1830 Downs Chapel Dr Unit 8B Delaware, OH 43015

Estimated Value: $277,000 - $327,000

2

Beds

2

Baths

1,370

Sq Ft

$222/Sq Ft

Est. Value

About This Home

This home is located at 1830 Downs Chapel Dr Unit 8B, Delaware, OH 43015 and is currently estimated at $303,561, approximately $221 per square foot. 1830 Downs Chapel Dr Unit 8B is a home located in Delaware County with nearby schools including Robert F. Schultz Elementary School, John C. Dempsey Middle School, and Rutherford B. Hayes High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 10, 2020

Sold by

Sandra P Woods Trust

Bought by

Karen E Everhart Revocable Tru

Current Estimated Value

Purchase Details

Closed on

Oct 30, 2020

Sold by

Sandra P Woods Trust

Bought by

Karen E Everhart Revocable Tru and Karen E Everhart Revocable Trust

Purchase Details

Closed on

Sep 2, 2014

Sold by

Woods Sandra P

Bought by

Woods Sandra P and Sandra P Woods Trust

Purchase Details

Closed on

May 9, 2012

Sold by

Woods John N and Woods Sandra P

Bought by

Woods Sandra P and Woods John N

Purchase Details

Closed on

May 13, 2002

Sold by

Willow Run Enterprises

Bought by

Woods John N and Woods Sandra P

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Karen E Everhart Revocable Tru | $240,000 | Shade And Shade | |

| Karen E Everhart Revocable Tru | $240,000 | Shade And Shade | |

| Woods Sandra P | -- | None Available | |

| Woods Sandra P | -- | None Available | |

| Woods Sandra P | -- | None Available | |

| Woods John N | -- | None Available | |

| Woods John N | $172,750 | -- |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,337 | $80,470 | $15,050 | $65,420 |

| 2023 | $3,373 | $80,470 | $15,050 | $65,420 |

| 2022 | $3,254 | $68,460 | $12,250 | $56,210 |

| 2021 | $3,814 | $68,460 | $12,250 | $56,210 |

| 2020 | $3,364 | $68,460 | $12,250 | $56,210 |

| 2019 | $3,129 | $59,080 | $12,250 | $46,830 |

| 2018 | $3,172 | $59,080 | $12,250 | $46,830 |

| 2017 | $2,931 | $55,790 | $8,750 | $47,040 |

| 2016 | $2,706 | $55,790 | $8,750 | $47,040 |

| 2015 | $2,721 | $55,790 | $8,750 | $47,040 |

| 2014 | $2,764 | $55,790 | $8,750 | $47,040 |

| 2013 | $2,895 | $57,750 | $8,750 | $49,000 |

Source: Public Records

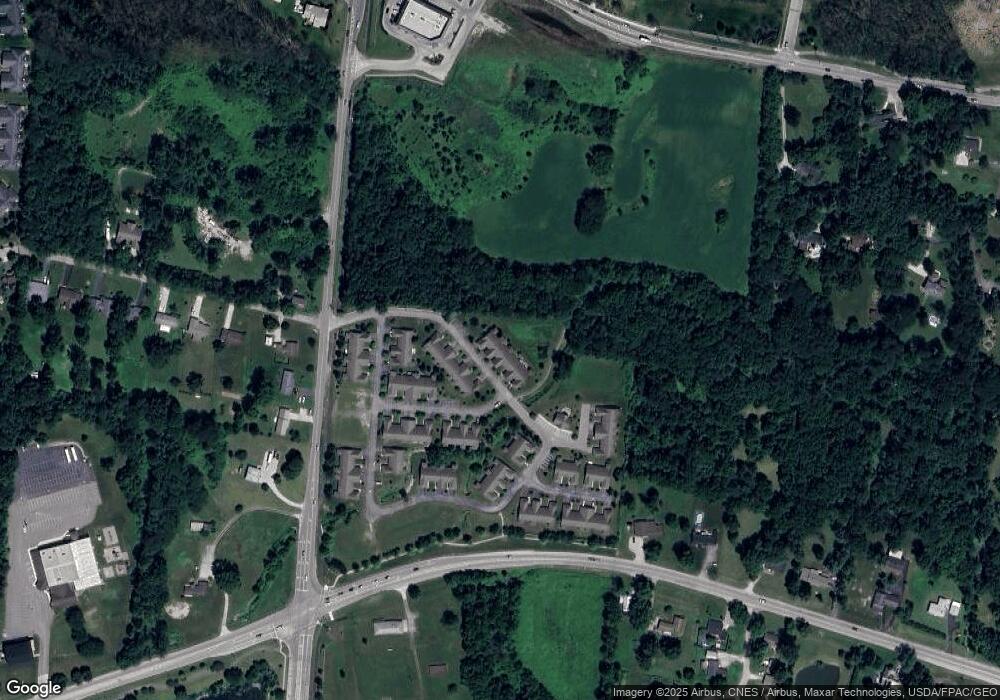

Map

Nearby Homes

- 1590 W William St

- 213 Hanover Ct Unit 213

- 736 Swanson St

- 466 Blaisdell Dr

- 123 Helen Ct

- 135 Saratoga St Unit 156

- 347 Amelia Ln

- 268 Aaron Dr

- 203 Springer Woods Blvd

- 106 Paine St Unit 189

- 659 Lehner Woods Blvd Unit 25

- 135 Crestview Dr

- 301 Tar Heel Dr

- 526 Penwell Dr Unit Lot 13896

- 502 Penwell Dr Unit Lot 13900

- 490 Penwell Dr Unit Lot 13901

- 231 Rockmill St

- 224 Overtrick Dr

- 430 Penwell Dr Unit Lot 13859

- 165 Schellinger St

- 1830 Downs Chapel Dr

- 1810 Downs Chapel Dr Unit 1810

- 1810 Downs Chapel Dr Unit 8C

- 1840 Downs Chapel Dr

- 1840 Downs Chapel Dr Unit 8A

- 1800 Downs Chapel Dr

- 1800 Downs Chapel Dr Unit 8D

- 1790 Downs Chapel Dr Unit 1790

- 1790 Downs Chapel Dr Unit 8E

- 1875 Downs Chapel Dr Unit 1875

- 1835 Downs Chapel Dr Unit 1835

- 1825 Downs Chapel Dr Unit 1825

- 1825 Downs Chapel Dr Unit 6F

- 1835 Downs Chapel Dr Unit 6E

- 1875 Downs Chapel Dr Unit 6A

- 1845 Downs Chapel Dr Unit 1845

- 1845 Downs Chapel Dr Unit 6D

- 1855 Downs Chapel Dr Unit 1855

- 1855 Downs Chapel Dr Unit 6C

- 1865 Downs Chapel Dr Unit 1865