1838 Bashan Dr Unit 75D Columbus, OH 43228

Estimated Value: $176,472 - $187,000

2

Beds

2

Baths

1,248

Sq Ft

$147/Sq Ft

Est. Value

About This Home

This home is located at 1838 Bashan Dr Unit 75D, Columbus, OH 43228 and is currently estimated at $183,618, approximately $147 per square foot. 1838 Bashan Dr Unit 75D is a home located in Franklin County with nearby schools including Bolton Crossing Elementary School, Holt Crossing Intermediate School, and Pleasant View Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 27, 2012

Sold by

Friend Michael G

Bought by

Schultz Toni M

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$67,250

Outstanding Balance

$45,836

Interest Rate

4.01%

Mortgage Type

FHA

Estimated Equity

$137,782

Purchase Details

Closed on

Aug 24, 2011

Sold by

Secretary Of Housing & Urban Development

Bought by

Friend Michael G

Purchase Details

Closed on

Aug 4, 2010

Sold by

Thompson Trina M

Bought by

Wells Fargo Bank Na

Purchase Details

Closed on

Jun 7, 2010

Sold by

Wells Fargo Bank Na

Bought by

Secretary Of Housing & Urban Development

Purchase Details

Closed on

Mar 19, 2001

Sold by

The Qualstan Corp

Bought by

Thompson Trina M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$83,087

Interest Rate

7.03%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Schultz Toni M | $69,000 | Bxvalmer Land | |

| Friend Michael G | $30,000 | Valmer Land | |

| Wells Fargo Bank Na | $44,000 | Attorney | |

| Secretary Of Housing & Urban Development | -- | None Available | |

| Thompson Trina M | $85,000 | Lawyers Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Schultz Toni M | $67,250 | |

| Previous Owner | Thompson Trina M | $83,087 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,702 | $46,690 | $10,500 | $36,190 |

| 2024 | $1,702 | $46,690 | $10,500 | $36,190 |

| 2023 | $1,672 | $46,690 | $10,500 | $36,190 |

| 2022 | $1,604 | $32,870 | $4,550 | $28,320 |

| 2021 | $1,636 | $32,870 | $4,550 | $28,320 |

| 2020 | $1,627 | $32,870 | $4,550 | $28,320 |

| 2019 | $1,418 | $25,270 | $3,500 | $21,770 |

| 2018 | $1,281 | $25,270 | $3,500 | $21,770 |

| 2017 | $1,278 | $25,270 | $3,500 | $21,770 |

| 2016 | $1,152 | $19,040 | $2,870 | $16,170 |

| 2015 | $1,152 | $19,040 | $2,870 | $16,170 |

| 2014 | $1,153 | $19,040 | $2,870 | $16,170 |

| 2013 | $672 | $22,365 | $3,360 | $19,005 |

Source: Public Records

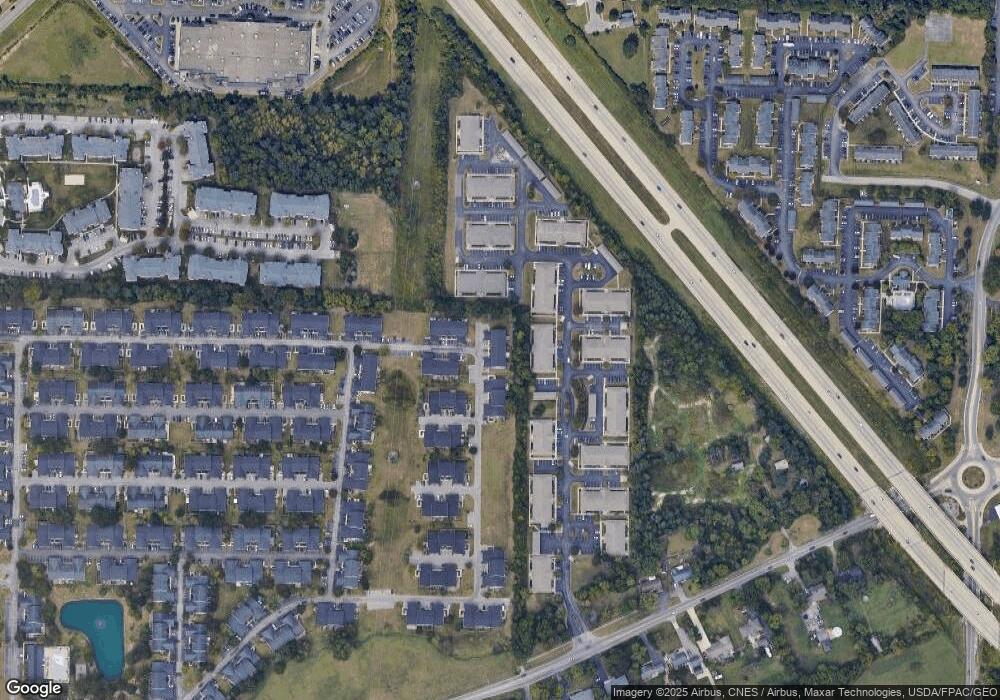

Map

Nearby Homes

- 1842 Bashan Dr Unit 75F

- 4633 Parrau Dr Unit 70F

- 4644 Hobson Dr Unit 13D

- 1981 Hoadley Dr Unit 10A

- 4701 Cadmus Dr Unit 31E

- 2073 Santuomo Ave

- 4704 Hobson Dr Unit 4A

- 4732 Lesbrook Dr

- 2120 Sunrush Ct

- 4655 Parkwick Dr

- 1925 Fortstone Ln Unit 1925

- 4315 Shady Meadows Dr

- 1870 Berrancher Dr Unit 1870

- 1800 Georgesville Square Dr

- 1997 Berrancher Dr Unit 1997

- 4320 Grouse Ct

- 1710 Carrigallen Ln

- 4474 Greystone Village Dr Unit 5D

- 2147 Exemplar Ct

- 4531 White Leaf Way

- 1836 Bashan Dr Unit 75C

- 1834 Bashan Dr Unit 75B

- 1832 Bashan Dr Unit 75A

- 1840 Bashan Dr Unit 75E

- 1840 Bashan Dr Unit C

- 4572 Parrau Dr Unit 74G

- 4574 Parrau Dr Unit 74F

- 4574 Parrau Dr Unit F

- 1852 Bashan Dr Unit 76A

- 1854 Bashan Dr Unit 76B

- 4577 Parrau Dr Unit 73A

- 4579 Parrau Dr Unit 73B

- 4576 Parrau Dr Unit 74E

- 1844 Bashan Dr Unit 75G

- 4581 Parrau Dr Unit 73C

- 4578 Parrau Dr Unit 74D

- 4580 Parrau Dr Unit 74C

- 4583 Parrau Dr Unit 73D

- 4584 Parrau Dr Unit 74A

- 4582 Parrau Dr Unit 74B

Your Personal Tour Guide

Ask me questions while you tour the home.