1825 Foxhall Cir Unit 1001 Kissimmee, FL 34741

Tapestry NeighborhoodEstimated Value: $182,000 - $223,000

2

Beds

2

Baths

938

Sq Ft

$210/Sq Ft

Est. Value

About This Home

This home is located at 1825 Foxhall Cir Unit 1001, Kissimmee, FL 34741 and is currently estimated at $196,591, approximately $209 per square foot. 1825 Foxhall Cir Unit 1001 is a home located in Osceola County with nearby schools including Kissimmee Elementary School, Kissimmee Middle School, and Osceola High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 31, 2016

Sold by

Andres Peter R and Lotz Kelye L

Bought by

Miga Group Llc

Current Estimated Value

Purchase Details

Closed on

Jul 24, 2005

Sold by

Sweatt Mack and Smith Plez J

Bought by

Andrews Peter R and Lotz Kelye L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$84,600

Interest Rate

5.46%

Mortgage Type

Fannie Mae Freddie Mac

Purchase Details

Closed on

Aug 23, 2004

Sold by

Leahigh Bruce D

Bought by

Beaver Lula M

Purchase Details

Closed on

Dec 3, 1998

Sold by

Housing & Urban Dev

Bought by

Leahigh Bruce D

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$52,200

Interest Rate

6.84%

Mortgage Type

FHA

Purchase Details

Closed on

Aug 14, 1998

Sold by

Chase Manhattan Mtg Corp

Bought by

Housing & Urban Dev

Purchase Details

Closed on

Dec 27, 1996

Sold by

Sullivan Cynthia L and Chhima Cynthia L

Bought by

Morris Wendy E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$51,300

Interest Rate

7.51%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Miga Group Llc | $71,000 | Stewart Title Company | |

| Andrews Peter R | $94,000 | Stewart Approved Title Inc | |

| Andrews Peter R | -- | Stewart Approved Title Inc | |

| Beaver Lula M | $91,000 | Stewart Approved Title Inc | |

| Leahigh Bruce D | $58,000 | -- | |

| Housing & Urban Dev | -- | -- | |

| Morris Wendy E | $52,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Andrews Peter R | $84,600 | |

| Previous Owner | Leahigh Bruce D | $52,200 | |

| Previous Owner | Morris Wendy E | $51,300 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,202 | $189,200 | -- | $189,200 |

| 2023 | $2,202 | $96,630 | $0 | $0 |

| 2022 | $1,646 | $107,000 | $0 | $107,000 |

| 2021 | $1,558 | $101,000 | $0 | $101,000 |

| 2020 | $1,456 | $96,400 | $0 | $96,400 |

| 2019 | $1,261 | $74,200 | $0 | $74,200 |

| 2018 | $1,111 | $60,000 | $0 | $60,000 |

| 2017 | $1,095 | $58,000 | $0 | $58,000 |

| 2016 | $902 | $52,100 | $0 | $52,100 |

| 2015 | $842 | $47,700 | $0 | $47,700 |

| 2014 | $775 | $44,100 | $0 | $44,100 |

Source: Public Records

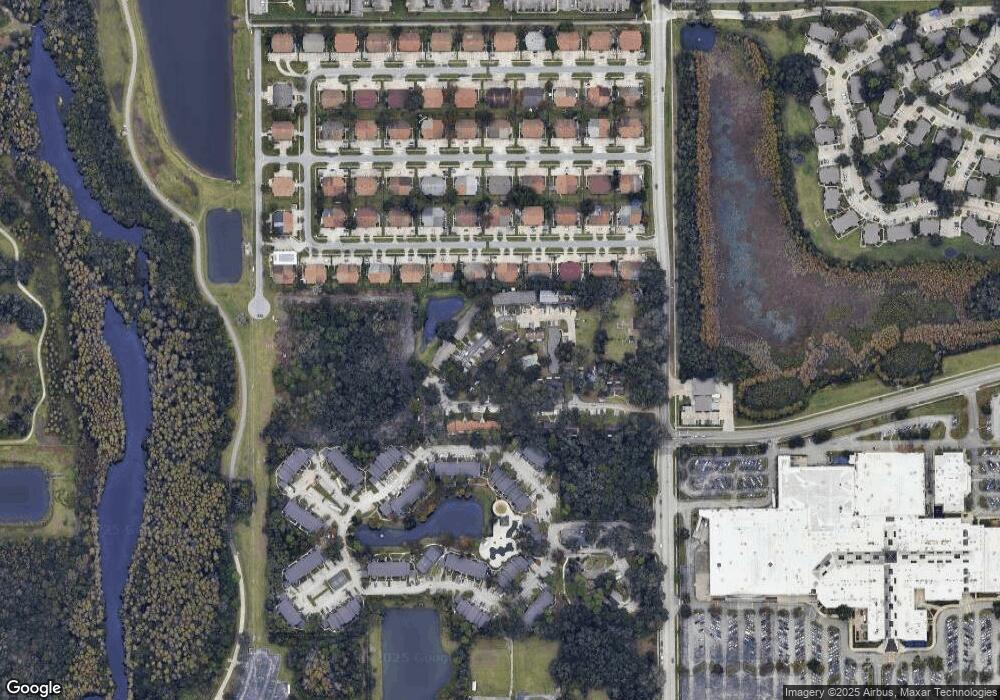

Map

Nearby Homes

- 1735 Foxhall Cir Unit 1

- 1736 Foxhall Cir Unit 1736

- 1708 Foxhall Cir

- 1834 Foxhall Cir

- 1860 Foxhall Cir

- 4132 Flying Fortress Ave

- 4204 Spitfire Ave

- 1500 N Hoagland Blvd

- 2202 Key Ct W Unit 633

- 2208 Antigua Place Unit 924

- 2208 Antigua Place Unit 933

- 2208 Antigua Place Unit 932

- 2218 Grand Cayman Ct

- 2218 Grand Cayman Ct Unit 1335

- 3827 Bay Club Cir Unit 204

- 2207 Antigua Place Unit 736

- 3831 Nautical Way Unit 203

- 2203 Key West Ct Unit 436

- 2216 Grand Cayman Ct Unit 1411

- 2216 Grand Cayman Ct Unit 1415

- 1825 Foxhall Cir

- 1825 Foxhall Cir Unit 1825

- 1823 Foxhall Cir

- 1821 Foxhall Cir Unit 1821

- 1819 Foxhall Cir

- 1833 Foxhall Cir Unit 1813

- 1833 Foxhall Cir

- 1831 Circle

- 1831 Foxhall Cir

- 1817 Foxhall Cir

- 1840 1840 Foxhall Cir

- 1836 Foxhall Cir Unit 1305

- 1838 Foxhall Cir

- 1840 Foxhall Cir

- 1840 Foxhall Cir Unit 1840

- 1834 Foxhall Cir Unit 605

- 1834 Foxhall Cir Unit 1834

- 1832 Foxhall Cir Unit 1832

- 1832 Foxhall Cir

- 1832 Foxhall Cir Unit 1301