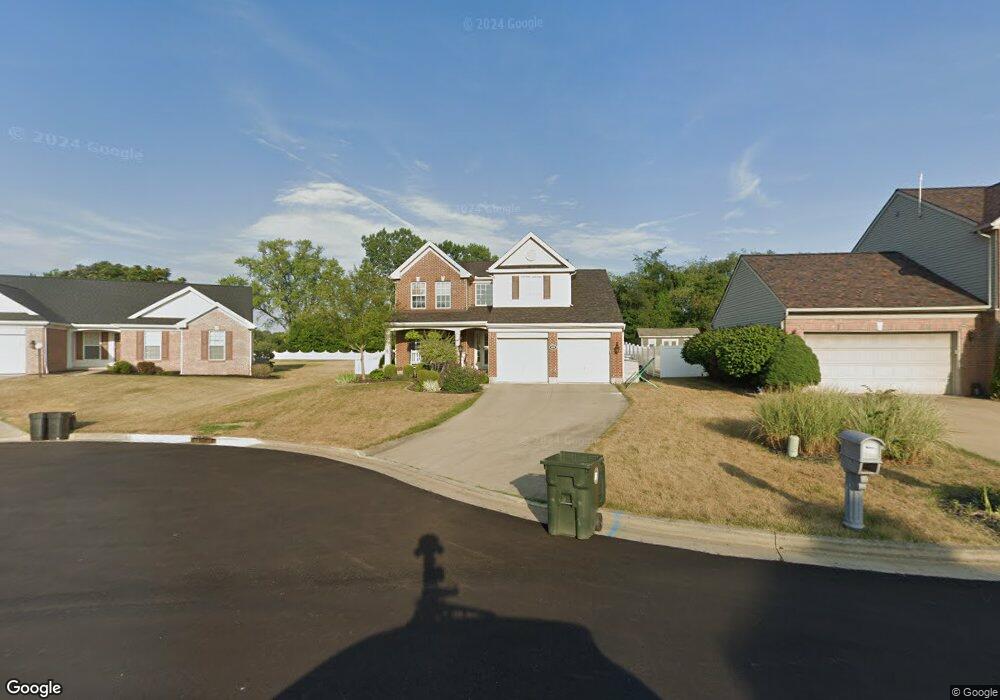

1818 48th St NE Canton, OH 44705

Martindale Park NeighborhoodEstimated Value: $330,000 - $411,000

3

Beds

3

Baths

2,389

Sq Ft

$157/Sq Ft

Est. Value

About This Home

This home is located at 1818 48th St NE, Canton, OH 44705 and is currently estimated at $375,345, approximately $157 per square foot. 1818 48th St NE is a home located in Stark County with nearby schools including Ransom H. Barr Elementary School, Glenwood Intermediate School, and GlenOak High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 27, 2010

Sold by

Johnston Alexis G

Bought by

Suba David A and Suba Kristina M

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$162,011

Outstanding Balance

$107,691

Interest Rate

4.96%

Mortgage Type

FHA

Estimated Equity

$267,654

Purchase Details

Closed on

Jul 31, 2006

Sold by

Ledford Travis A

Bought by

Ledford Alexis G and Johnston Alexis G

Purchase Details

Closed on

Mar 1, 2004

Sold by

The Drees Co

Bought by

Ledford Travis A and Johnston Ledford Alexis G

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$150,000

Interest Rate

5.5%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Aug 27, 2003

Sold by

Northeast Land Inc

Bought by

The Drees Co

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Suba David A | $165,000 | None Available | |

| Ledford Alexis G | -- | None Available | |

| Ledford Travis A | $167,900 | -- | |

| The Drees Co | $34,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Suba David A | $162,011 | |

| Closed | Ledford Travis A | $150,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | -- | $115,860 | $19,850 | $96,010 |

| 2024 | -- | $115,860 | $19,850 | $96,010 |

| 2023 | $3,098 | $80,360 | $19,460 | $60,900 |

| 2022 | $3,111 | $80,360 | $19,460 | $60,900 |

| 2021 | $3,123 | $80,360 | $19,460 | $60,900 |

| 2020 | $3,053 | $69,340 | $16,770 | $52,570 |

| 2019 | $3,020 | $69,340 | $16,770 | $52,570 |

| 2018 | $2,973 | $69,340 | $16,770 | $52,570 |

| 2017 | $3,180 | $68,360 | $16,910 | $51,450 |

| 2016 | $3,184 | $68,360 | $16,910 | $51,450 |

| 2015 | $3,182 | $68,360 | $16,910 | $51,450 |

| 2014 | $1,324 | $68,120 | $16,840 | $51,280 |

| 2013 | $1,772 | $72,460 | $16,840 | $55,620 |

Source: Public Records

Map

Nearby Homes

- 4662 Helmsworth Dr NE

- 1852 Southpointe Cir NE Unit 39W

- 1709 Southpointe Cir NE Unit 25W

- 2211 48th St NE

- 4613 Magnolia Rd NE

- 2216 49th St NE

- 1920 Birk Cir NE

- 4701 Roosevelt Ave NE

- 2317 Raintree St NE

- 2419 Bur Oak St NE

- 1327 44th St NE

- 1912 40th St NE

- 4654 Beverly Ave NE

- 2040 55th St NE

- 5225 Loma Linda Ln NE

- 1902 39th St NE

- 5409 Glenhill Ave NE

- 2426 40th St NE

- 815 44th St NE

- 5242 Aster Ave NE

- 4809 Marbury Ave NE

- 1822 48th St NE

- 4815 Marbury Ave NE

- 1826 48th St NE

- 4823 Marbury Ave NE

- 1834 48th St NE

- 4804 Marbury Ave NE

- 4810 Marbury Ave NE

- 1840 48th St NE

- 4816 Marbury Ave NE

- 4829 Marbury Ave NE

- 4824 Marbury Ave NE

- 1906 48th St NE

- 4835 Marbury Ave NE

- 4811 Parwich Cir NE

- 4830 Marbury Ave NE

- 4817 Parwich Cir NE

- 1912 48th St NE

- 4825 Parwich Cir NE

- 4843 Marbury Ave NE