1815 Exton Dr Fallston, MD 21047

Estimated Value: $528,000 - $621,000

1

Bed

3

Baths

1,850

Sq Ft

$305/Sq Ft

Est. Value

About This Home

This home is located at 1815 Exton Dr, Fallston, MD 21047 and is currently estimated at $565,108, approximately $305 per square foot. 1815 Exton Dr is a home located in Harford County with nearby schools including Youths Benefit Elementary School, Fallston Middle School, and Fallston High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 27, 2011

Sold by

Nvr Inc

Bought by

Sciarretta Roger D and Sciarretta Charlene

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$223,992

Outstanding Balance

$156,215

Interest Rate

4.88%

Mortgage Type

New Conventional

Estimated Equity

$408,893

Purchase Details

Closed on

Apr 27, 2011

Sold by

Nvr Inc

Bought by

Sciarretta Roger D and Sciarretta Charlene E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$223,992

Outstanding Balance

$156,215

Interest Rate

4.88%

Mortgage Type

New Conventional

Estimated Equity

$408,893

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Sciarretta Roger D | $279,990 | -- | |

| Sciarretta Roger D | $279,990 | -- | |

| Sciarretta Roger D | $279,990 | Stewart Title Guaranty Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Sciarretta Roger D | $223,992 | |

| Closed | Sciarretta Roger D | $223,992 | |

| Closed | Sciarretta Roger D | $223,992 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,134 | $489,000 | $115,000 | $374,000 |

| 2024 | $5,134 | $471,033 | $0 | $0 |

| 2023 | $4,742 | $453,067 | $0 | $0 |

| 2022 | $4,742 | $435,100 | $115,000 | $320,100 |

| 2021 | $4,672 | $419,967 | $0 | $0 |

| 2020 | $4,672 | $404,833 | $0 | $0 |

| 2019 | $4,497 | $389,700 | $70,500 | $319,200 |

| 2018 | $4,341 | $379,633 | $0 | $0 |

| 2017 | $4,156 | $389,700 | $0 | $0 |

| 2016 | $140 | $359,500 | $0 | $0 |

| 2015 | $3,552 | $339,133 | $0 | $0 |

| 2014 | $3,552 | $318,767 | $0 | $0 |

Source: Public Records

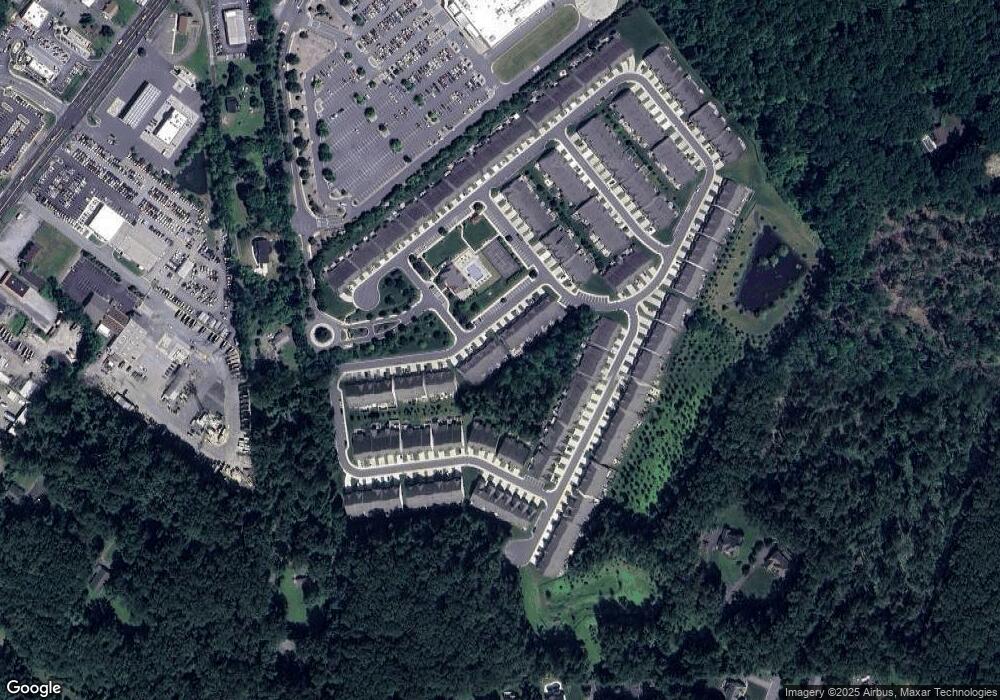

Map

Nearby Homes

- 1843 Exton Dr Unit 197

- 331 Tufton Cir Unit 102

- 309 Lennox Dr

- 313 Lennox Dr

- 371 Tufton Cir

- 2511 Easy St

- 2510 Easy St

- 950 Old Joppa Rd

- 324 Old Joppa Rd

- 2435 Whitt Rd

- 638 Iron Gate Rd

- 0 Winter Park Rd

- 603 Deep Ridge Rd

- 605 Buggy Ride Rd

- 2405 Jerusalem Rd

- 700 Remington Rd

- 0 W Wheel Rd Unit MDHR2045912

- 608 E Churchill Rd Unit 608E

- 604 Churchhill Rd Unit 604

- 304 Canterbury Rd Unit K