Estimated Value: $241,444 - $273,000

--

Bed

--

Bath

1,237

Sq Ft

$211/Sq Ft

Est. Value

About This Home

This home is located at 184 Walenda Dr NW, Rome, GA 30165 and is currently estimated at $261,611, approximately $211 per square foot. 184 Walenda Dr NW is a home located in Floyd County with nearby schools including Armuchee Middle School and Armuchee High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 27, 2016

Sold by

Roland Lynn Estate

Bought by

Bragg Donald Jason

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$54,003

Outstanding Balance

$43,460

Interest Rate

3.75%

Mortgage Type

FHA

Estimated Equity

$218,151

Purchase Details

Closed on

Jan 29, 2009

Sold by

Tudor Mary Ann

Bought by

Tudor Mary Ann

Purchase Details

Closed on

Feb 11, 2008

Sold by

Not Provided

Bought by

Tudor Mary Ann and Tudor Roland Lynn

Purchase Details

Closed on

Aug 24, 2006

Sold by

Not Provided

Bought by

Tudor Mary Ann and Tudor Roland Lynn

Purchase Details

Closed on

Apr 18, 2003

Sold by

Shiflett Richard D and Shiflett Lisa K

Bought by

Weatherby Ronnie W and Jennifer Star

Purchase Details

Closed on

Aug 1, 1988

Sold by

Lester Charles Wayne

Bought by

Shiflett Richard D and Shiflett Lisa K

Purchase Details

Closed on

Feb 24, 1984

Sold by

Home Federal Savings & Loan Association

Bought by

Lester Charles Wayne

Purchase Details

Closed on

Jan 1, 1901

Bought by

Home Federal Savings & Loan Association

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Bragg Donald Jason | $55,000 | -- | |

| Tudor Mary Ann | -- | -- | |

| Tudor Mary Ann | $120,000 | -- | |

| Tudor Mary Ann | -- | -- | |

| Tudor Mary Ann | $132,500 | -- | |

| Weatherby Ronnie W | $118,900 | -- | |

| Shiflett Richard D | -- | -- | |

| Lester Charles Wayne | $54,300 | -- | |

| Home Federal Savings & Loan Association | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Bragg Donald Jason | $54,003 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,130 | $83,972 | $4,200 | $79,772 |

| 2023 | $2,138 | $77,410 | $4,200 | $73,210 |

| 2022 | $1,925 | $67,563 | $4,000 | $63,563 |

| 2021 | $1,759 | $57,104 | $4,000 | $53,104 |

| 2020 | $1,733 | $55,366 | $4,000 | $51,366 |

| 2019 | $1,362 | $45,169 | $4,000 | $41,169 |

| 2018 | $1,526 | $46,378 | $4,000 | $42,378 |

| 2017 | $794 | $42,842 | $4,000 | $38,842 |

| 2016 | $722 | $45,628 | $4,000 | $41,628 |

| 2015 | -- | $45,628 | $4,000 | $41,628 |

| 2014 | -- | $45,628 | $4,000 | $41,628 |

Source: Public Records

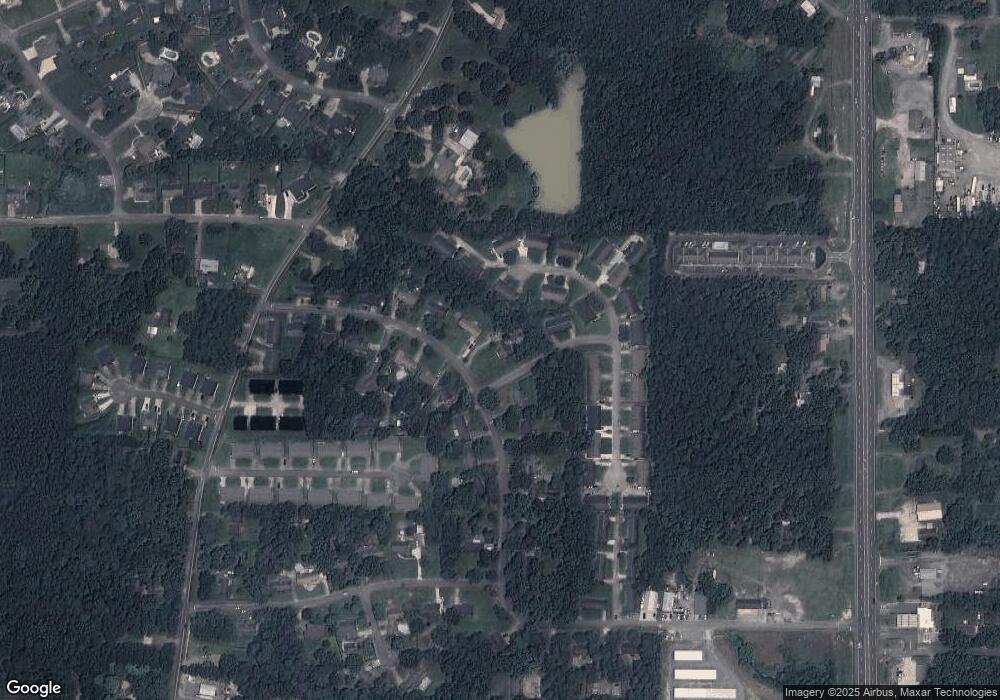

Map

Nearby Homes

- 13&15 Crabapple Ln

- 13 & 15 Crabapple Ln NW

- 4 Silverbell Ln

- 8 Silverbell Ln

- PEARSON Plan at Old Summerville Village

- 12 Silverbell Ln

- 10 Silverbell Ln

- 67 Dixie Park Rd NW

- 16 Quarter Horse Dr NW

- 8 Walking Horse Dr NW

- Tupelo Plan at Summer Club

- Elder Plan at Summer Club

- Hazel Plan at Summer Club

- Spruce Plan at Summer Club

- Cedar Plan at Summer Club

- 10 Summer Club Blvd NW

- 8 Hitchin Post Dr NW

- 20 Trotters Ln NW

- 194 Walenda Dr NW

- 170 Walenda Dr NW

- 117 Baby Doe Dr NW

- 0 Deerfield Trail NW

- 5 Deerfield Trail NW

- 115 Baby Doe Dr NW

- 183 Walenda Dr NW

- 204 Walenda Dr NW

- 138 Walenda Dr NW

- 195 Walenda Dr NW

- 169 Walenda Dr NW

- 109 Baby Doe Dr NW

- 113 Baby Doe Dr NW

- 119 Baby Doe Dr NW

- 205 Walenda Dr NW

- 190 Walenda Dr NW

- 124 Baby Doe Dr NW

- 152 Walenda Dr NW

- 120 Baby Doe Dr NW

- 105 Baby Doe Dr NW