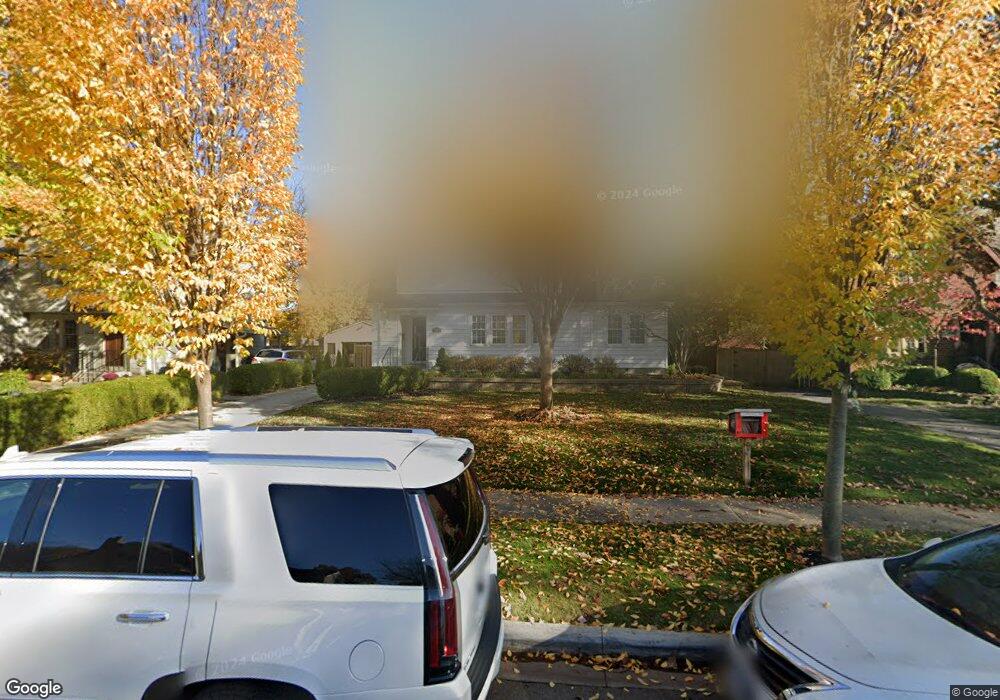

1812 Bedford Rd Columbus, OH 43212

Estimated Value: $700,000 - $757,416

4

Beds

2

Baths

2,108

Sq Ft

$345/Sq Ft

Est. Value

About This Home

This home is located at 1812 Bedford Rd, Columbus, OH 43212 and is currently estimated at $728,104, approximately $345 per square foot. 1812 Bedford Rd is a home located in Franklin County with nearby schools including Barrington Road Elementary School, Jones Middle School, and Upper Arlington High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 28, 2006

Sold by

Cendant Mobility Financial Corp

Bought by

Clevenger Scott and Clevenger Nicole

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$236,000

Outstanding Balance

$133,614

Interest Rate

6.2%

Mortgage Type

Fannie Mae Freddie Mac

Estimated Equity

$594,490

Purchase Details

Closed on

Aug 31, 2005

Sold by

Hall Peter C and Hall Gwendolyn K

Bought by

Cendant Mobility Financial Corp

Purchase Details

Closed on

Sep 6, 2000

Sold by

Disalvo Darla M

Bought by

Hall Peter C and Hall Gwendolyn K

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$184,900

Interest Rate

8.14%

Purchase Details

Closed on

Mar 31, 1989

Bought by

Disalvo Darla M

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Clevenger Scott | $295,000 | Talon Group | |

| Cendant Mobility Financial Corp | $295,000 | Talon Group | |

| Hall Peter C | $234,900 | Chicago Title | |

| Disalvo Darla M | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Clevenger Scott | $236,000 | |

| Previous Owner | Hall Peter C | $184,900 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $13,572 | $234,430 | $118,300 | $116,130 |

| 2023 | $13,425 | $234,430 | $118,300 | $116,130 |

| 2022 | $11,982 | $171,470 | $65,350 | $106,120 |

| 2021 | $10,607 | $171,470 | $65,350 | $106,120 |

| 2020 | $10,530 | $171,470 | $65,350 | $106,120 |

| 2019 | $10,631 | $153,310 | $65,350 | $87,960 |

| 2018 | $9,297 | $153,310 | $65,350 | $87,960 |

| 2017 | $9,290 | $153,310 | $65,350 | $87,960 |

| 2016 | $8,031 | $121,460 | $50,720 | $70,740 |

| 2015 | $8,024 | $121,460 | $50,720 | $70,740 |

| 2014 | $8,033 | $121,460 | $50,720 | $70,740 |

| 2013 | $3,835 | $110,390 | $46,095 | $64,295 |

Source: Public Records

Map

Nearby Homes

- 1782 Wyandotte Rd

- 1733 Elmwood Ave

- 1661 Ashland Ave Unit 663

- 1655-1657 Ashland Ave

- 2015 W 5th Ave Unit 211

- 2015 W 5th Ave Unit 102

- 2015 W 5th Ave Unit 108

- 1561 Glenn Ave

- 2110 Northwest Blvd

- 1631 Roxbury Rd Unit F3

- 1631 Roxbury Rd Unit B6

- 1459 Elmwood Ave Unit 1459

- 1398 Lower Green Cir Unit 1398

- 1869 Tewksbury Rd

- 1535 Doone Rd

- 2063 Westover Rd

- 1364 W 7th Ave

- 1313 Lincoln Rd

- 1565 Berkshire Rd

- 00 W 7th Ave

- 1800 Bedford Rd

- 1818 Bedford Rd

- 1796 Bedford Rd

- 1803 Andover Rd

- 1793 Andover Rd

- 1785 Andover Rd

- 1811 Tremont Rd

- 1790 Bedford Rd

- 1811 Bedford Rd

- 1845 Tremont Rd

- 1781 Andover Rd

- 1795 Bedford Rd

- 1784 Bedford Rd

- 1773 Andover Rd

- 1824 Tremont Rd

- 1789 Bedford Rd

- 1765 Andover Rd

- 1798 Andover Rd

- 1792 Andover Rd

- 1776 Bedford Rd