18233 E 1600th Rd Marshall, IL 62441

Estimated Value: $172,450 - $248,000

Studio

--

Bath

1,841

Sq Ft

$110/Sq Ft

Est. Value

About This Home

This home is located at 18233 E 1600th Rd, Marshall, IL 62441 and is currently estimated at $202,150, approximately $109 per square foot. 18233 E 1600th Rd is a home located in Clark County with nearby schools including South Elementary School, North Elementary School, and Marshall Junior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 23, 2017

Sold by

Fraker Robert W and Fraker Tamara J

Bought by

Spittler Tannor W and Spittler Leslie J

Current Estimated Value

Purchase Details

Closed on

Jan 18, 2013

Sold by

Fraker William Blain and Fraker Cortney Diane

Bought by

Fraker William Blain and Fraker Cortney Diane

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$67,000

Interest Rate

3.34%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jun 4, 2010

Sold by

Fraker William B

Bought by

Fraker Robert W and Fraker Tamara J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$53,928

Interest Rate

5.05%

Mortgage Type

Future Advance Clause Open End Mortgage

Purchase Details

Closed on

Mar 10, 2010

Sold by

Pine William W

Bought by

Fraker William Blaine

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$120,000

Interest Rate

5%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Spittler Tannor W | $180,000 | None Available | |

| Fraker William Blain | -- | None Available | |

| Fraker Robert W | $53,000 | None Available | |

| Fraker William Blaine | $125,000 | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Fraker William Blain | $67,000 | |

| Previous Owner | Fraker Robert W | $53,928 | |

| Previous Owner | Fraker William Blaine | $120,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,607 | $31,320 | $3,480 | $27,840 |

| 2023 | $1,558 | $31,320 | $3,480 | $27,840 |

| 2022 | $1,459 | $27,964 | $3,107 | $24,857 |

| 2021 | $1,429 | $26,135 | $2,904 | $23,231 |

| 2019 | $1,406 | $26,135 | $2,904 | $23,231 |

| 2018 | $1,439 | $26,135 | $2,904 | $23,231 |

| 2017 | $1,150 | $22,208 | $2,178 | $20,030 |

| 2016 | $1,222 | $21,715 | $2,130 | $19,585 |

| 2015 | $1,219 | $22,310 | $2,188 | $20,122 |

| 2014 | $1,080 | $21,085 | $2,070 | $19,015 |

| 2013 | $1,080 | $20,375 | $2,000 | $18,375 |

Source: Public Records

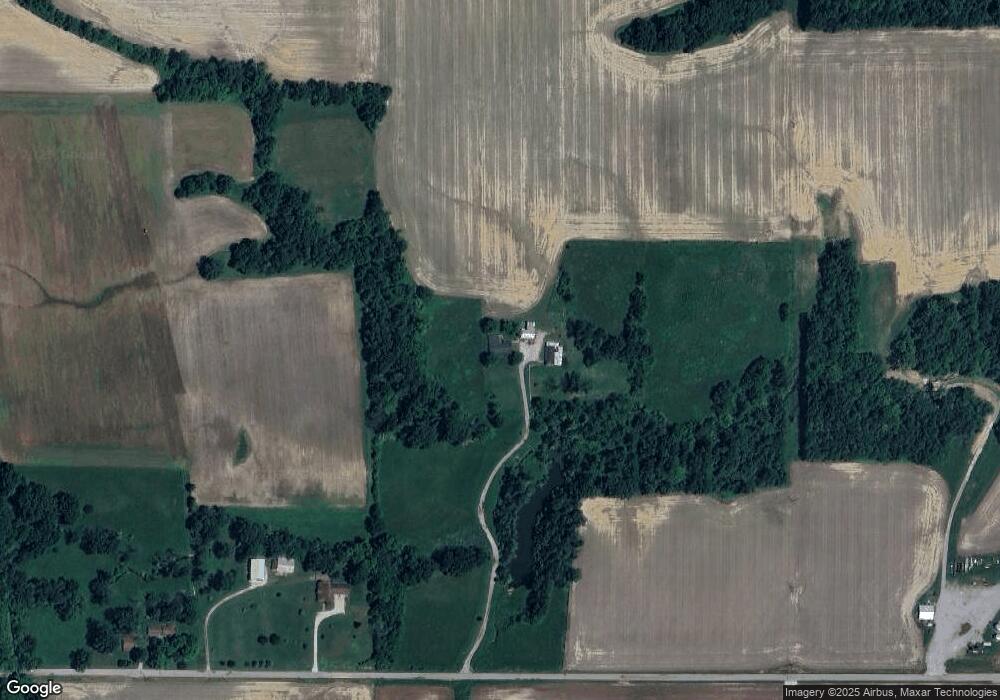

Map

Nearby Homes

- 1314 Archer Ave

- 1014 Plum St

- 1204 Beech St

- 812 S 4th St

- 10 Lakeview Dr

- 15827 N Oak Crest Rd

- 107 Linden St

- 10 Rose Ln

- 7 Willow Ln

- 103 Kyden Dr

- 4 Woodridge Ln

- 17383 N Hummingbird Ln

- 104 Thomas Dr

- 14568 U S 40

- 000 E Clark Center Rd

- 12040 N Fox Rd

- 19996 N 2250th St

- 1165 Crooked Ln

- 0 Crooked Ln Unit Lot WP001 24435818

- 000 Clark Rd

- 18233 E 1600th Rd

- 18233 E 1600th Rd

- 18233 County Road 1600 N

- 18079 E 1600th Rd

- 1134 E Vine St

- 1134 E Vine St

- 1135 E Vine St

- 19706 E 1670th Rd

- 13797 County Road 1600 N

- 1121 Cherry Ln

- 1120 Cherry Ln

- 1127 E Vine St

- 1119 E Vine St

- 0 E Plant Rd

- 0 1670 N

- 1119 Cherry Ln

- 1118 Cherry Ln

- 1117 Cherry Ln

- 1116 Cherry Ln

- 1115 Cherry Ln