18319 S 273rd West Ave Bristow, OK 74010

Estimated Value: $438,000 - $1,120,505

2

Beds

1

Bath

518

Sq Ft

$1,594/Sq Ft

Est. Value

About This Home

This home is located at 18319 S 273rd West Ave, Bristow, OK 74010 and is currently estimated at $825,502, approximately $1,593 per square foot. 18319 S 273rd West Ave is a home located in Creek County with nearby schools including Kellyville Elementary School, Kellyville Upper Elementary School, and Kellyville Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 12, 2019

Sold by

Jackson Jeffrey J and Jackson Misty D

Bought by

Lin Zhu Kun

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$481,728

Outstanding Balance

$325,273

Interest Rate

3.7%

Mortgage Type

Future Advance Clause Open End Mortgage

Estimated Equity

$500,229

Purchase Details

Closed on

Oct 12, 2011

Sold by

Jackson Jeff J and Jackson Misty D

Bought by

Jackson Jeffrey J and Jackson Misty D

Purchase Details

Closed on

Mar 5, 2004

Sold by

Laster John and Laster Lisa

Purchase Details

Closed on

May 14, 1999

Sold by

Mcguire Freddie and Mcguire Iva

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Lin Zhu Kun | $585,000 | Oklahoma City Abstract & Ttl | |

| Jackson Jeffrey J | -- | -- | |

| -- | $150,000 | -- | |

| -- | $77,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Lin Zhu Kun | $481,728 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $10,263 | $104,734 | $4,179 | $100,555 |

| 2024 | $10,293 | $105,455 | $4,179 | $101,276 |

| 2023 | $10,293 | $104,536 | $4,179 | $100,357 |

| 2022 | $9,870 | $104,078 | $4,179 | $99,899 |

| 2021 | $4,240 | $44,319 | $2,410 | $41,909 |

| 2020 | $4,326 | $44,319 | $2,410 | $41,909 |

| 2019 | $1,204 | $12,161 | $1,397 | $10,764 |

| 2018 | $1,154 | $11,463 | $1,368 | $10,095 |

| 2017 | $1,128 | $11,129 | $1,353 | $9,776 |

| 2016 | $983 | $10,805 | $1,339 | $9,466 |

| 2015 | -- | $1,029 | $899 | $130 |

| 2014 | -- | $998 | $893 | $105 |

Source: Public Records

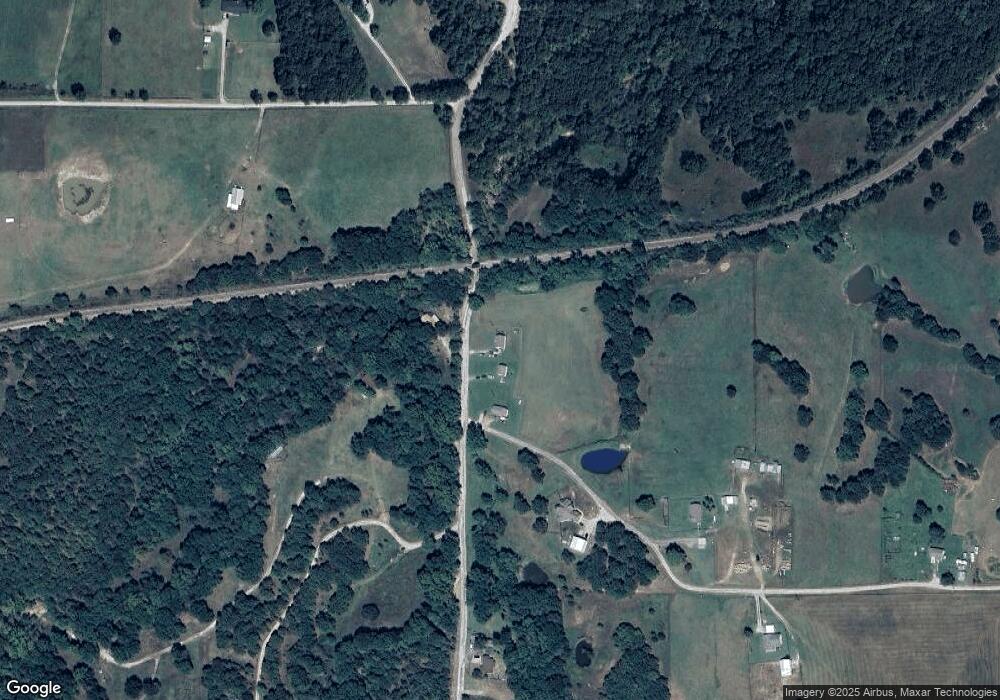

Map

Nearby Homes

- 28520 W 166th St S

- 16590 S 257th West Ave

- 24055 W 171st St S

- 0 W 203rd St S

- 15459 S 283rd West Ave

- 32109 W Highway 66

- 17504 S 327th West Ave

- West 211th St S

- 18500 Slick Rd

- 17800 Slick Rd

- 19619 S 337th West Ave

- 18694 S 340 Ave W

- 14398 S 246th West Place

- 0 W 181st St S Unit 2539521

- 19635 Kellyville Ranch Rd

- 20785 McKellop Dr

- 15641 Draft St

- 20665 McKellop Dr

- 20711 McKellop Dr

- RC Armstrong II Plan at McKellop Meadow

- 18305 S 273rd West Ave

- 27447 S 273rd West Ave

- 18435 S 273rd West Ave

- 18307 S 273rd West Ave

- 18309 S 273rd West Ave

- 18309 S 273rd West Ave

- 27447 W 181st St S

- 18311 S 273rd West Ave

- 18645 S 273rd West Ave

- 18313 S 273rd West Ave

- 27904 W 181st St S

- 17936 S 273rd West Ave

- 17781 S 273rd West Ave

- 18531 S 273rd West Ave

- 17764 S 273rd West Ave

- 17733 S 273rd West Ave

- 17643 S 273rd West Ave

- 17547 S 273rd West Ave

- 28502 W Hwy 66

- 17525 S 273rd West Ave